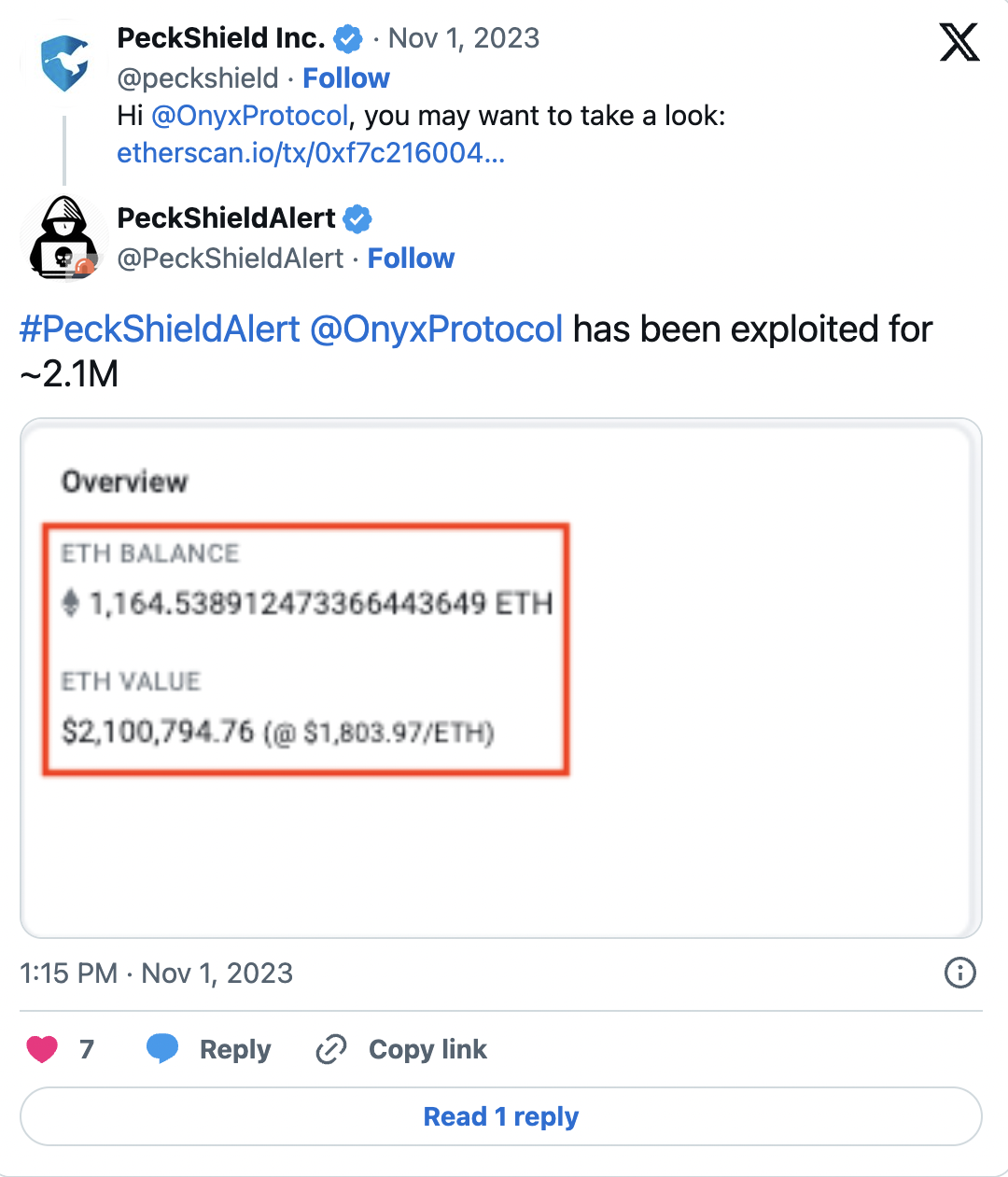

Blockchain ecosystems have witnessed yet another hack attack. According to reports, the decentralized lending protocol Onyx Protocol fell victim to a market exploit attack due to lack of liquidity. The protocol suffered a loss of $2.1 million in assets during the attack, which took place on October 27. Security research and efforts in the blockchain field continue to accelerate in recent times.

Hack Attack on Onyx Protocol

Blockchain researcher PeckShield continues to inform many Web3 users with the developments he shares, particularly on Twitter. Shortly after issuing a warning about the attack that went unnoticed by the Onyx Protocol team, the famous figure revealed that the hacker exploited a bug in the popular CompoundV2 fork behind Onyx Protocol.

PeckShield’s independent research revealed that the funds donated to borrow liquidity from other pools, particularly in the oPEPE pair that is claimed to have a liquidity shortage, were abused using a known method called rounding problem. PeckShield shared the following statement on Twitter:

“The donated funds were later used by taking advantage of a known method called rounding problem.”

