Recent sales transactions by short-term Bitcoin (BTC) holders could indicate that the market is preparing to continue its rise. Bitcoin gained just over 3%, increasing its value by 11% to $43,800 compared to its value a week ago.

Short-Term Outlook for Bitcoin

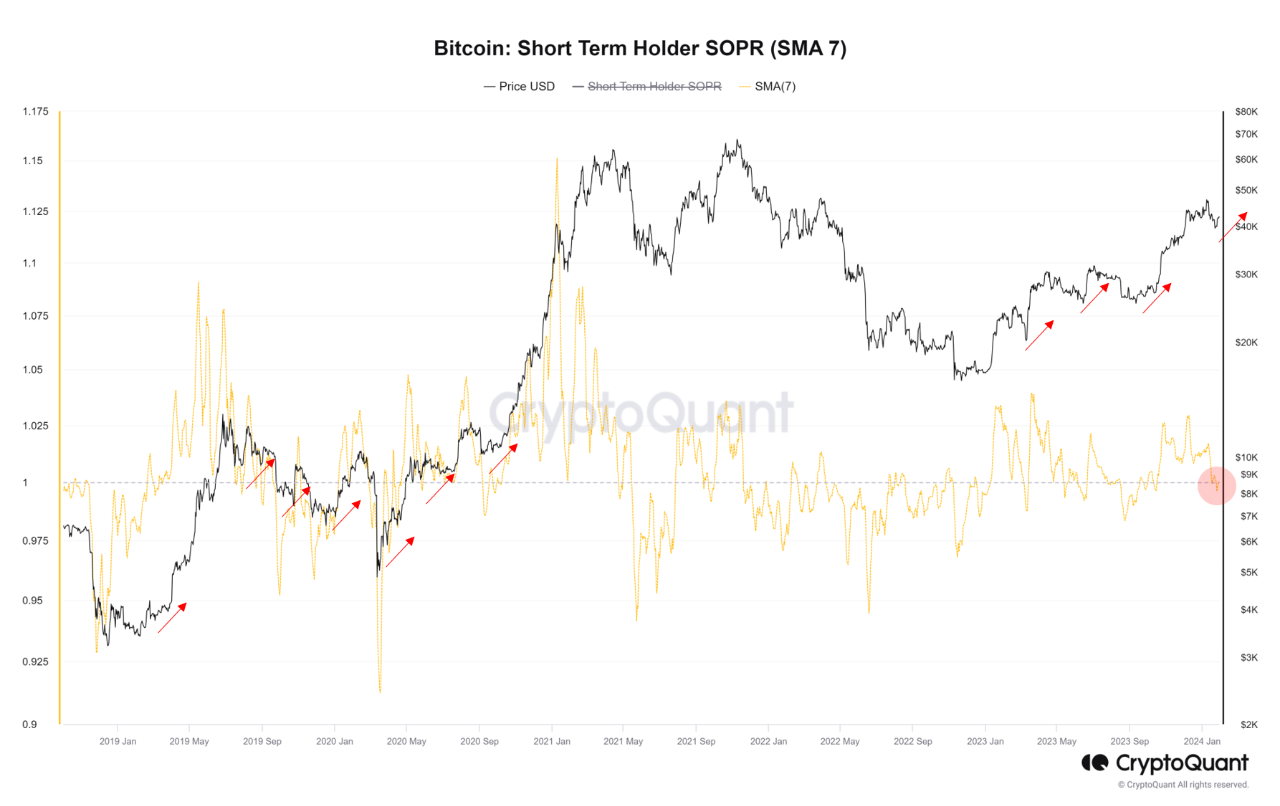

Amid volatility triggered by macroeconomic patterns, short-term investors appear to be selling tokens at a loss. However, according to recent information from CryptoQuant, the market could be expected to recover shortly. The on-chain analysis platform revealed that short-term Bitcoin investors are selling at a loss. This situation can be verified by CryptoQuant’s Short-Term Holder Profitability (SOPR), a measure used to assess the profit or loss for cryptocurrencies held for more than one hour but less than 155 days.

SOPR serves as an indicator showing whether investors who held a token for a short period before a trading transaction made a profit with a value exceeding 1, indicating that a significant portion of these investors made gains from their short-term investments. On the other hand, a value below 1 could indicate that a significant number of investors incurred losses. Recently, this metric has been showing values below 1, which could indicate that short-term holders of the leading cryptocurrency are selling at a loss. This could mean that whale investors may interpret this as a positive buying opportunity, potentially leading to the purchase of Bitcoin held by short-term investors. Consequently, a market recovery is expected shortly.

Critical Report from Santiment!

Since the approval of spot Bitcoin ETFs by the US Securities and Exchange Commission (SEC) on January 10th, Bitcoin has been consistently leaving exchange wallets, which could signal a significant change in market dynamics. According to analysts at the cryptocurrency analytics firm Santiment, this separation aligns with the declining trend in Bitcoin’s exchange supply and could occur concurrently with a steady increase in stablecoin reserves over the past five weeks.

The increase in USDT reserves on exchanges is interpreted as a sign of increased buying power, which could indicate that the mid-term bullish cycle that began in October is still gaining momentum. Additionally, the fourth halving event, historically known to trigger price increases, is expected to take place on April 18th, further boosting optimism among Bitcoin investors and analysts.