The second month of the year is about to end, and the king cryptocurrency surged to as much as $59,000, nearly reaching $60,000. In February, the price experienced a rise of $17,000-$18,000, forming a bullish candle rarely seen in history. We last saw such an event in February and March of 2021. Even then, there was no closing at the peak, but a long upper wick was formed. So, what happens now?

Bitcoin On-Chain Analysis

Technical indicators were suggesting that after the last correction, the price could embark on a journey targeting $65,000. Now, BTC has rapidly increased to $59,045, and this rally happened in just 3 days. The price was at $50,000 just three days ago. So, what do the technical indicators tell us now?

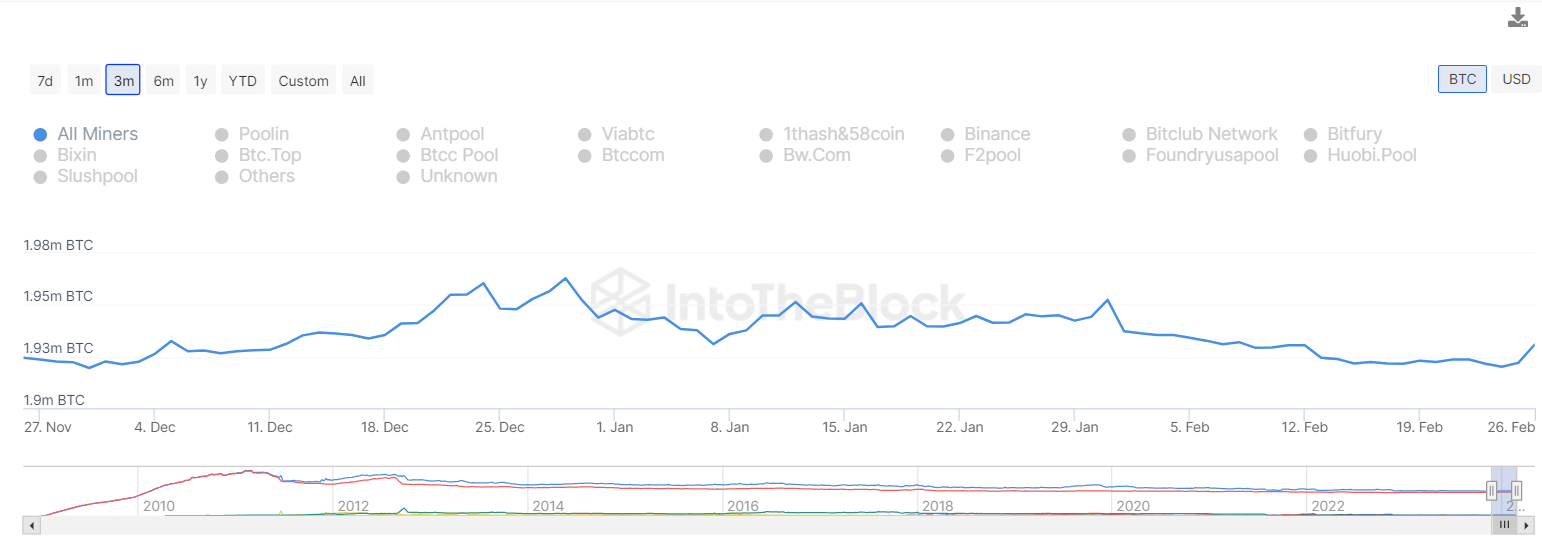

Miner Reserves

During the period when the Bitcoin price increase accelerated, contrary to the usual trend, miner reserves began to grow. On February 24, the reserves reached their lowest level in recent times, but today they have increased to 1.93 million BTC. This suggests that miners are expecting an even higher peak as the halving approaches.

Still, miners need more accumulation to reach the reserve size they had at the end of December, which was around 1.96 million.

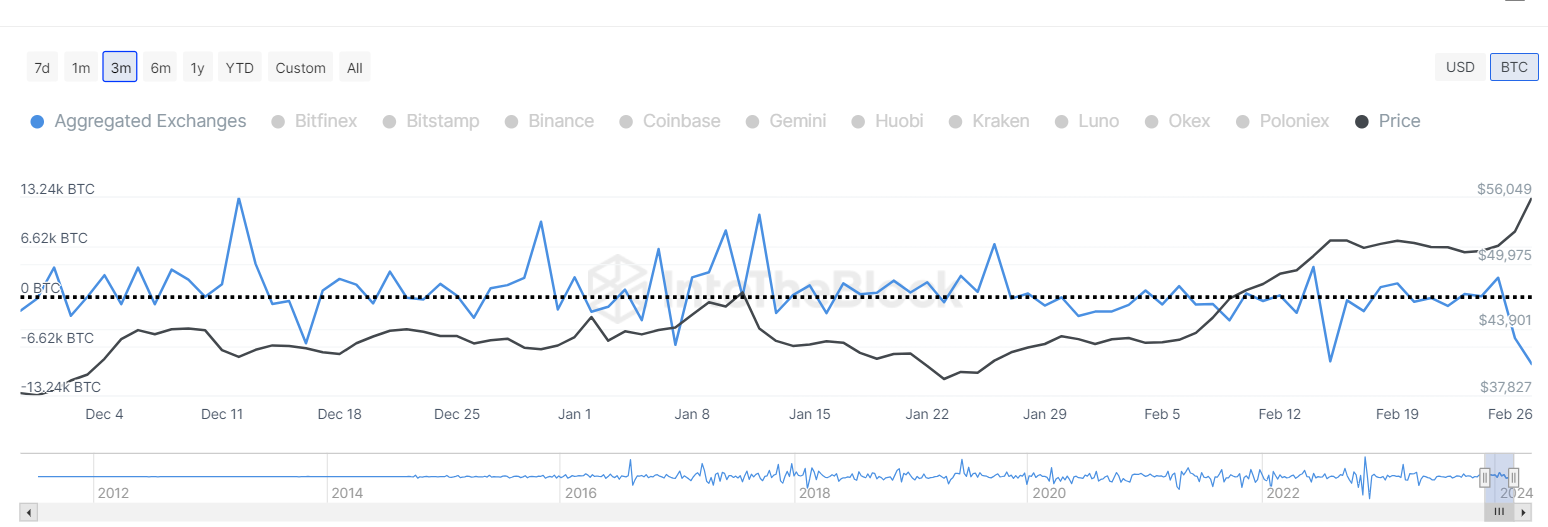

Exchange Net Outflows

In the last 3 days, there was a net outflow of 9,004 BTC from exchanges. Despite the price increase over the last 30 days, the total net inflow was only 3,045 BTC. In the weekly period, the net outflow was 8,330 BTC, which means that the net inflow data from exchanges supports the price increase. With the demand for ETFs increasing over-the-counter while the supply on exchanges does not multiply, we can see the price rising further.

Bitcoin Google Searches

The data here has not yet reached the peak levels of the ETF approval day. This is good news in a way because it reflects growth potential. As the price likely approaches surpassing its previous peaks, we will see days when the necessary influx of investors for a bigger rally begins. In previous bull markets, we always saw a reversal from the real peak months after new investors flooded into the markets.

Now, with OTC and exchange-driven demand being strong and the halving approaching, it seems logical for more new investors to rush into this space through increasing investment channels.