When he dies, headlines will say we lost a legend that traditional markets can’t forget. The 93-year-old billionaire was born in 1930 and became one of the world’s richest thanks to the stock markets. But before he died, he lost to Bitcoin. How did the CEO of Berkshire Hathaway, who hated BTC, lose to it?

Buffett and Bitcoin

Warren Buffett only mentions Bitcoin to declare his hatred for it once again. Buffett, who has said for years that he wouldn’t pay even $10 for all Bitcoins, has fallen far behind Bitcoin in terms of gains.

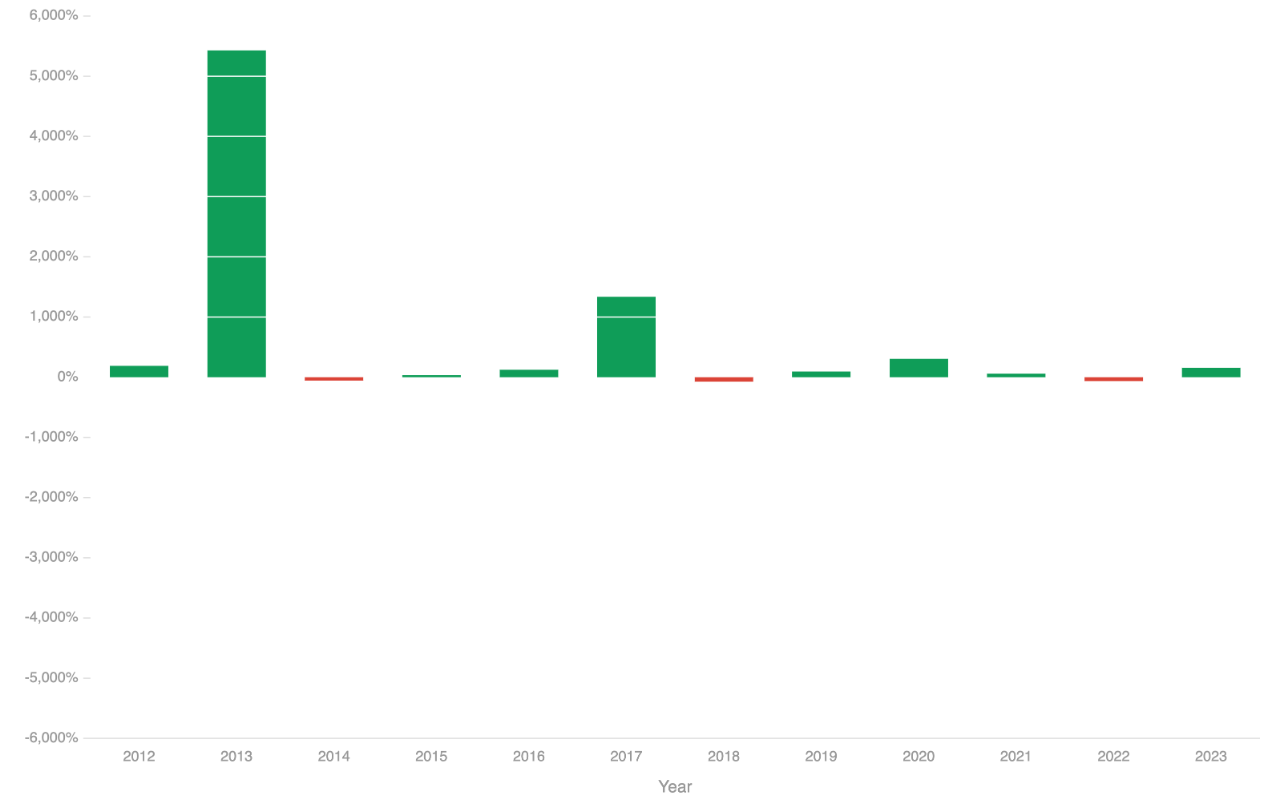

The king of cryptocurrency has provided an average annual return of 104% since 2011. When comparing Bitcoin’s Compound Annual Growth Rate (CAGR) with the gains from Warren Buffett’s portfolio (which includes major assets like Apple, Bank of America, American Express, Coca-Cola, and Chevron Corp), Bitcoin is far ahead.

