Noteworthy developments in the crypto market continue to emerge. Accordingly, BitFuFu, a cloud mining company affiliated with Bitmain, published an unaudited financial and operational report for the second quarter of 2024, ending June 30. The results reveal significant cost increases in Bitcoin mining amidst the company’s challenges and growth over the past 12 months.

What is Happening in Bitcoin Mining?

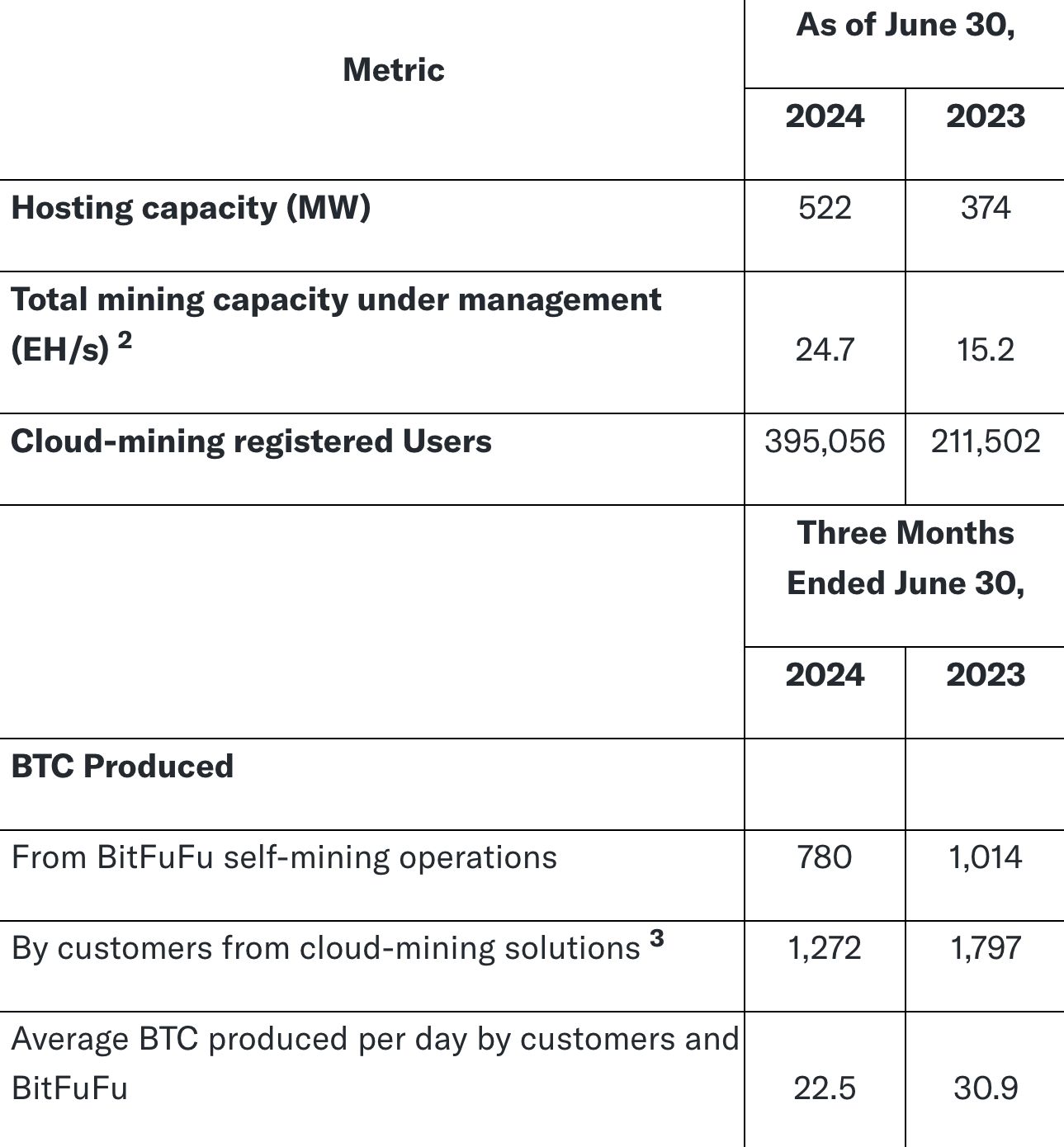

In addition to this cost increase, the report also noted that the mining capacity under management rose by 62.5% to 24.7 EH/s compared to 15.2 EH/s in the same period of 2023. Among the statistics reported in BitFuFu’s Q2 report, the most dramatic change was the average cost to mine each Bitcoin, which soared to $51,887.

During the same period, a sharp price increase can be seen compared to $19,344 per Bitcoin mined in 2023, which can be attributed to higher electricity and operational costs. This increase can also be linked to the rising mining difficulty and the Bitcoin halving event in April 2024, which will reduce Bitcoin rewards by 50%.

Details on the Subject

Despite the significant increase in Bitcoin mining costs, BitFuFu expanded the scale of its mining operations. The Bitcoin mining company increased its operational capacity by over 60%, reaching 24.7 exahash per second (EH/s) amidst the rising mining-related costs.

The Bitcoin mining company also reported an almost 70% increase in total revenue, reaching $129.4 million in Q2 2024 from $76.3 million in the same period of 2023. The revenue increase can be attributed to the expansion of the company’s cloud mining services, which generated $77 million during the reporting period.

In an interview with CNBC on August 19, Matthew Sigel, head of crypto asset research at VanEck, stated that the forced sale of Bitcoin is over. Sigel explained that the current state of the crypto market and Bitcoin price is characterized by a typical seasonal pattern one to three months after the halving event. The forced sale Sigel referred to involves the German government selling 49,858 Bitcoins for $2.6 billion while repaying Mt. Gox creditors.

Türkçe

Türkçe Español

Español