BlackRock’s “Strategic Income Opportunities Portfolio” has significantly increased its Bitcoin  $91,967 investments by boosting its shares in the iShares Bitcoin Trust (IBIT) by 14%. According to the latest filings with the SEC, as of September 30, the fund owned 2.39 million IBIT shares, an increase from 2.09 million at the end of June. The rise in Bitcoin’s value, surpassing $91,000, resulted in a 2% pre-market trading increase in IBIT shares.

$91,967 investments by boosting its shares in the iShares Bitcoin Trust (IBIT) by 14%. According to the latest filings with the SEC, as of September 30, the fund owned 2.39 million IBIT shares, an increase from 2.09 million at the end of June. The rise in Bitcoin’s value, surpassing $91,000, resulted in a 2% pre-market trading increase in IBIT shares.

BlackRock’s Flexible Approach Embraces Cryptocurrency

The Strategic Income Opportunities Portfolio goes beyond traditional bond portfolios, combining various asset classes into a flexible structure. The fund diversifies investments across government bonds, corporate credits, mortgage-backed securities, and emerging market instruments.

This flexible management strategy allows the inclusion of alternative investment vehicles that support total returns and diversification objectives. Consequently, this approach permits the portfolio to incorporate non-traditional assets like IBIT.

The inclusion of IBIT signals the growing integration of cryptocurrencies in institutional investment strategies. BlackRock’s preference for a Bitcoin ETF even within its own fund underscores the shifting landscape where cryptocurrencies are becoming central rather than peripheral to financial systems.

Institutional Demand Reaches New Heights

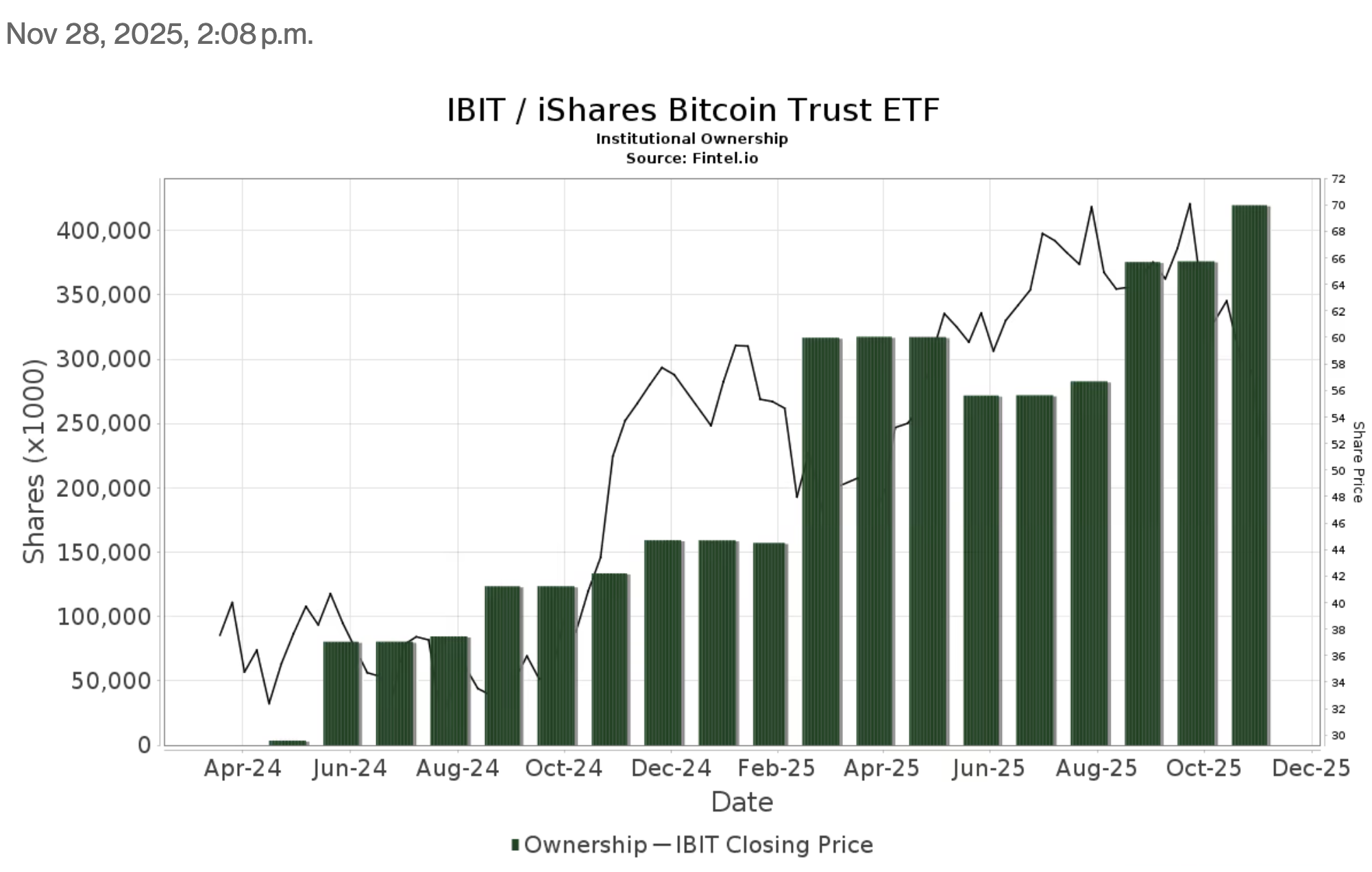

According to data provider Fintel, IBIT’s institutional ownership rate has reached its highest level ever. With over 400 million IBIT shares, the data reflect increasing institutional confidence in cryptocurrencies. This surge indicates both long-term portfolio managers and short-term return-seeking funds are evaluating Bitcoin as a strategic asset.

Additionally, Nasdaq ISE’s application to increase IBIT options’ position limits to one million contracts stands to enhance the product’s liquidity. Parallel to Bitcoin’s price increases, the rising trading volume around IBIT suggests that the ETF is swiftly approaching market maturity. Encouraged by BlackRock’s leadership, growing institutional participation strengthens cryptocurrencies’ position in traditional capital markets.