BounceBit (BB) integrates CeFi and DeFi to provide high-yield opportunities in the Bitcoin ecosystem. Its innovative approach, including BTC restaking, dual-token Proof of Stake system, and Liquid Custody, ensures both security and efficiency. Tools like BounceClub allow users to easily create DeFi experiences and make high-yield Bitcoin investments accessible to a broader audience. BounceBit aims to democratize access to these opportunities, transforming how Bitcoin is used and maximized for returns. This article will answer many questions about what BounceBit is, what BB coin is, and how to buy BB coin.

What is BounceBit?

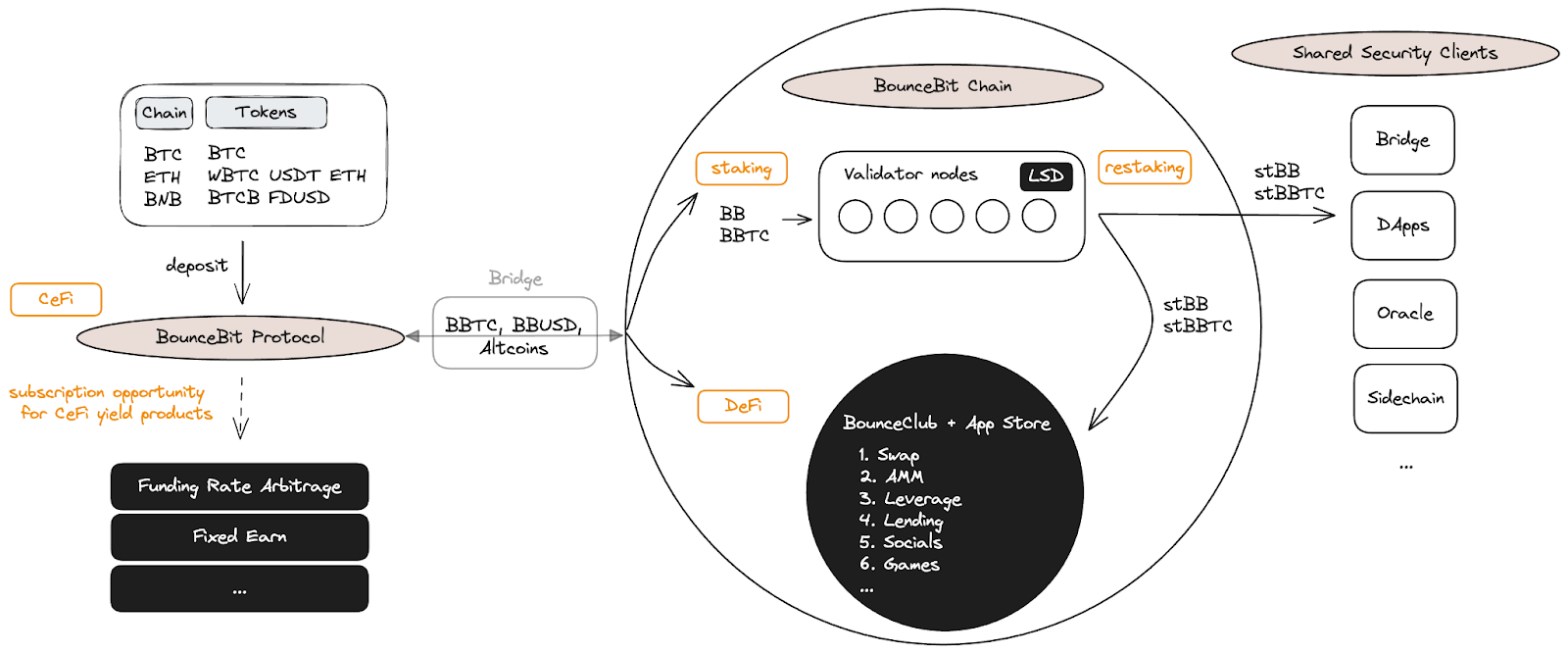

BounceBit is a BTC restaking protocol leveraging an innovative CeDeFi (Centralized-Decentralized Finance) framework that transforms Bitcoin from a passive asset into a dynamic force within the ecosystem. BounceBit aims to enhance Bitcoin’s usage and yield potential by facilitating active participation in network validation and yield-generating activities, including CeFi, DeFi, and restaking.

