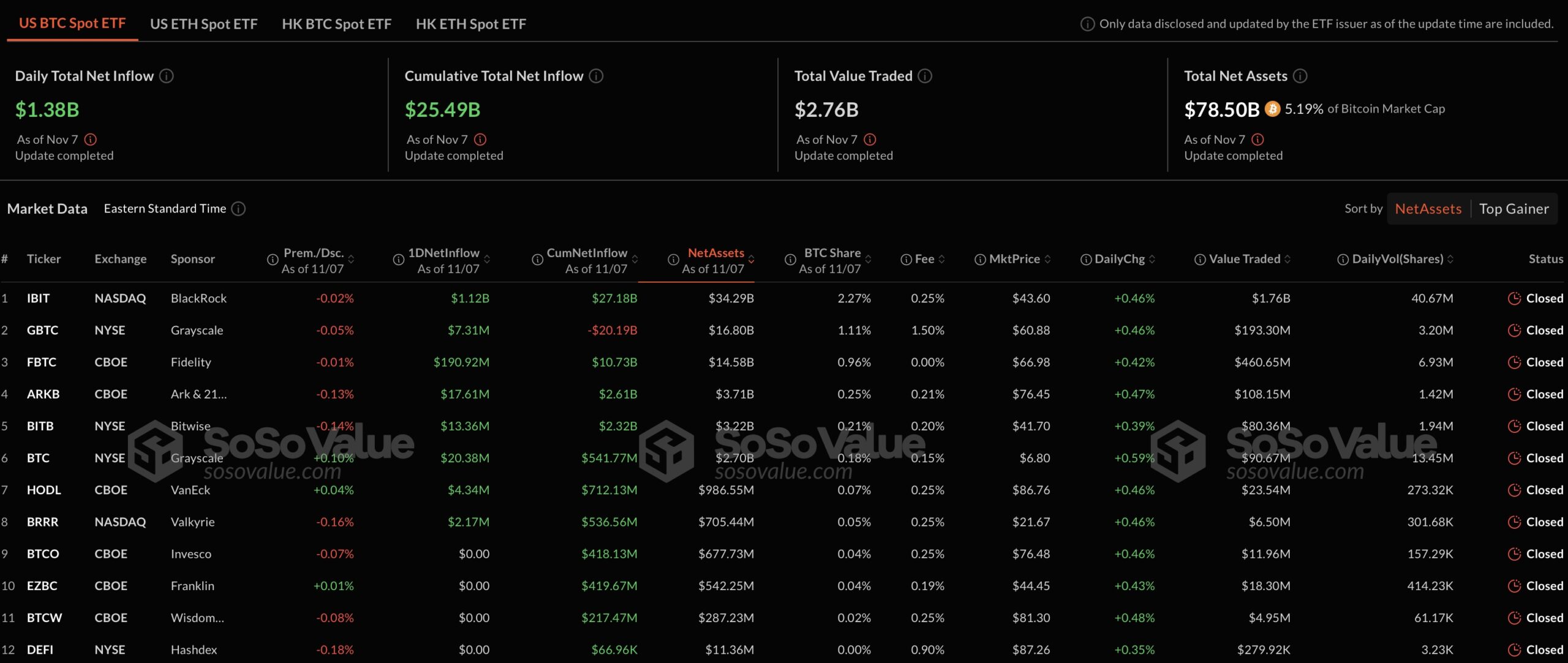

The world’s largest asset management company, BlackRock, achieved a remarkable milestone on Thursday when its iShares Bitcoin  $102,347 Trust (IBIT) recorded a net investment flow of $1.12 billion, breaking its previous record. This new high surpassed the former record of $872 million set on October 30. This extraordinary increase in inflows contributed to a daily net investment flow record of $1.38 billion in spot Bitcoin ETFs.

$102,347 Trust (IBIT) recorded a net investment flow of $1.12 billion, breaking its previous record. This new high surpassed the former record of $872 million set on October 30. This extraordinary increase in inflows contributed to a daily net investment flow record of $1.38 billion in spot Bitcoin ETFs.

Trump’s Election Victory and Interest Rate Cuts Attract Bitcoin Investment

Donald Trump’s victory in the U.S. presidential elections significantly boosted investor confidence in the cryptocurrency market. According to crypto analyst Rachael Lucas from BTCMarkets, the markets for both stocks and cryptocurrencies experienced an uptrend following Trump’s win, with Bitcoin reaching an all-time high. Concurrently, the Federal Open Market Committee (FOMC) reduced interest rates by 25 basis points to a range of 4.50-4.75 percent.

Jeff Mei, COO of BTSE exchange, noted that Trump’s election win and the Fed’s rate cuts have directed institutional investors toward spot Bitcoin ETFs. Mei expressed optimism, stating that increased expectations of further rate cuts, potential professional cryptocurrency regulations, and ongoing economic incentives from China have heightened institutional interest in BlackRock’s spot Bitcoin ETF, anticipating more inflows in the coming months.

Investment Surge in Spot Bitcoin and Ethereum ETFs

In addition to BlackRock’s $1.12 billion investment inflow, Fidelity’s FBTC fund attracted a net investment of $190.92 million, while Grayscale’s mini trust garnered $20.38 million. Other spot Bitcoin ETFs, including those from Ark & 21Shares, Bitwise, VanEck, and Valkyrie, also recorded significant investment flows.

Data revealed that 12 spot Bitcoin ETFs in the U.S. reached a total trading volume of $2.76 billion on Thursday, accumulating a total of $25.49 billion in net investments recently.

Post-election interest in spot Ethereum  $2,544 ETFs also surged. On Thursday, nine spot Ethereum ETFs received a total of $79.74 million in investments, achieving a trading volume of 466.39 million. The trading volume of Ethereum ETFs notably exceeded the average trading range of $100 million to $200 million.

$2,544 ETFs also surged. On Thursday, nine spot Ethereum ETFs received a total of $79.74 million in investments, achieving a trading volume of 466.39 million. The trading volume of Ethereum ETFs notably exceeded the average trading range of $100 million to $200 million.

Türkçe

Türkçe Español

Español