Let’s recall 2021, Cryptocom was making such large advertising deals that it was the talk of the town. With decade-long agreements and billion-dollar advertising budgets, the bear markets arrived. If your trading volume, and therefore your exchange revenue, falls, you can’t spend billions on advertising like you used to. This was a criticism also voiced by Binance‘s CEO, and Cryptocom, along with other exchanges, made significant layoffs last year.

The Downtrend of Cronos (CRO): Is It Over?

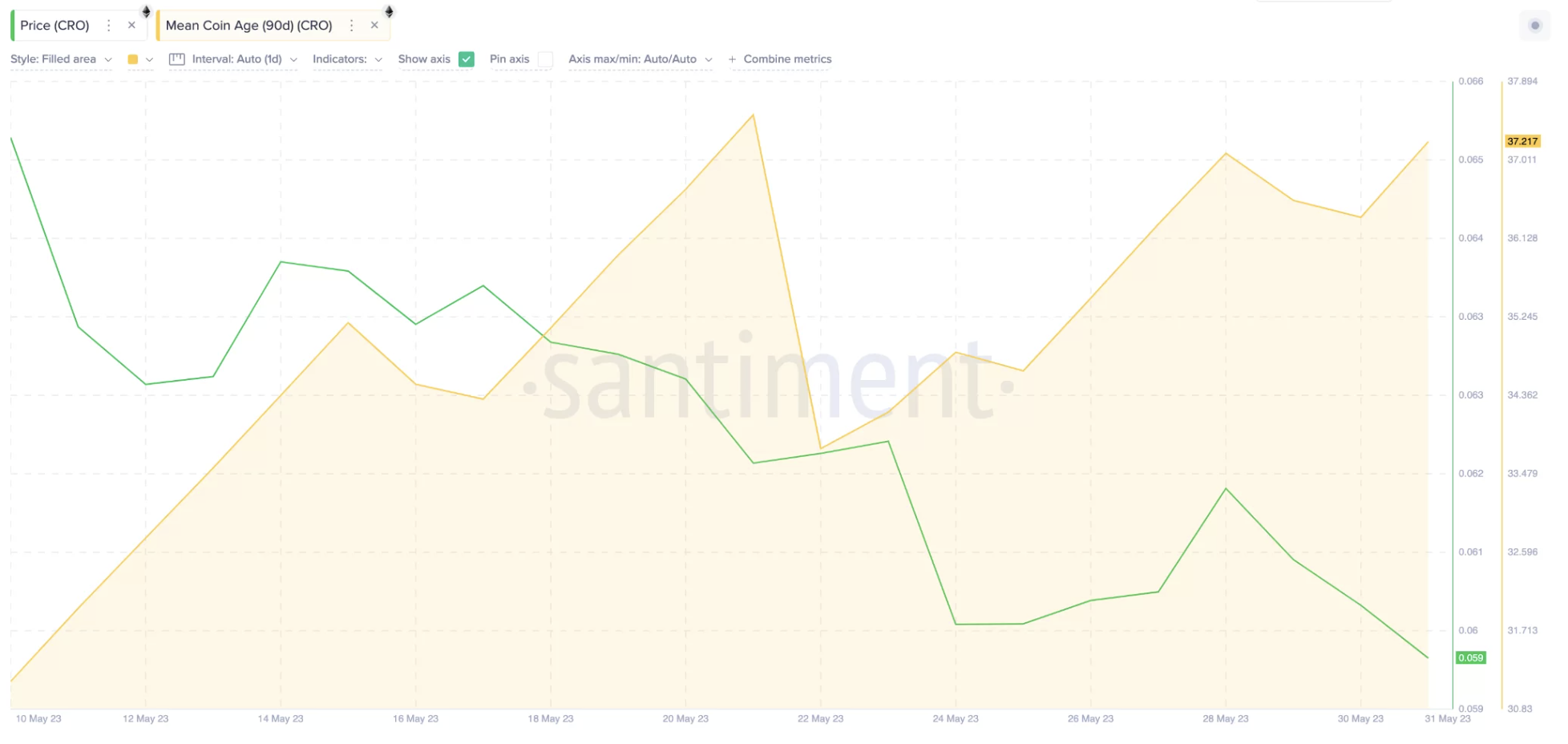

But if we return to the price, investors seem less inclined to sell at current levels. On-chain readings suggest that unrealized losses are prompting investors to wait. The Rising Average Coin Age is a significant indicator of this.

Between May 8 and June 1, the CRO Average Coin Age increased by 21%, rising from 37.13 to 33.38.

Should Cronos (CRO) Be Bought?

The fact that investors have accepted their losses and are forced to wait seems to show that sales have weakened, and a rise may start. Moreover, as CRO prices continue to fall, investors are benefiting from yield protocols while they wait. Between May 8 and June 1, CRO Coin investors staked an additional 5.6 million tokens. If this trend continues, it will be another development that could increase the price as supply on exchanges will weaken.

Looking at the increased staking activity and long-term investors who do not want to sell, it seems likely that the price could rise to $0.07. IntoTheBlock’s Global In/Out of the Money Around Price (GIOM) data indicates there is a resistance that CRO must overcome at the $0.064 level.

Short-term traders can consider this region as stop and take a sell target position at $0.07 on closing above it. The bullish outlook can remain in place as long as the $0.059 support is maintained. In the opposite scenario, we could see the price drop to $0.05.

Türkçe

Türkçe Español

Español