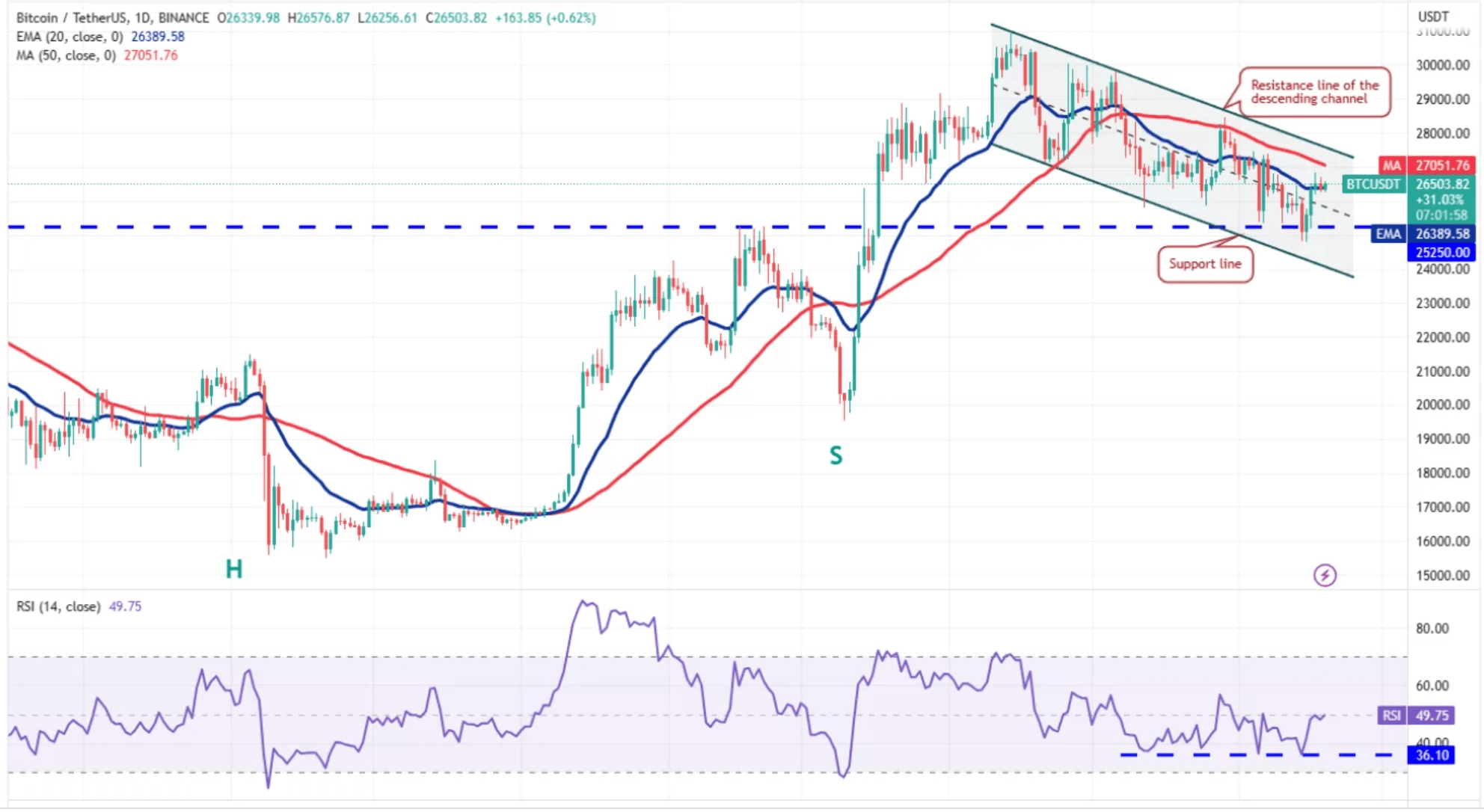

The king of cryptocurrencies, Bitcoin, saw a sharp rise above $27,050 due to strong purchases on derivative and spot exchanges during evening hours. However, the price couldn’t linger there for long. The swift drop due to profit sales was the result of excessive volatility. While movements exceeding $700 intervals are relatively positive, short-term traders using these intervals for profit feeds current ambiguity regarding the direction.

Bitcoin (BTC) Comment Forecast

Remember the decline experienced in 2022. The price must not lose the $30,000 support, we’ve heard comments such as “it should test but rebound” for every support region. In this way, BTC price experienced a slow yet steady decline down to $15,500. In bull markets, the opposite happens. Investors expecting that the price will fail to overcome resistance zones constantly await a drop, yet BTC continues on its path by making higher lows. If we are in the last stages of bear markets (as many predict), we should see the price steadily making higher lows. At this point, it’s crucial for us to see that the $30,000 support has been permanently reclaimed, just like the $20,000 level today.

Buyers will attempt to push the price to the resistance line of the channel. This is an essential level for the bears to defend, as a break and close above it could trigger a new upward movement. Alternatively, if the price drops sharply from the current level, it would indicate that bears continue to sell at rallies. The BTC/USDT pair could then return to the strong support between $25,250 and $24,800.

Will Bitcoin Fall?

The following developments could be decisive for the price trend;

- Early approval/rejection related to BlackRock’s application

- The U.S. Department of Justice getting involved in the Binance case

- Genesis announcing a settlement before the deadline of August 2nd, or officially declaring bankruptcy

- Developments related to the ongoing ETF case between Grayscale and the SEC. If the case continues, it might be difficult for BlackRock to get approval unless Grayscale prevails and eases the SEC’s hand for approval. Alternatively, the SEC may settle the case and GBTC and BlackRock approvals may follow each other.

- Overly hawkish data and statements from Powell+members this week on the macro front

- An escalation of military tensions in Russia, Taiwan, and other areas

And hundreds of surprising developments can direct the price. However, the first four items are hot topics.