Bonk (BONK), draws attention with its price drop and volume decrease. However, the macro outlook for the altcoin indicates a potential recovery in the coming days as the price action approaches a potential support area. Bonk has been among the best-performing memecoins since the beginning of the month and now has the potential to perform better if certain support levels are maintained.

Bonk Price May Be Preparing for a Rise

U.S. Securities and Exchange Commission‘s (SEC) decision to withdraw the classification of Solana (SOL) as a security means a partial victory for SOL. This development could also reflect on BONK as conditions for a bullish movement in the market are maturing.

BONK is currently trading at $0.00002637, experiencing a 5.1% drop in the last 24 hours. The altcoin’s price is currently above both the 50-day (green line) and 200-day (black line) exponential moving averages (EMA). This outlook confirms a bullish trend for BONK. Additionally, the upward trend in the price is supported by the rising trend line, indicating a strong bullish trend for this altcoin.

BONK’s price faces a minor resistance level around $0.0000292. If it surpasses this level, the price could rise by 30% to reach the next significant resistance level of $0.00004. This level coincides with previous peaks and a significant supply area. On the other hand, if the price drops, it could find support at $0.0000255 (50-day EMA) and $0.0000225 (200-day EMA). Falling below these levels would invalidate the ascending triangle formation.

Technical Indicators and Market Outlook for Altcoin

Relative Strength Index (RSI) is currently at 54.95, in a neutral position but close to the bullish zone. This indicates room for further upward movement. The Chaikin Money Flow (CMF) indicator also supports this bullish outlook, standing at 0.06. CMF’s current outlook indicates positive money flow towards Bonk and modest buying pressure.

Coinalyze data shows that Bonk’s on-chain metrics indicate market participants are accumulating. Although Open Interest (OI) has dropped by 4% in the last 24 hours, the Long/Short (L/S) ratio has increased by 11.11% in the past week, reaching 1.879.

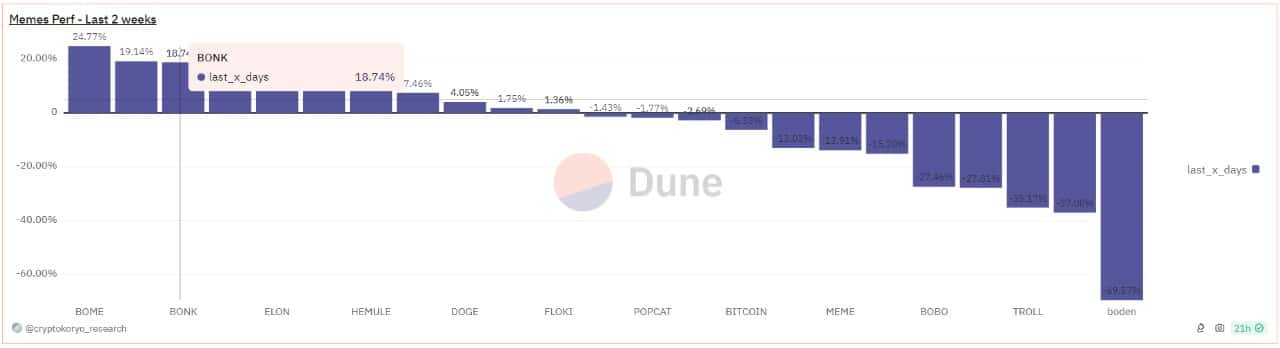

The L/S ratio compares the percentage of investors in long positions to those in short positions. Along with the falling OI, this ratio indicates that market participants are holding onto their BONK and expecting a price rise soon. According to Dune Analytics, Bonk has been among the best-performing memecoins in the past two weeks, with its price rising by 18.7% during this period, ranking third after BOME and COQ.