BounceBit’s mission is to democratize access to high-yield opportunities in the Bitcoin asset class, traditionally reserved for quantitative funds and top-tier asset management firms. By combining the transparent and efficient features of CeFi and DeFi, BounceBit aims to make these advantages accessible to a broader audience, thereby transforming how Bitcoin is used and invested.

The core idea at the heart of the project is to enhance Bitcoin’s utility without altering the Blockchain. This is achieved by providing access to funding rate arbitrage and creating on-chain certificates for redemption and mining. By integrating the strengths of both CeFi and DeFi, BounceBit creates new opportunities for Bitcoin, enabling better yields and broader applications. This approach allows BTC holders to maximize their returns while preserving the integrity of the Bitcoin Blockchain.

BounceBit is developing a BTC restaking infrastructure where funds are secured through regulated custody services provided by Ceffu, Mainnet Digital, and Fireblocks. Assets attract interest through arbitrage strategies managed by experienced asset managers. Users receive a pegged version of BTC called bounceBTC (BBTC), which can be delegated to node operators and turned into a coupon known as stBTC. This liquid staking derivative can then be restaked to other shared security clients (SSCs) like sidechains, bridges, and oracles.

BounceBit uses a Dual-Token Proof-of-Stake (PoS) system where validators can accept both BBTC and BB coins. This hybrid consensus mechanism broadens the stakeholder base and enhances the network’s resilience and security. By allowing validators to accept multiple coins, BounceBit creates a more inclusive and robust consensus model.

BounceClub is an on-chain space that allows users to create DeFi experiences without any coding. Users can easily integrate and customize DeFi applications using pre-built widgets available in the App Store. This feature lowers the barrier to entry for creating DeFi solutions, making it accessible to users of all technical backgrounds.

BounceBit has introduced Liquid Custody, ensuring that deposited assets remain liquid. When users deposit their assets, they receive a Liquid Custody Token (LCT) representing their assets at a 1:1 ratio under regulated custody. These tokens can be bridged to BounceBit and used in various yield-generating activities. This concept offers more accessible opportunities for users to earn yields while maintaining liquidity.

The LSD module allows token holders to delegate their BBTC or BB coins to validators and receive a coupon called an LST (stBBTC or stBB). Validators are selected based on voting weight, and governance determines the maximum number of validators. This module simplifies the staking process while ensuring security and efficiency. In the Liquid Custody system, users receive LCT after depositing their assets. Funds are stored in industry-standard custody solutions, and users can participate in delta-neutral Funding Rate Arbitrage strategies through off-exchange settlement solutions like Ceffu’s MirrorX. This setup ensures asset security while offering yield generation opportunities.

BB Coin Review

BB coin is BounceBit’s mainnet asset. It serves multiple purposes, including staking, protocol incentives, gas fees, and governance participation. Users can stake BB coin to actively participate in the PoS dual-token staking mechanism, enhance network security, and earn rewards.

BB coin is paid as staking rewards to validators who secure the network, encouraging participation and ensuring robust network security. Additionally, BB coin is used to pay gas fees required for transactions and smart contract execution on the BounceBit platform, facilitating smooth and efficient operations.

BB coin holders can participate in on-chain governance, including voting on protocol updates and other critical decisions, ensuring the platform evolves according to the community’s needs.

Moreover, BB coin functions as a currency on the BounceBit platform. It can be used as a medium of exchange or a store of value in various applications and infrastructures, contributing to its utility and versatility.

How to Buy BB Coin?

BB coin can be safely bought and sold on Binance, the world’s largest cryptocurrency exchange by trading volume. BB coin was listed on Binance on May 13, 2024, and is available for trading in BB/BTC, BB/USDT, BB/BNB, BB/FDUSD, and BB/TRY pairs.

To buy BB coin, one must first register on the Binance exchange if they are not already a member. After completing the registration process, users should transfer cryptocurrency or fiat currency like Turkish lira to their Binance account wallet. Once the transfer is complete, BB coin can be purchased from any of the five trading pairs mentioned above.

To buy from the BB/USDT trading pair on Binance, first navigate to the interface of this trading pair. Enter the desired amount in the specified area under the limit tab of the trading pair interface. After entering the amount, complete the purchase by placing a Buy BB order.

Türkçe

Türkçe Español

Español