Bitcoin price is once again confidently above $69,000, and altcoins have turned green. At the time of writing, Bitcoin is at $69,280, having risen to $69,777 in the last 24 hours. Although optimism has been growing for the past few hours, making the rest of the day look promising, the crypto market is always full of surprises.

Solana (SOL)

Over the last 12 months, we have seen SOL Coin price rise impressively. After the FTX collapse, Solana has been fighting for survival and has now proven to everyone that it is still standing and will continue to exist. The price has seen an increase of nearly 25 times between its last peak and the 2023 bottom, achieving rare gains with its massive market value.

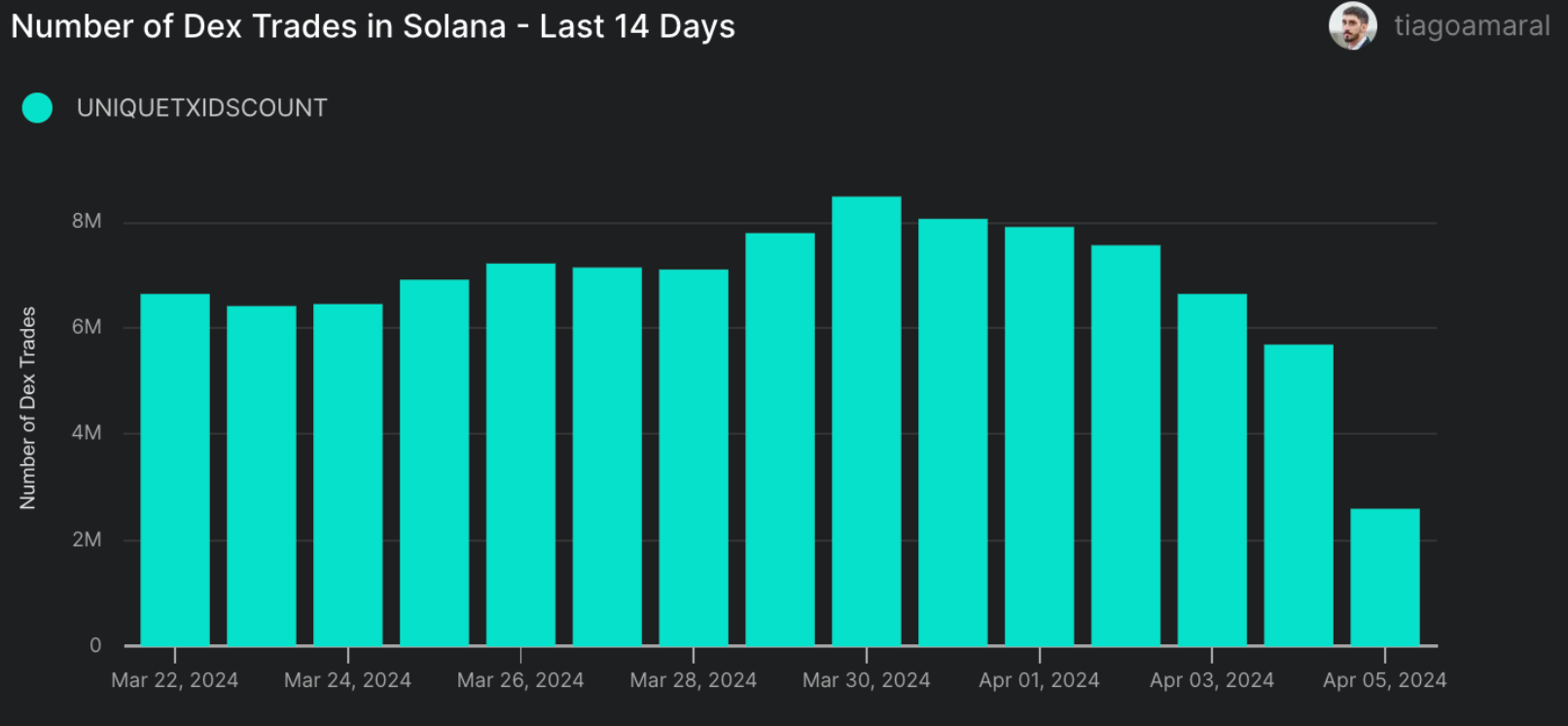

However, although the long-term outlook is positive, the short-term situation is changing. New meme coins based on Solana may have pushed the network activity and altcoin prices up, but there seems to be a pause here. DEX transactions peaked at 8.5 million on March 30th, but dropped to 5.6 million a few days ago. Moreover, up to 75% of failed transactions are negative for SOL Coin price.

SOL Coin Predictions

The Average Direction Index (ADX) in Solana is giving a strong bearish signal for the popular altcoin. The ADX is just below 40 at a level of 36, having climbed from 9 to 36 in a short period. The rising ADX reflects the increasing strength of the downtrend and seems to indicate further losses. Moreover, the repeated breach of the $181 support and waning interest in network meme coins also create significant negativity.

The decline in DEX transactions, the ADX, and additionally, we have a death cross. If the downtrend materializes, SOL Coin could fall to $167 and then to $137. Below that, there is potential for a drop to the main support at $107.

However, if the BTC price remains strong and Solana can eliminate operational issues, the bearish outlook could reverse. An important detail here is the $181 support level, which the price was hovering around at the time of writing. If it can stay above this, resistance levels beyond $205 could be targeted.

Türkçe

Türkçe Español

Español