The recent volatile trajectory of Bitcoin‘s price, which surged to approximately $48,000 before dropping to around $45,000, has sparked speculation and caution within the crypto community. The sudden fluctuation was triggered by a misleading post announcing the approval of Bitcoin ETFs from a hacked SEC account.

Bitcoin Critic Peter Schiff’s Cautious Perspective

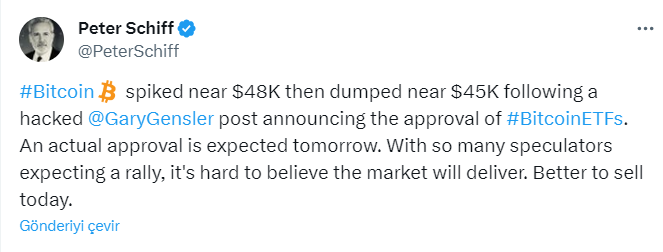

Peter Schiff, a well-known Bitcoin and crypto skeptic, has expressed a cautionary perspective amidst market frenzy. Schiff’s warning revolves around the anticipation of a real Bitcoin ETF approval and the potential for disappointment following the recent turbulence.

Schiff suggests that the price increase due to the hack and the subsequent correction might not be an isolated incident. According to him, this event could be the beginning of a more significant market downturn. Schiff’s contrarian view challenges the conventional optimism surrounding the expected ETF approval and warns investors about the unpredictability of market reactions.

Bearish Stance: Considering Selling Today as a Strategic Move

In line with the general bearish trend towards Bitcoin, Schiff advises investors to consider selling today instead of waiting for potential disappointments on actual ETF approval news. While Schiff’s perspective aligns with his skepticism, it resonates with investors who prioritize risk aversion and seek to reduce unnecessary exposure.

Schiff’s warning introduces the concept of a potential “overbought” scenario. The idea here is that the excitement leading to approval may already be factored into the market, and the actual event could trigger profit-taking rather than a continuous buying frenzy. This cautious stance underscores Schiff’s belief that market dynamics may not align with the rise expectations associated with ETF approval.

Market Dynamics and Regulatory Developments

Schiff’s core message emphasizes caution by urging investors to consider current market dynamics. The crypto market, known for challenging majority expectations, especially in the context of high-risk regulatory developments, requires a cautious approach.

The coming days are poised to be a critical test for Bitcoin. The question now is whether Bitcoin will continue its rise following the long-awaited ETF approval or if Schiff’s warning of potential disappointment will materialize. As the crypto world navigates through market turmoil and awaits clearer regulations, informed decision-making becomes increasingly important.

In the midst of Bitcoin’s recent price fluctuations, Peter Schiff’s cautionary tale underscores the need for vigilance in the crypto market. Whether investors heed Schiff’s advice or follow a different path, the evolving dynamics highlight the importance of adapting to market sentiment and regulatory developments for a comprehensive view of Bitcoin’s trajectory.

Türkçe

Türkçe Español

Español