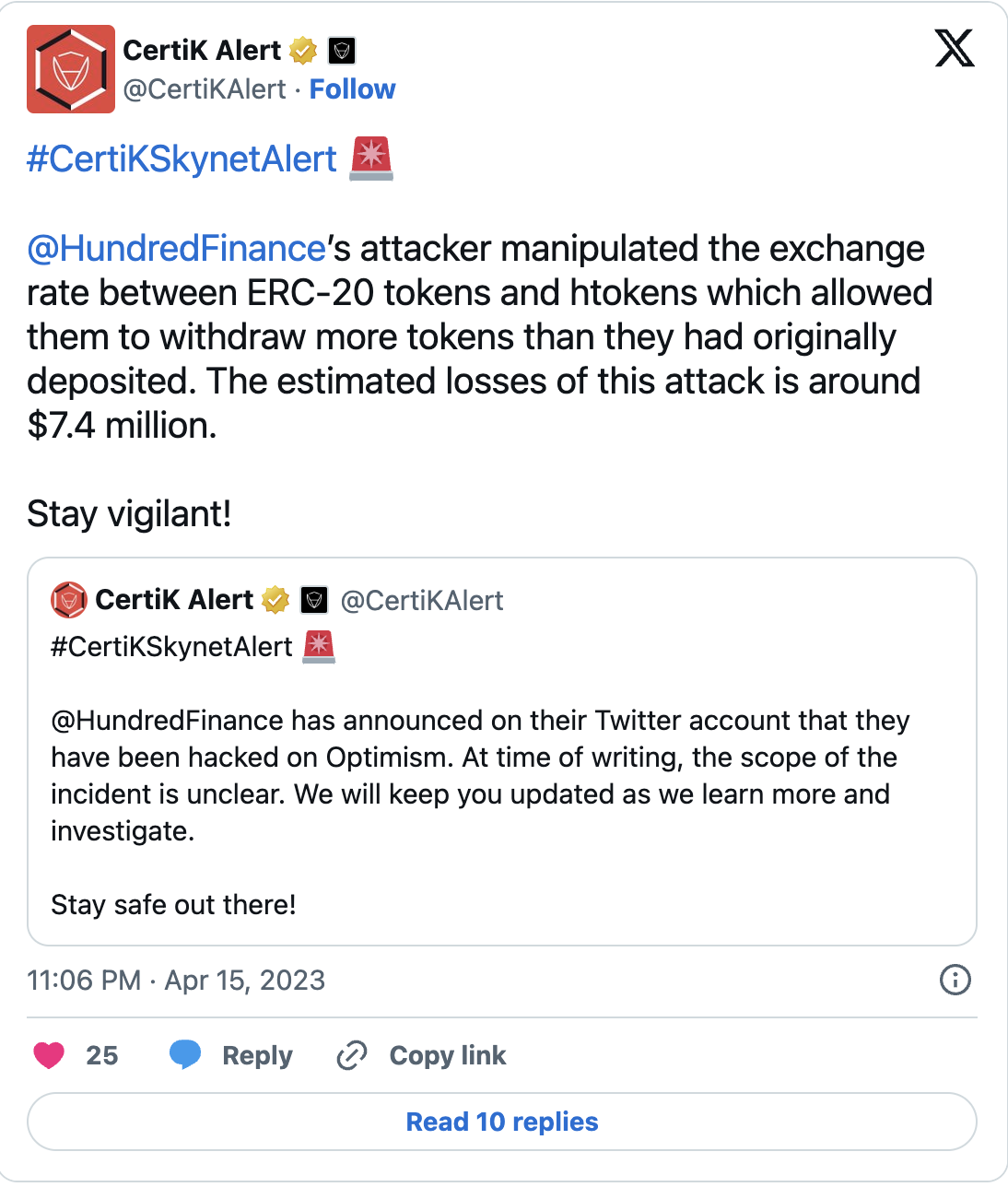

This method is commonly used by many hackers, and a similar exploit occurred on April 16, when an attacker stole $7 million through the multi-chain lending protocol Hundred Finance using the same vulnerability.

According to the blockchain security platform Certik, the attacker in the Hundred case manipulated the exchange rate between ERC-20 tokens and hTOKENS, allowing them to withdraw more tokens than initially deposited.

The Other Side of the Blockchain Sector

The attempted attacks from malicious hackers in this field once again demonstrate the importance of tracking crypto assets.

Although the blockchain ecosystem, which entered our lives during the 2021 rally, is promoted as the future of the finance world, it continues to face many problems. The technology offers advantages such as fast transactions and low commission fees to investors, and the tokenization of all kinds of assets also excites entrepreneurs.

However, the infrastructure work in blockchain technology has not yet produced significant security measures for smart contracts. Even the slightest flaws or mistakes in smart contracts can lead to asset losses for both users and protocols.

Türkçe

Türkçe Español

Español