Bitcoin (BTC) demonstrated a strong recovery last weekend, rising above the $66,000 threshold amidst selling pressure. Analysts closely monitor Bitcoin‘s price trajectory, expecting significant momentum in the short term. However, despite this optimistic outlook, a significant portion of Bitcoin’s supply remains in profit, creating a restrictive effect on further upward movement.

Profitability at 88.8 Percent

Recent on-chain data shows that about 88.8% of the current Bitcoin supply is now in a profitable state. Despite the high profitability rate, this figure marks a notable decline from the peak reached earlier this year. This statistic reflects conditions observed on February 7, 2024, corresponding to a Bitcoin price of $44,000. Analysts are now closely watching whether Bitcoin can maintain its current momentum or if a cooling period is needed for market stabilization.

Nebraskagooner and other market analysts are evaluating potential bottom levels for Bitcoin, claiming that a rise to $75,000 from its current position could indicate that the market has reached its lowest point. Conversely, a fall below $58,000 would suggest that the bottom has not yet been reached.

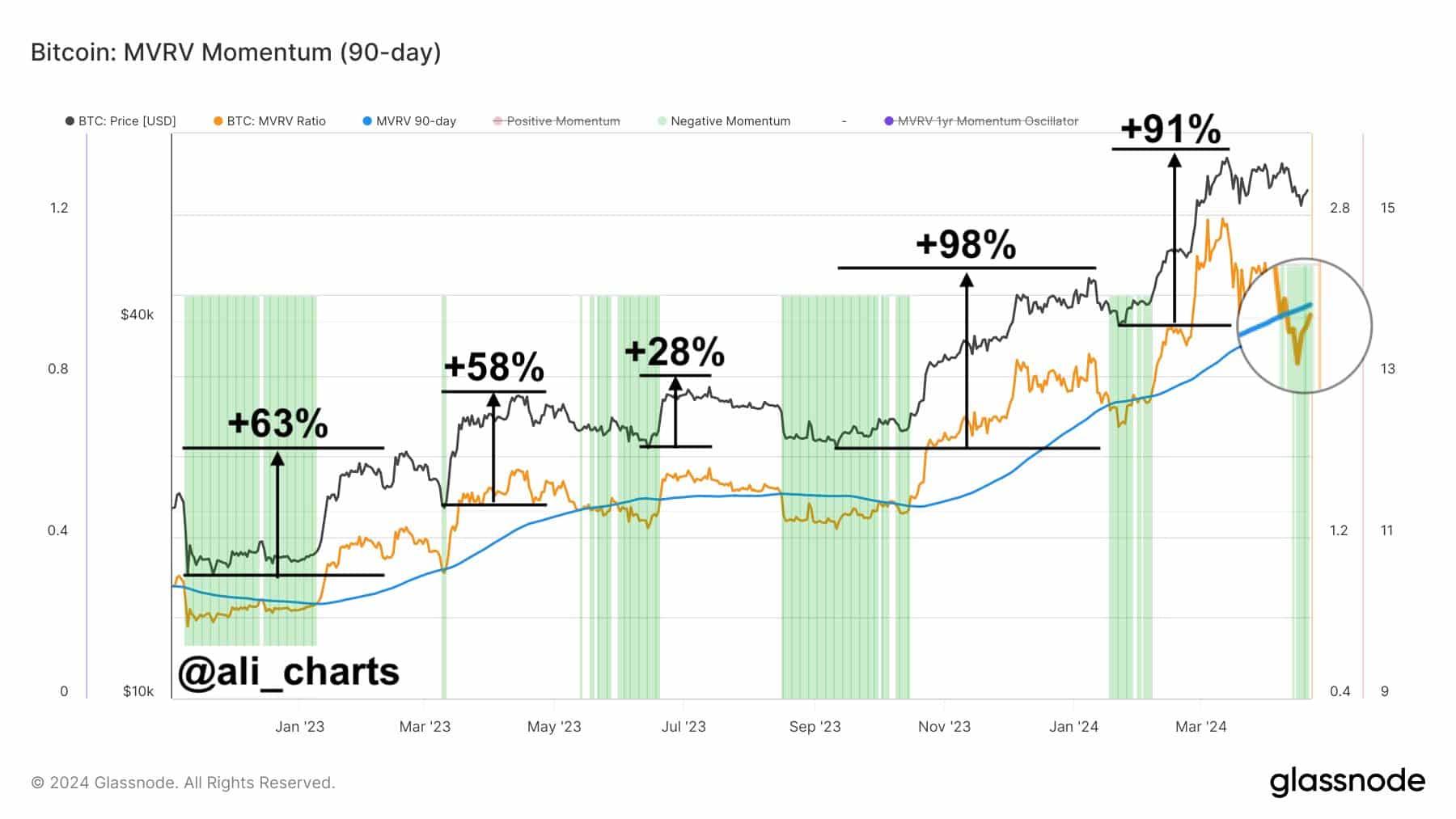

MVRV Ratio Signals Buying Opportunity

The MVRV ratio of Bitcoin, analyzed by experienced cryptocurrency analyst Ali Martinez, indicates that it is a suitable time to buy BTC. Martinez points out that Bitcoin’s MVRV ratio falling below its 90-day average since November 2022 signals a good buying opportunity, historically yielding an average gain of 67%. This recurring pattern suggests that it might be an ideal time to purchase BTC.

Additionally, Martinez highlights a disruption in the correlation between Bitcoin and the Global Liquidity Index, which has historically remained strong until 2024. However, this year, the breakdown of this correlation underscores the importance of a liquidity injection before the US elections to sustain Bitcoin’s ongoing upward trajectory.

On the other hand, there has been a significant increase in transaction fees paid to Bitcoin miners. Recently, transaction fees paid to miners reached 1,258 BTC. Despite this increase in transaction fees, the creation of new BTC addresses has decreased, with only 260,838 addresses recently created. The rise in Bitcoin transaction fees is primarily attributed to the Runes protocol.

Türkçe

Türkçe Español

Español