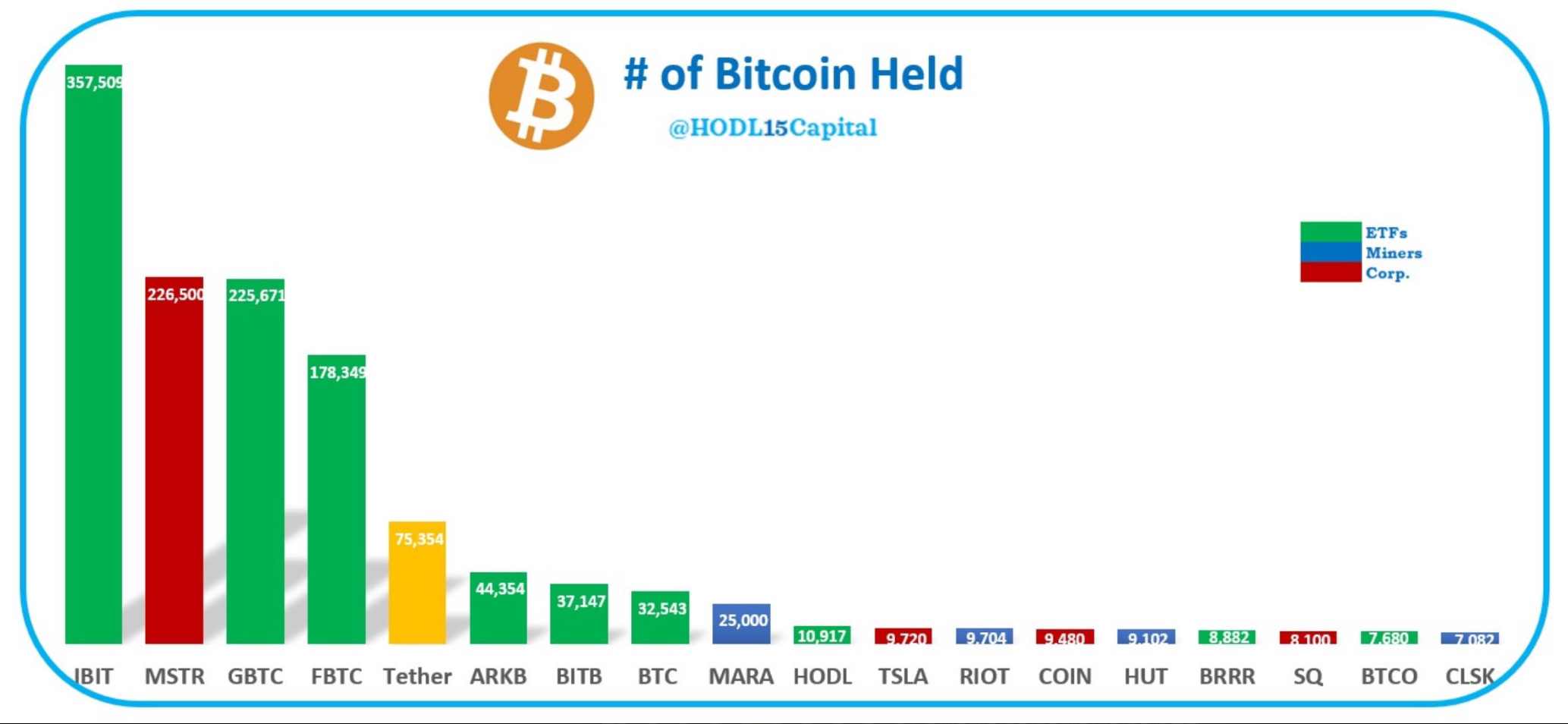

According to HODL15Capital data, as of September 1, BlackRock‘s spot Bitcoin ETF IBIT holds 357,509 BTC, making it the world’s largest institutional Bitcoin holder. This significant investment places BlackRock ahead of other major institutional investors and demonstrates the world’s largest asset management company’s strong position within the cryptocurrency market.

MicroStrategy Now in Second Place

Previously known as the largest institutional Bitcoin holder, MicroStrategy now holds 226,500 BTC, placing it in second place. The company’s BTC holdings narrowly surpass Grayscale’s GBTC, which holds 225,671 BTC. Despite the rising popularity of spot Bitcoin ETFs, MicroStrategy, which had earlier announced its transformation into a “Bitcoin development company,” has not stepped back from its strategy. Through its acquisitions, it continues to demonstrate its commitment to Bitcoin investment, maintaining its strong market position.

Fidelity‘s ETF FBTC holds 178,349 BTC, ranking fourth and emerging as a significant player in the developing spot Bitcoin ETF world. Meanwhile, leading stablecoin issuer Tether holds 75,354 BTC, ranking fifth among institutional investors. Other notable institutional investors include ARK Invest/21Shares‘ spot Bitcoin ETF ARKB, holding 44,354 BTC, and leading Bitcoin mining company Marathon Digital, holding 25,000 BTC.

Institutional Participation on the Rise

Figures indicate a rising trend in institutional participation in Bitcoin, led by financial giants like BlackRock and Fidelity. Although Bitcoin’s price has not yet matched the expected level of institutional participation, market observers point to macroeconomic developments. The Fed’s potential interest rate cuts and the alleviation of recession fears in the US economy could lead to a significant price increase alongside institutional participation.

On the other hand, participation in institutional BTC investment from various sectors, such as stablecoin issuers, highlights the diversity of Bitcoin investors. All these institutions seem to be strategically positioning themselves to benefit from Bitcoin’s continued adoption as an asset class as the market evolves.

The continuous increase in institutional holdings of BTC not only reflects confidence in Bitcoin’s long-term potential but also indicates broader acceptance of cryptocurrencies in the traditional financial world.