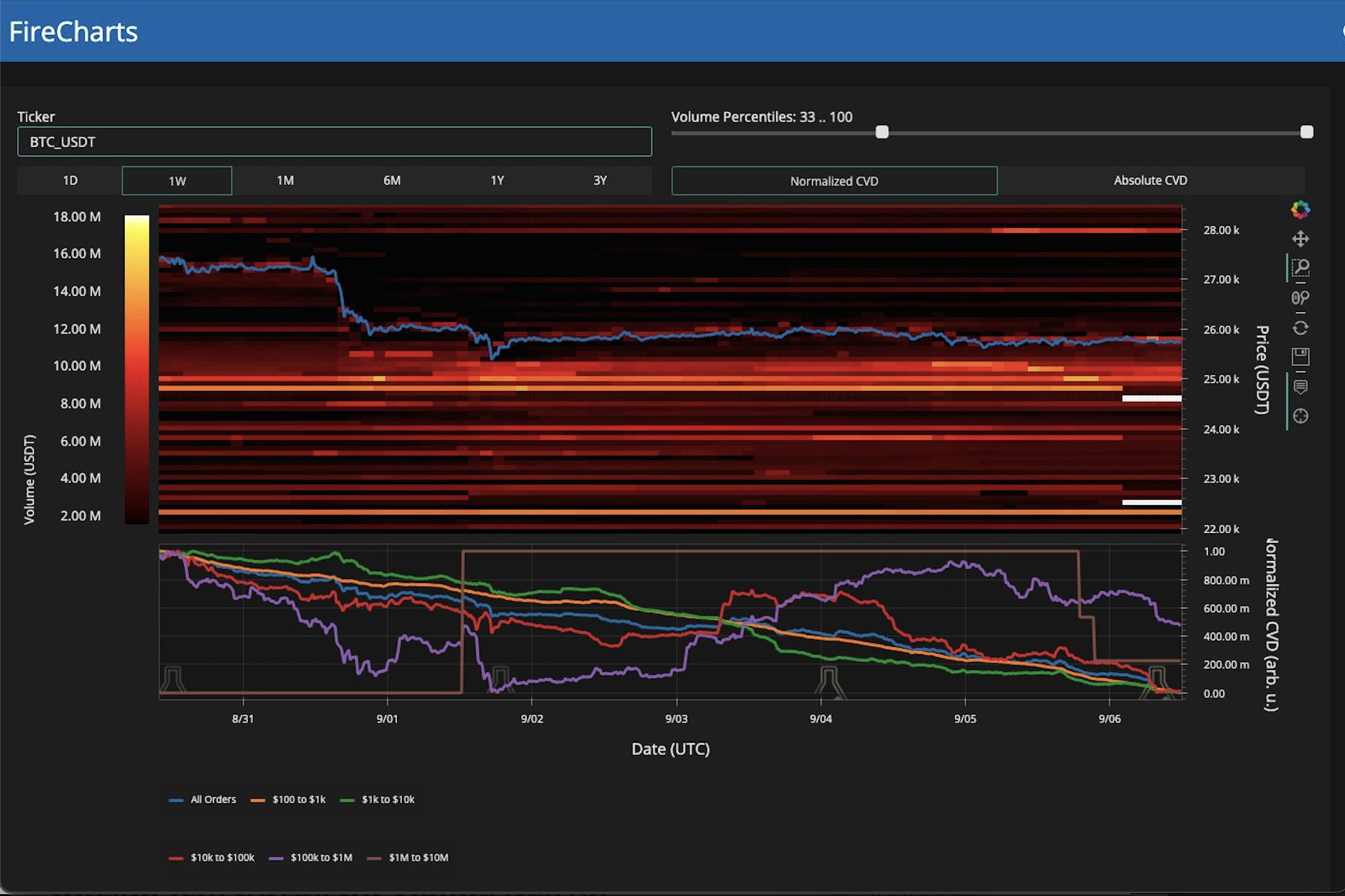

A new analysis in Bitcoin warns that the rising momentum is decreasing due to the variable movement of liquidity changes. Keith Alan, co-founder of the crypto asset data monitoring platform Material Indicators, drew attention to new changes in the Binance order book in a post on September 6th.

Bitcoin is Powerless on Both Sides

BTC’s price has been moving in a narrow range since the weekend, but exchange data indicates that this situation may change. Alan, who published an instant snapshot of the BTC/USD pair order book on Binance, warned about concerning changes in liquidity. The support level of the BTC bid liquidity has dropped below the previously set support level, which is the most worrisome aspect:

“The most concerning thing here is that the BTC bid liquidity has dropped below the lower part of the largest concentration range, which was previously established as the support level.”

According to data from TradingView, the BTC/USD pair reached $24,750 before rising, hitting the lowest level since March, in mid-June.

Alan also said that he expects a similar bounce from the current spot levels before any downward turn:

“From a macro perspective, I expect prices to eventually fall, so it is not surprising to think about falling below a new support, but I was expecting a stronger short-term rally from this range before it happened.”

Alan had previously emphasized that $24,750 is a support line that bulls need to hold to maintain the broader Bitcoin price uptrend.

A Major Move is Coming for Bitcoin

In another post, popular investor Skew acknowledged the activity in the derivative markets, indicating that volatility should soon return.

Another investor known for his comparative optimism about BTC price expectations, Credible Crypto, also hoped that the downside would be limited to the high range of $24,000. In a post to X subscribers, he made the following comment along with an explanatory chart:

“The support level on major liquid/spot exchanges is at $25,200. We would like to see that these low levels are taken while holding the lowest level of a higher time frame at $24,800 (which is more important) before a return to fill the inefficiency above us (red).”