BlackRock’s spot Bitcoin exchange-traded fund (ETF) recorded its largest inflow day in four months on July 23, with over $523 million entering the fund. Despite significant outflows from Grayscale’s newly converted Ethereum Trust, Ethereum investment funds reported a net inflow of $106.6 million in the first trading days. Asset manager Bryan Courchesne made notable statements. Here are three significant developments from the past week.

What’s Happening on the Bitcoin ETF Front?

BlackRock’s spot Bitcoin exchange-traded fund recorded its largest inflow day in four months on July 23, with over $523 million entering the fund. iShares Bitcoin Trust ETF (IBIT), co-founder Julian Fahrer cited Hey Apollo data in a post on July 23 on X, stating that on July 22, it accumulated 7,759 Bitcoins, valued at just over $523 million at the time of writing.

The inflows on July 22 increased IBIT’s total assets under management to 333,000 Bitcoins, valued at approximately $22 billion at current prices. This marked the seventh-largest inflow day for IBIT in terms of US dollars. IBIT witnessed its largest single inflow day on March 18 when $849 million worth of Bitcoin was added to the fund. According to Farside Investors data, the second-largest inflow day on record occurred on March 5, with $788 million entering the fund.

Strong Interest in Ethereum ETF Funds

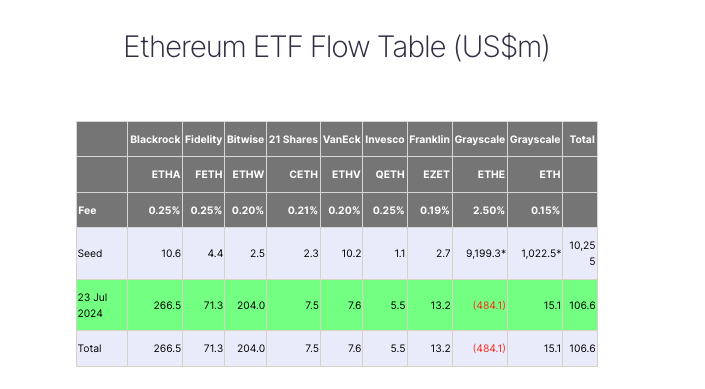

Ethereum exchange-traded funds reported a net inflow of $106.6 million in the first trading days, despite significant outflows from Grayscale’s newly converted Ethereum Trust. BlackRock’s iShares Ethereum Trust ETF led with $266.5 million in inflows, followed closely by Bitwise Ethereum ETF with a net inflow of $204 million. Fidelity Ethereum Fund ETF ranked third with $71.3 million.

The inflows into Ethereum ETF funds were sufficient to offset the selling pressure from Grayscale Ethereum Trust (ETHE), which saw $484.9 million in outflows in a single day, equivalent to 5% of the once $9 billion fund. ETHE was launched by Grayscale in 2017, allowing institutional investors to purchase Ethereum but imposed a six-month lock-up period on all investments.

Bitcoin Debate Continues in the US

Asset manager Bryan Courchesne recently appeared on CNBC to discuss the potential of Bitcoin becoming a strategic reserve asset for the US government under a possible future Trump administration. According to the asset manager, adopting Bitcoin as a reserve asset is challenging but not impossible. Courchesne pointed to the Department of Justice’s large holdings of 200,000 Bitcoins, making the US government the largest holder of Bitcoin after Satoshi Nakamoto.

Courchesne explained that the Department of Justice could transfer Bitcoin to the US Treasury, paving the way for the Treasury to start accumulating and holding this scarce asset in the long term. Speculation about Bitcoin becoming a global reserve asset or a strategic US Treasury asset increased after former President Donald Trump expressed support for the crypto asset sector in the face of rising global debt and monetary inflation.

Türkçe

Türkçe Español

Español