The cryptocurrency market experienced significant fluctuations on January 7, yet BlackRock’s iShares Bitcoin  $119,370 ETF (IBIT) recorded an impressive $597 million in inflows. This entry provided a glimmer of hope for investors during a challenging period for the market.

$119,370 ETF (IBIT) recorded an impressive $597 million in inflows. This entry provided a glimmer of hope for investors during a challenging period for the market.

IBIT Balances Market Decline

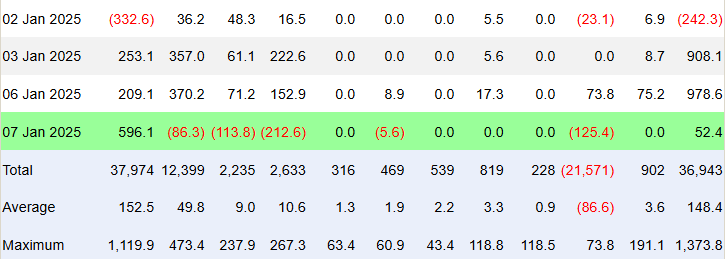

BlackRock made a notable purchase of 6,078 BTC on the second trading day of the week, totaling an investment of $208.7 million. On the same day, miners produced only 450 new BTC, showcasing IBIT’s effectiveness in meeting market demands. According to Trader T data, the ETF saw a total net inflow of $597.18 million.

IBIT closed its third consecutive trading day with positive inflows. Notably, U.S. spot Bitcoin ETFs recorded a total inflow of $978.6 million on Monday, which fostered optimism in the cryptocurrency market, lifting Bitcoin’s price above $102,000.

Conversely, Fidelity’s FBTC, Bitwise’s BITB, and Ark Invest’s ARKB saw outflows of $86.29 million, $113.85 million, and $212.55 million, respectively. Franklin Templeton’s EZBC experienced a $5.58 million outflow, while Grayscale’s GBTC saw a $125.45 million outflow, with no inflows or outflows reported from other ETFs.

BlackRock’s spot Bitcoin ETF has provided a sense of optimism for investors despite the overall negative sentiment in the cryptocurrency market. The inflows into ETFs are interpreted as a positive signal regarding the market’s future.

Macroeconomic Data Challenges Bitcoin

The U.S. reported a rise in JOLTS job openings, reaching 8.098 million with an increase of 259,000 in November 2024. Additionally, the ISM Services PMI data came in higher than expected. These figures highlight the resilience of the U.S. economy but also led to a price drop of over 5% for Bitcoin due to ongoing inflationary pressures.

The U.S. dollar index (DXY) climbed above the 108.50 level after two days of decline. Although Bitcoin’s price showed partial recovery, it currently trades above the $95,000 threshold. Furthermore, the trading volume of the largest cryptocurrency dropped by 23% in the last 24 hours.

Türkçe

Türkçe Español

Español