BlackRock USD Institutional Digital Liquidity (BUIDL) fund paid over $2 million in dividends in July, marking a record monthly payment. According to Etherscan data, BlackRock distributed $2.12 million to investors in July, a 16% increase from June. The fund has paid over $7 million in dividends since its launch, with yields increasing every month.

What’s Happening in the RWA Space?

BlackRock’s first tokenized fund, BUIDL, was launched in the Ethereum ecosystem in March. According to Etherscan data, it has since reached a market value of approximately $522 million, quickly surpassing established funds like Franklin Templeton’s Franklin OnChain U.S. Government Money Fund (BENJI).

According to Deloitte, BUIDL’s increasing dividend yields indicate a growing preference among institutional investors for tokenized money market funds. These funds offer enhanced liquidity, accessibility, and efficiency compared to traditional funds. DeFi protocols like Ondo are also using BUIDL for futures products.

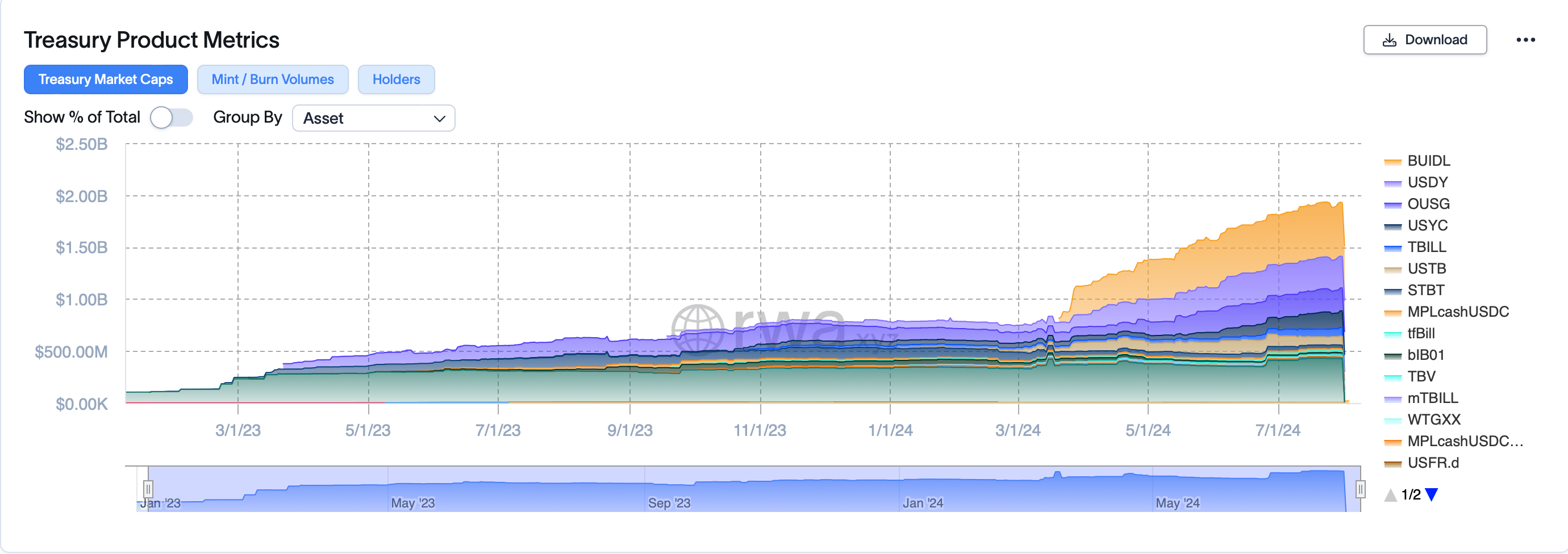

The tokenized U.S. Treasury market experienced significant growth in 2024. RWA xyz data shows that the total value of this segment increased from $726.23 million to $1.88 billion this year. BlackRock’s BUIDL and Franklin Templeton’s FOBXX contribute significantly with market values of $522.81 million and $414.30 million, respectively.

Details on the Subject

Analysts predict this growth will continue, with the market reaching $3 billion by the end of 2024. Demand from decentralized autonomous organizations (DAOs) and decentralized finance (DeFi) projects seeking stable, risk-free returns in the blockchain ecosystem is driving this growth. Consulting firm McKinsey & Company forecasts that the tokenized financial assets market could reach $2 trillion by 2030.

RWA tokenization involves converting tangible assets like bonds, real estate, and debt into crypto assets on blockchain networks. These digital representations can be traded and transferred within DeFi ecosystems. Mohamed Elkasstawi, co-founder and CEO of Hamilton, explained the potential new opportunities in the RWA tokenization sector:

“We foresee tokenized assets bringing more transparency, liquidity, and accessibility to traditional financial markets. We believe enabling fractional ownership and 24/7 liquidity will democratize access to high-quality investment opportunities.”

Meanwhile, BlackRock continues to be a leading provider of spot Bitcoin ETF funds and spot Ethereum ETF funds. BlackRock’s Chief Investment Officer Samara Cohen stated earlier this week that it is unlikely we will see more funds based on other cryptocurrencies soon.

Türkçe

Türkçe Español

Español