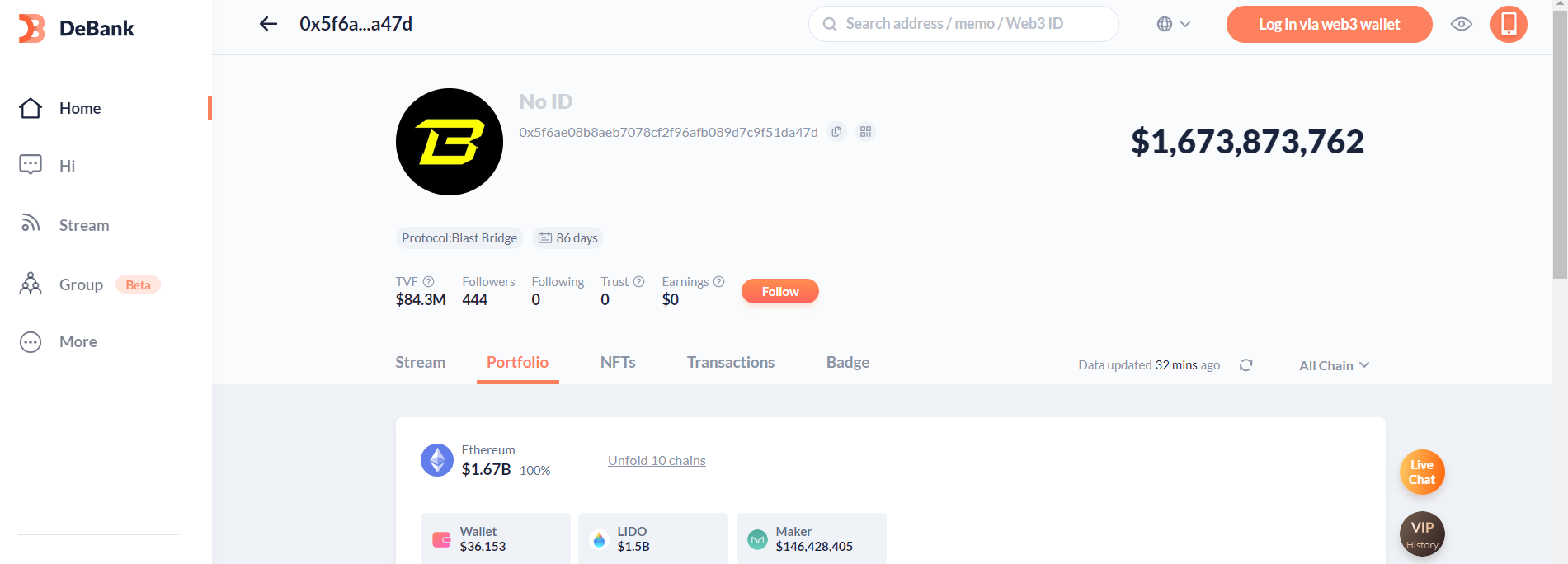

According to DeBank data, the total value of assets located in the contract address of Blast, a Layer-2 network led by founder Pacman, has surpassed $1.673 billion. The details of the reached figure include approximately $1.5 billion worth of ETH invested in the Lido protocol. In this respect, Ethereum has secured the lion’s share. Additionally, there is more than $146 million worth of DAI stored in the Maker protocol.

Why Has Blast Reached This Figure?

The rapid growth witnessed in Blast’s Layer-2 network may be a result of its approach to the DeFi sector. Investors in the cryptocurrency world, especially those in search of passive income, are exploring protocols to achieve the income they need. Blast reaching such a figure indicates that investors in search are choosing this network.

Another reason for Blast’s success could be its seamless integration with leading DeFi protocols like Lido and Maker. Thus, investors turning to DeFi protocols such as Lido and Maker also have the opportunity to interact with Blast.

Why Is Blast Attracting Interest?

The protocol Blast, as controversial as it is intriguing in the cryptocurrency world, is preferred for its user-friendly interface. The ease of the user interface undoubtedly offers investors the biggest advantage of being able to transact without difficulty. This can be guiding for those seeking passive income in the cryptocurrency space without much knowledge.

While Blast has reached a critical figure, criticisms for the Layer-2 network continue. In particular, Blast’s policy of not allowing users to withdraw their invested funds for three months was criticized. This was clearly emphasized by Paradigm’s research director Dan Robinson as setting a bad precedent for other projects.

Is DeFi the Trend for 2024?

During the 2021 bull market, especially DeFi and related cryptocurrencies stood out. Similarly, it is suggested that DeFi-focused cryptocurrencies could emerge in the potential bull season expected in 2024.

Analyst Michael van de Poppe listed 2024’s cryptocurrency trends, noting that alongside artificial intelligence and gaming-focused cryptocurrencies, the DeFi sector could also come to the forefront.