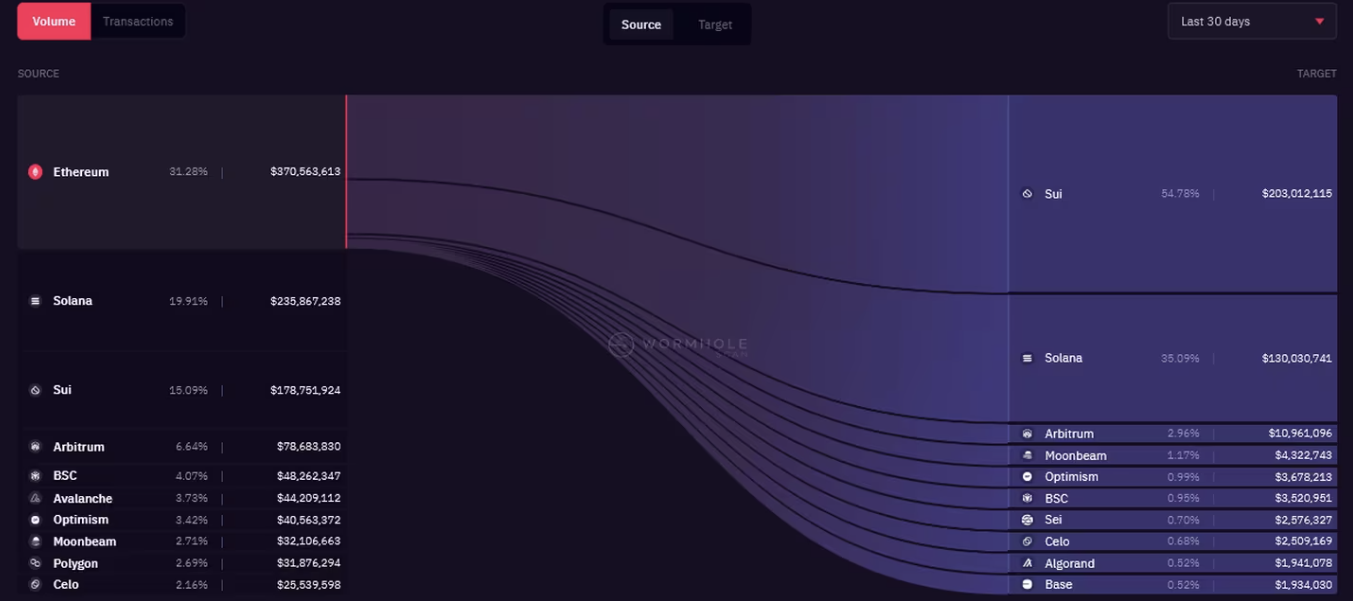

Interest in blockchain ecosystems continues to increase day by day. Accordingly, Sui and Solana managed to attract much more liquidity than the Ethereum ecosystem in the past month. According to data taken by the crypto bridge protocol Wormhole, $370 million in liquidity was moved from Ethereum ecosystems to other blockchain networks, and nearly 90% of these assets were sent to the Sui and Solana ecosystems.

Demand for Airdrop Events Increases

Wormhole’s Chief Operations Officer Dan Reecer stated that some of the assets taken into account could be explained by the incentive program that drives a lot of DeFi activity within Sui’s ecosystem. Regarding the interest in Solana, Reecer said:

“It could be related to users wanting to earn points in different applications after seeing recent airdrop events by applications like Jito.”

In the Web3 ecosystem, airdrop hunters are known to keep up with the latest trends to position themselves for potential rewards. They do this by quickly directing liquidity to protocols likely to offer airdrop events for user deposits.

One of the relevant data points is reward points, a system that confirms user participation in DeFi protocols and can make them eligible for future airdrop events. The NFT marketplace Blur popularized the point-based airdrop system and created a significant impact to capture a substantial market share from the previous market leader, OpenSea, in past years.

Now, this trend is spreading across platforms, protocols, and blockchain ecosystems, becoming more prevalent on Solana. Many Solana DeFi protocols, including Kamino, MarginFi, Parcl, and Solend, have announced their own point systems.

Noteworthy Developments in Sui

The Sui team announced a $50 million incentive program in October. These types of programs are used to attract the interest of developers and investors by financing grants for the former and user rewards for the latter. According to data from the blockchain data analysis platform DefiLlama, since the announcement of the program, Sui’s locked total value, a measure of investor deposits, has increased tenfold to reach $320 million.

Solana’s largest DeFi lending application with $160 million in deposits, Solend, could further increase Sui’s total value following integration into the Sui ecosystem. Despite significant amounts of liquidity being directed from Ethereum to both Solana and Sui, the total TVL of $1.65 billion still lags far behind Ethereum’s TVL level of $32.6 billion.

Türkçe

Türkçe Español

Español