BONK seemed to be doing well over the past three days. There was a significant increase in both the number of unique daily transactions and the number of unique daily investors, suggesting that BONK might have started to rise again. On the other hand, metrics also indicate an uptrend for BONK.

Comments on BONK Coin

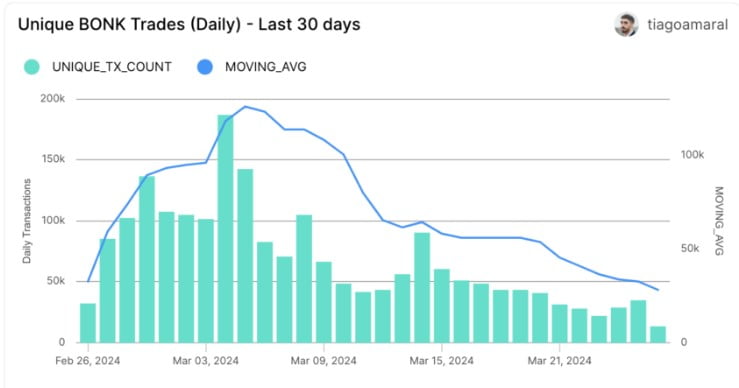

When the calendars showed March 4th, BONK reached a record level after its daily transaction count hit 187,000. However, it could not maintain this peak level for very long. In a short time, by March 23rd, it fell to the lowest level in 30 days with 22,200 transactions.

Looking at BONK transactions, a decline is still observed in the 7-day moving average. Nevertheless, promising signs continued to emerge over the last three days. There began a recovery in trading activities, and the number rose from 22,200 on March 23rd to 34,800 by March 25th.

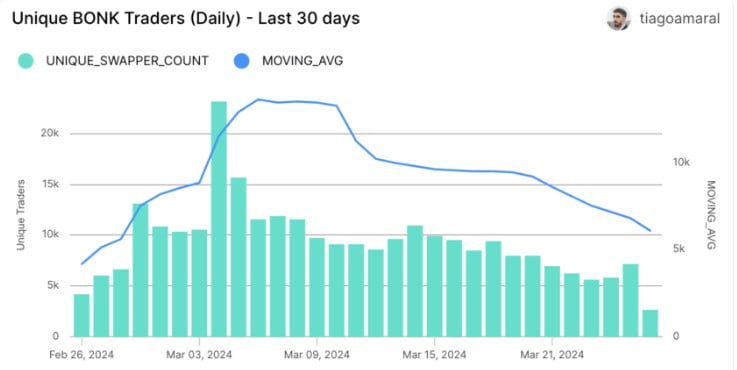

Similarly, the daily trader participation pattern also reflects this fluctuation. After reaching a peak on the same day as the trading volume peak with 23,200 individual investors, this decline turned into stability in mid-March.

This stability pointed to a stagnant period before the gradual increase in trader activities seen in recent days. The number of traders, which was 5,660 on March 23rd, rose to 7,170 by March 25th.

Although the 7-day moving average of daily trader count still indicates a decline, the recent increase in both transactions and trader numbers over the last few days could mean that interest in BONK is starting to rise again.

The Outlook for BONK Coin

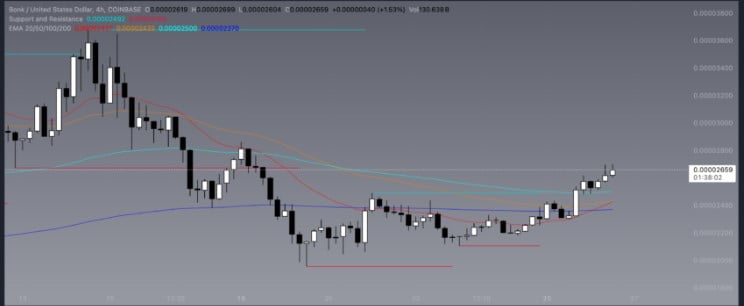

Recently, one of BONK’s short-term Exponential Moving Average (EMA) lines crossed over a long-term EMA line, creating a golden cross. The technical indicator marking the golden cross is generally known to bring an uptrend.

This golden cross, visible on BONK’s charts and dependent on its performance, is revealing rising optimism among investors and indicating the potential for a significant price rally.

As of the time of writing, BONK is moving towards a significant resistance level at $0.000036. Potentially breaking through this level could see BONK’s price experience an 80% increase, moving towards a new peak of $0.000047.

On the other hand, if it were to move downwards, BONK’s price could fall to $0.000019, potentially leading to losses for investors.

Türkçe

Türkçe Español

Español