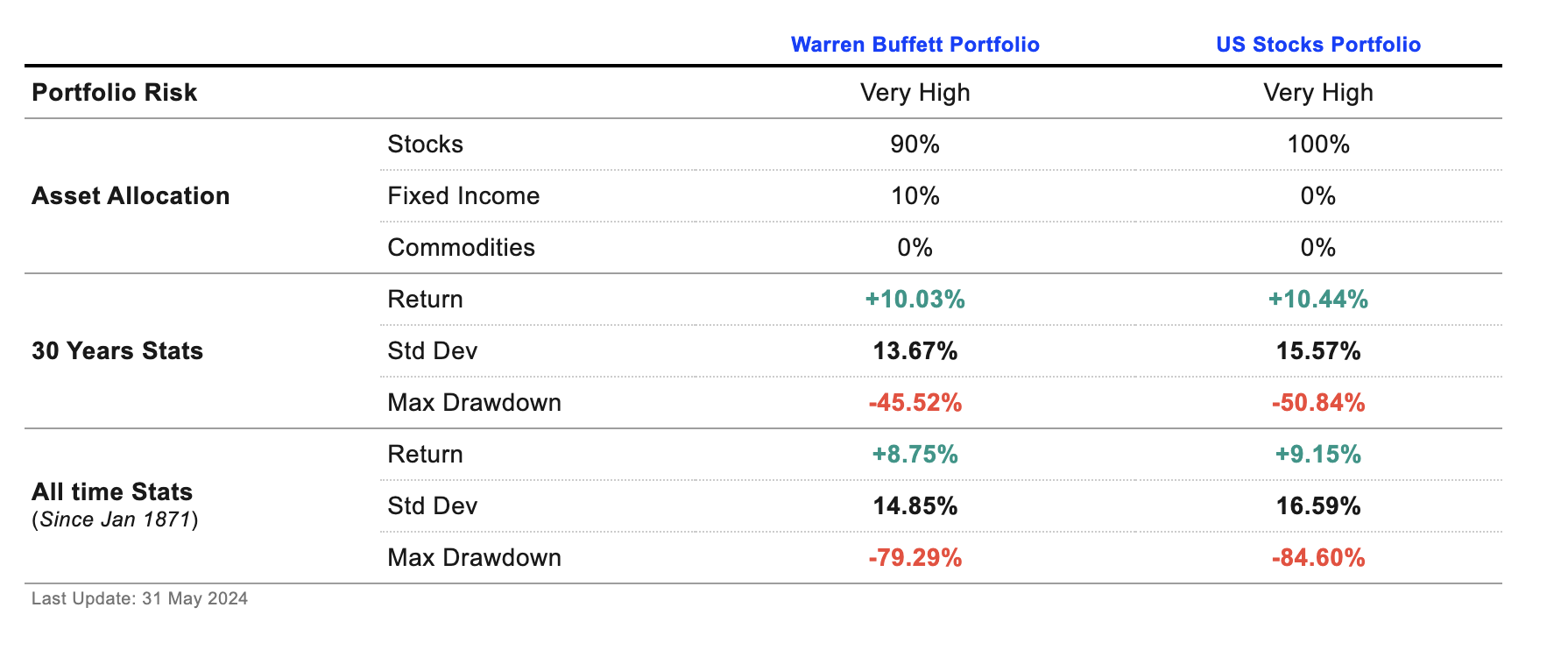

According to Lazy Portfolio ETF data, Buffett’s investments achieved an annual compound return rate of 10.03% with a standard deviation of 13.67% over the past 30 years. Similar returns are seen when compared to US stock portfolios.

Bitcoin (BTC)

While gold provides an average annual gain of 6%, Bitcoin has achieved much higher returns. However, Bitcoin has a problem. The growth seen since 2011 has weakened over the years. This highlights the reality that the growth rate from very low market values to current levels may not be similar in the future.

As Bitcoin is just beginning to be recognized worldwide and has integrated with traditional markets through ETFs, the same growth rate cannot be expected. Moreover, the risk of governments still potentially banning it altogether continues.

Although it has attracted attention as an alternative to combat inflation in recent years, Tesla has largely abandoned this idea. Elon Musk‘s companies sold a significant portion of their holdings. While he did this, MicroStrategy was on the buying side, and we saw the company continuously borrowing to increase its reserves by billions of dollars.

Türkçe

Türkçe Español

Español