Various Bitcoin  $91,081 forums are buzzing with predictions that the leading cryptocurrency could reach $130,000 within the next 90 days. Recently, Bitcoin demonstrated its best weekly performance in two months, rising 4.24% to a peak of $88,804 within 24 hours. The closing above the 200-day exponential moving average (EMA) on the daily chart has reignited bullish expectations in the market. To test the critical resistance at $90,000, Bitcoin must close the week above $84,600. However, a sustainable increase requires a strong breakout above the declining trend resistance line.

$91,081 forums are buzzing with predictions that the leading cryptocurrency could reach $130,000 within the next 90 days. Recently, Bitcoin demonstrated its best weekly performance in two months, rising 4.24% to a peak of $88,804 within 24 hours. The closing above the 200-day exponential moving average (EMA) on the daily chart has reignited bullish expectations in the market. To test the critical resistance at $90,000, Bitcoin must close the week above $84,600. However, a sustainable increase requires a strong breakout above the declining trend resistance line.

“The Recent Bitcoin Correction is a Healthy Pause”

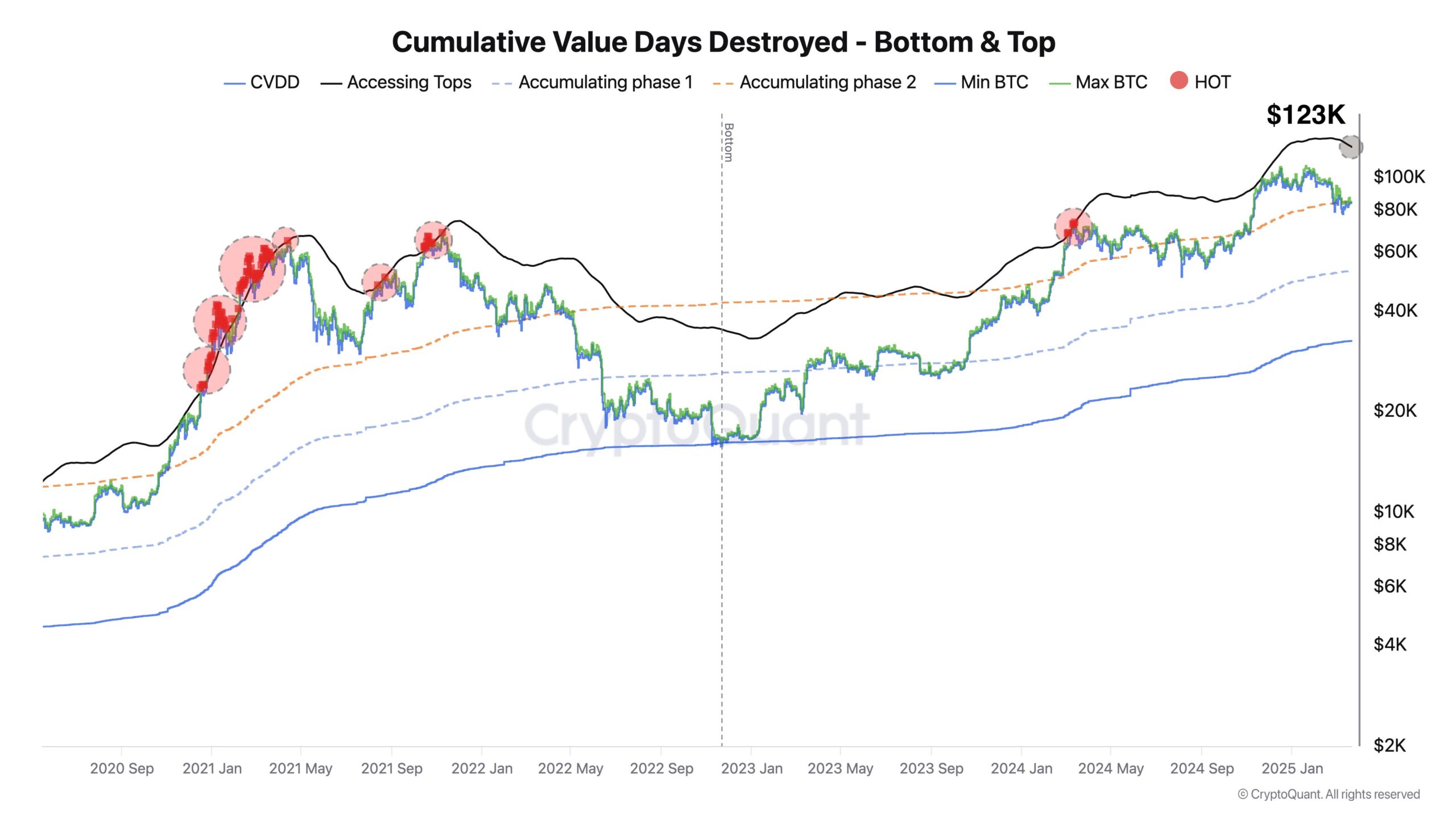

Renowned Bitcoin researcher Axel Adler Jr. stated that the recent price correction represents a healthy pause for the market. He noted that Bitcoin’s on-chain metrics have not reached the overheating zone, suggesting that this movement does not signal the start of a bear market.

Adler Jr. also mentioned that the investor price model data has only provided sell signals twice during this cycle. This model offers a comprehensive perspective by incorporating elements like realized market value, thermal market value, investor price, and Bitcoin supply.

Bitcoin Analysis: “Price Could Reach $130,000”

According to Adler Jr.’s analysis, Bitcoin’s price could rise to $130,000 in the next 90 days. He cautioned that experienced traders may take profits once the price exceeds $123,000. Such profit-taking could exert downward pressure on prices in the short term, but overall market dynamics and technical data indicate that Bitcoin’s upward potential may persist.

According to Velo data, open interest in Bitcoin futures markets increased by $1.5 billion in the last 24 hours. Funding rates remain neutral, suggesting neither bulls nor bears have established firm control. Moreover, following Bitcoin’s rise above $87,500 over the weekend, anonymous crypto analyst IT Tech PL warned that high open interest combined with rapid price increases could pose liquidation risks.