Blockchain-based technologies are continuing to rise on the shoulders of crypto developers. Chainlink is leading the way in blockchain-based oracle solutions. The cryptocurrency project is currently collaborating with many global partners, including Swift. However, founder Sergey recently made some important statements.

The Future of Chainlink (LINK)

Chainlink, the best option in its field, saw its token appreciate by more than 15% weekly after the latest Swift tests. Sergey focused on the section related to financial institutions and delved into important details that shed light on the future of Chainlink.

The founder of Chainlink clearly acknowledges that financial institutions are extremely eager about blockchain-based solutions. And there is more, Sergey said the following yesterday:

“This year’s Sibos conference showed me that financial institutions’ desire and demand to integrate blockchain technology is real. They also want to implement it quickly. After speaking with many central banks, private banks, financial market infrastructures, central securities depositories, and more, I am definitely convinced.

I see that the global financial ecosystem is rapidly transitioning to an onchain format.”

Chainlink and Financial Institutions

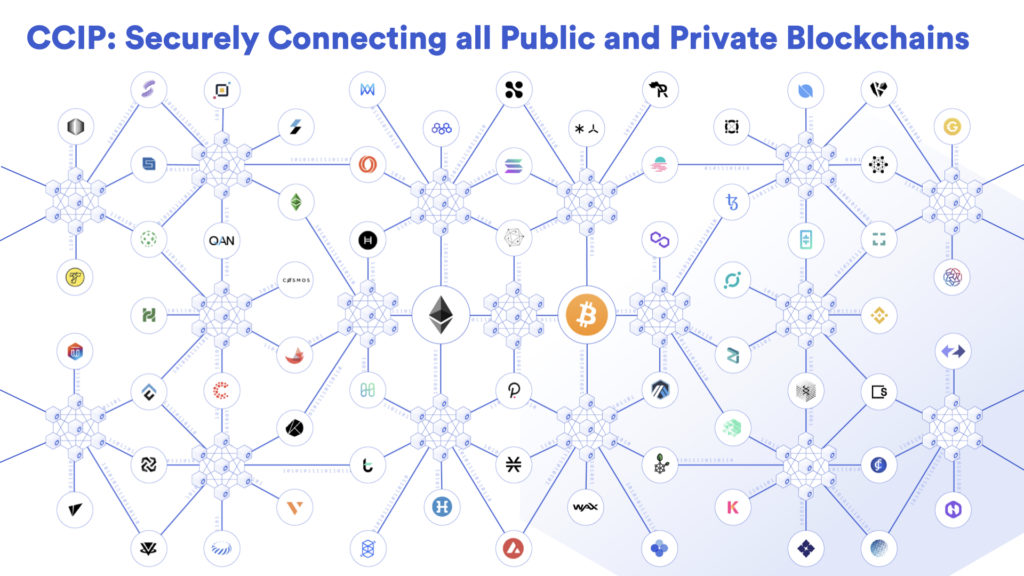

So, how will this positively impact the future of Chainlink? This is where CCIP comes into play. The reason why many experts strongly believe that LINK Token is closely tied to it is due to such promising moves. Sergey continued by focusing on this aspect.

“There are three main challenges they need to overcome. Connecting their existing systems to the blockchain is the first. The other two are conducting transactions with tokenized assets on any public or private blockchain and keeping all these tokens up to date with critical data while moving between chains.

CCIP helps solve these problems for capital markets with a single seamless and secure integration, eliminating the complexities that prevent banks from integrating blockchain technology on a large scale. CCIP has all the capabilities to securely manage trillions of dollars in asset flows for financial institutions.”

Institutions and market infrastructures such as Swift, DTCC, Euroclear, and ANZ see and experience how CCIP serves as an abstraction layer to connect and modernize transactions to any blockchain.

I believe that when such initiatives turn into real steps, others will follow.”