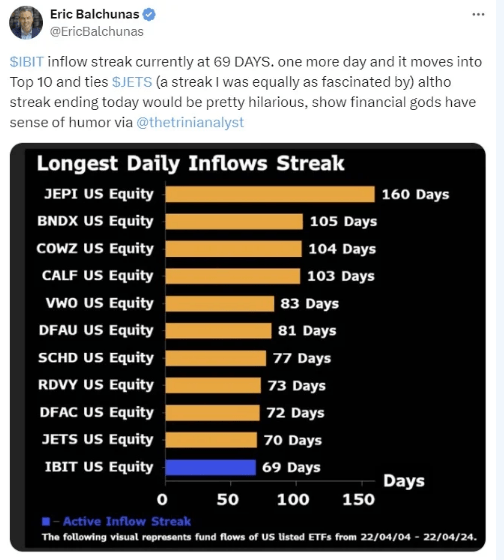

With assets under management worth $10.5 trillion, Blackrock, the world’s largest asset manager, has consistently contributed to a spot bitcoin exchange-traded fund (ETF) for 70 consecutive days. This success has positioned the Ishares Bitcoin Trust (IBIT) among the top 10 ETFs with the longest daily inflows since its market entry in January, gathering approximately 274,000 Bitcoin.

IBIT and 274,000 Bitcoin

Blackrock’s spot bitcoin exchange-traded fund (ETF), Ishares Bitcoin Trust (IBIT), has hosted uninterrupted inflows over a 70-day period.

IBIT shines among the 11 funds approved by the US Securities and Exchange Commission (SEC) on January 10, continuing to rank at the forefront of the US spot ETF process.

In its first-quarter earnings announcement, Blackrock reported record-breaking assets under management of $10.5 trillion.

Recently, Bloomberg ETF analyst Eric Balchunas mentioned on the X platform on Monday that IBIT was just one day away from being among the top 10 ETFs with the longest series of daily inflows. Following this statement, an inflow of $19.7 million occurred on Monday, marking 70 consecutive days of inflows to IBIT.

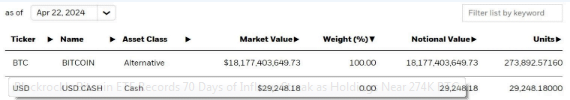

Since its inception, IBIT has amassed approximately 273,892.57 BTC, equivalent to about $18.18 billion in nominal value, capturing all attention.

Blackrock or Grayscale?

The amount of Bitcoin currently held by Blackrock’s Ishares Bitcoin Trust is nearly equal to that held by Grayscale’s Bitcoin Trust (GBTC).

GBTC hosted significant Bitcoin outflows after converting from a trust to a spot bitcoin ETF in January. According to Grayscale’s website, GBTC’s Bitcoin assets rose to 304,220.4615 BTC as of Monday.

Blackrock CEO Larry Fink recently stated that he is very optimistic about Bitcoin’s long-term viability.

Fink also highlighted that Ishares Bitcoin Trust is the fastest growing ETF in the history of ETFs, emphasizing that no other asset has accumulated as quickly as IBIT in its history.

Fink also expressed pleasant surprise at the substantial individual investor demand, adding:

I could never have guessed this before we applied.

Türkçe

Türkçe Español

Español