According to expert Axel Adler Jr., the $35,000 region may have become a new accumulation area for short-term Bitcoin (BTC) holders. Adler mentioned this in a post on November 26th.

BTC’s Historical Data

Data analyst and research expert used historical data from one week to 12 months of Bitcoin supply to reach his conclusion. The graph shared by Adler shows that STHs began accumulating around $18,000 in February. However, these holders did not start taking profits until BTC reached $28,000. On-chain metrics revealed that STHs started accumulating at the $35,000 level in the first week of November.

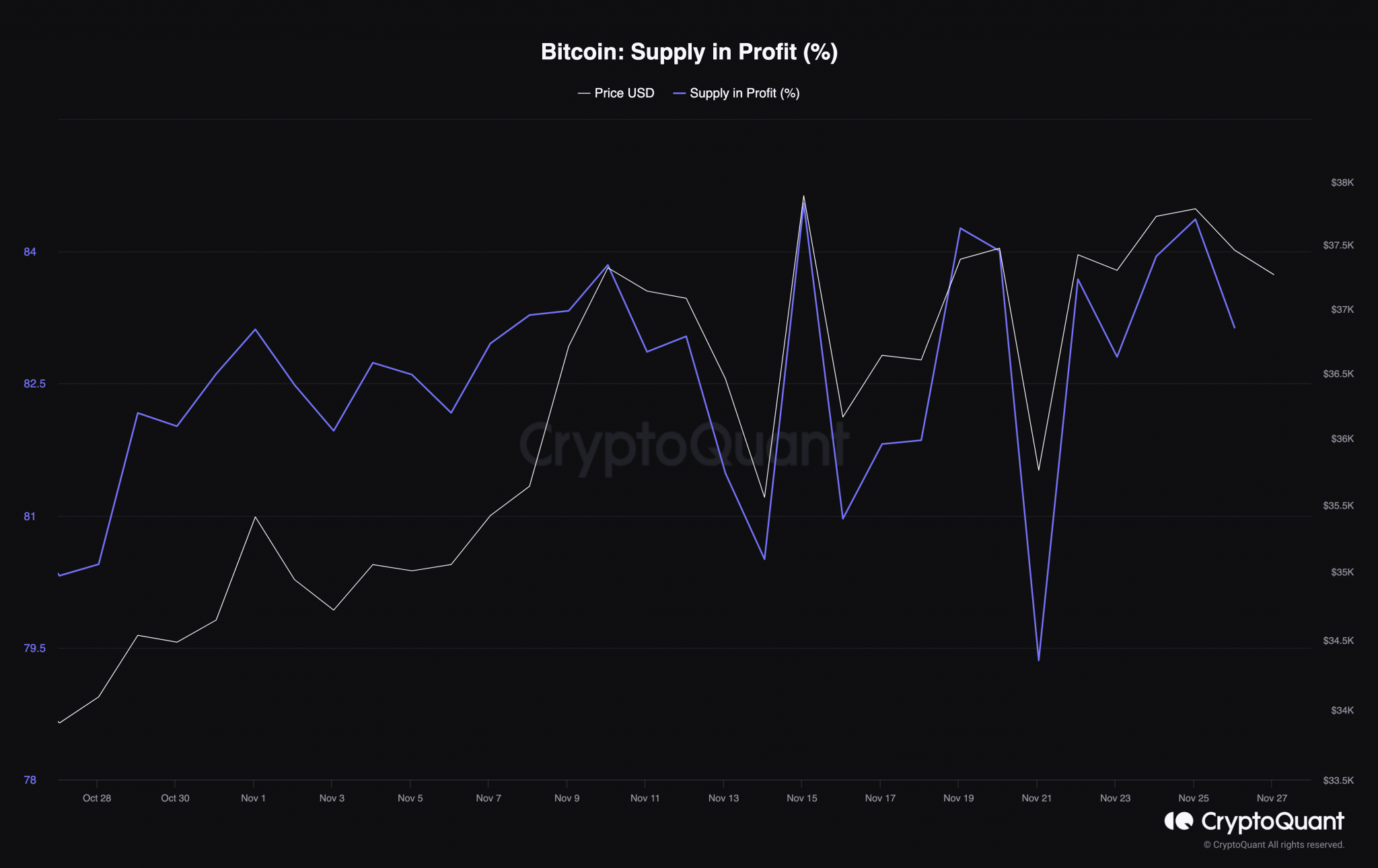

What are the chances of Bitcoin reaching this price before the end of the year? Analyzing this potential, according to CryptoQuant, the Bitcoin supply in profit stood at 83.13% when the article was written. This figure has decreased since November 25th, when it was at 84.36%.

The increasing trend of this metric may mean that investors have started to realize profits. This could lead to selling pressure that might trigger a drop in Bitcoin’s price. However, the decrease in profit supply could mean that BTC has a chance to recover before the year ends. Although $45,000 may seem far-fetched, BTC could have a chance to reach $40,000.

BTC’s Key Metrics

For this to happen, the cryptocurrency needs to retest $38,000 before the end of November. Technically, the BTC/USD H4 chart showed that the Relative Strength Index (RSI) fell to 46.23. This reading suggests that sellers are dominating the market, making it unlikely for BTC to reclaim $38,000.

However, if the RSI reading falls below 40.00, market participants may view this as an opportunity to buy Bitcoin at a discount. If accumulation begins at this point, buying pressure could push BTC towards $40,000. This bullish thesis is also confirmed by the Exponential Moving Average (EMA). When the article was written, the 20 EMA was above the 50 EMA, which could indicate that BTC might trade well above the $37,000 region in some weeks. Another critical measurement is the Spent Output Profit Ratio (SOPR), which can indicate the degree of profit realized by both long-term holders (LTH) and STH. Higher values of the ratio could mean that LTH are spending more profits compared to STH.

- STHs show signs of Bitcoin accumulation.

- Profit supply decrease suggests BTC recovery potential.

- Key metrics indicate possible BTC price movements.

Türkçe

Türkçe Español

Español