The price of Bonk, one of the popular memecoin projects on the Solana network, closed at $0.000041 on May 28, the highest level in several months, and has since fallen to form a descending channel. As the price heads towards the lower line of this channel, the memecoin is preparing to break the support and fall further.

Why is Bonk’s Price Falling?

A descending channel is notable as a bearish signal. When an asset’s price trends in this channel, it consistently moves downward, creating a series of lower highs and lower lows. The upper line of the channel forms resistance, and in BONK’s case, this corresponds to the $0.000044 level. Since the memecoin started falling from the $0.000041 price mark, its value has dropped by 36%, and at the time of writing, BONK is trading at $0.000026.

The memecoin BONK is trading below the 20-day Exponential Moving Average (EMA), which tracks the average price over the last 20 days and highlights recent prices. When an asset trades below this fundamental moving average, it confirms a bearish trend because recent prices are lower than the average of the last 20 days.

BONK’s daily chart shows that it has been trading below the 20-day EMA since June 6. The continued process below the 20-day EMA indicates a sign of persistent selling pressure that could attract more sellers or lead to a pullback by current holders.

What Awaits Bonk?

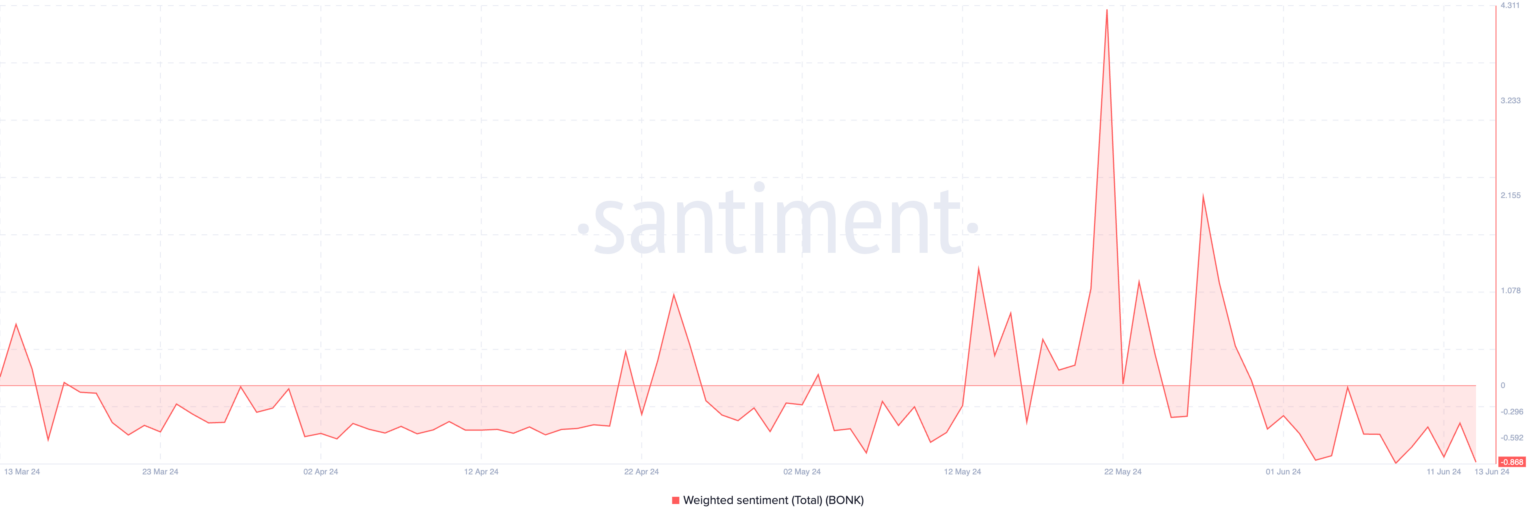

The downward trend following BONK is confirmed by negative-weighted sentiment. This on-chain data has only returned negative values since May 30, and as of the date of publication, this value was -0.86.

When the value is negative, as in the case of BONK, it indicates a high amount of discussion around the asset, with most expressing negative views and showing a lack of confidence. If this sentiment continues to follow BONK and buying pressure continues to decrease, the bulls may not be able to defend the support, causing the price to trade at $0.000021. However, if sentiment improves and buying momentum rises rapidly, the altcoin could rise towards $0.000027.