One of the top competitors of Ethereum in terms of smart contract platforms, Avalanche, has been struggling below inflation rates for a while now. The price of AVAX, which has been pushed to new lows due to high token inflation in a market dominated by sellers in 2023, has dropped below $10. So, can Stars Arena save it?

Avalanche (AVAX) and Stars Arena

The SocialFi platform, Stars Arena, has been making waves on social media this week. The price of Avalanche (AVAX) returned to double-digit levels with a 10% increase this week, but it couldn’t sustain it. The social media application launched as a rival to Friend Tech on September 27th could yield positive results for Avalanche.

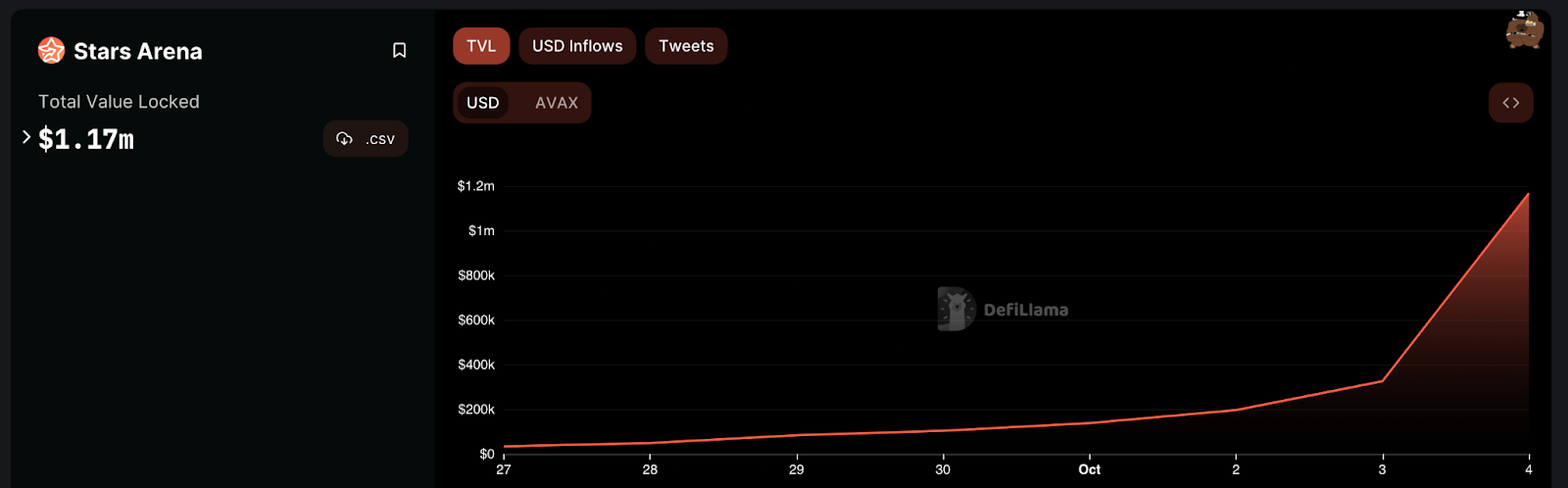

Stars Arena was released on the Avalanche network last week and triggered an increase in on-chain metrics. According to on-chain data compiled by DeFiLlama, the platform has experienced impressive growth in capital inflows over the course of a week.

The graph below shows how the Total Locked Value (TVL) of the social media protocol climbed from $33,000 to $1.17 million between September 27th and October 2nd. TVL increased by 3400% in the first week after the launch.

In terms of TVL power, the SocialFi platform became the second-largest platform in a very short period of time.

AVAX Coin Review

If interest in the Stars Arena project continues to grow, it will have a positive impact on AVAX demand. Joining the platform, which has attracted the intense interest of social media influencers due to its quick financial return, is also easy. To access the platform, you can go to the website through the link and click on the register button with your X (formerly Twitter) account. After granting the necessary permissions, your profile and new AVAX wallet will be automatically created.

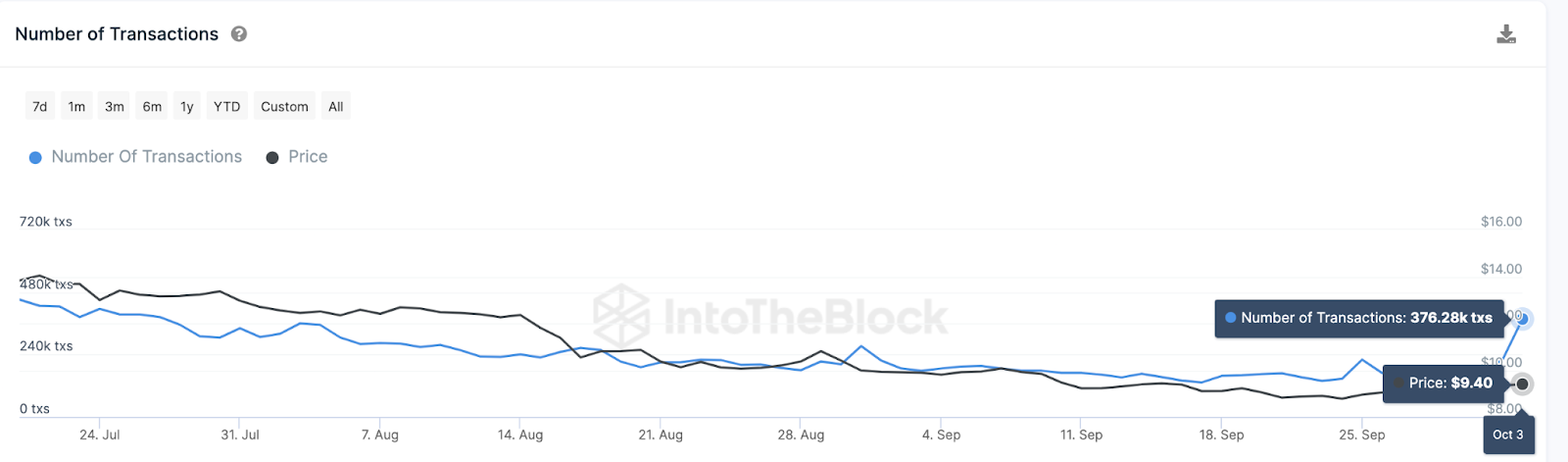

The Avalanche network has seen a significant increase in transaction activity this week. This confirms the positive view that the growth in Stars Arena TVL can increase the demand for the AVAX market. At the time of writing, the price of AVAX coin is $9.7.

Since September 27th, AVAX transactions have increased and reached 376,000 transactions on October 3rd. This figure was last seen on July 26th.

The increase in the transaction count metric is a positive movement for the price as it reflects interest in the network.

If the overall market sentiment allows it and more popular names join the platform, we may see the start of a rally for AVAX with a target of $20. However, first, the $10 level needs to be confirmed as support, and the $15-14.77 resistance needs to be overcome.

In the event of a possible decline, the $9 and $7 supports remain intact.