Cardano (ADA) continues to face challenges in the highly volatile cryptocurrency market, significantly impacted by selling pressure. As of Wednesday, ADA’s price fell by 0.6%, dropping below the $0.4 threshold and struggling to find support above this level. The price movement indicates a downtrend characterized by lower highs and lower lows, with the price trading below both the 50-day and 200-day exponential moving averages (EMAs), suggesting continued downward pressure unless market conditions improve.

ADA’s Technical Outlook Indicates a Downtrend

ADA‘s primary support is around $0.30, highlighted by the lower boundary of the descending channel and past price data. If the downward momentum continues, the altcoin could potentially fall further, reaching a significant support level at $0.3165 and possibly hitting the year’s lowest level. The nearest resistance on the upside is at $0.42, aligned with the 50-day EMA, while stronger resistance is at $0.50, where the 200-day EMA and previous highs converge.

Currently, technical indicators for ADA present a mixed outlook. The Relative Strength Index (RSI) stands at 45.63, indicating a neutral stance but leaning towards the oversold region. This suggests potential for further decline before any recovery. Additionally, the Chaikin Money Flow (CMF) indicator at -0.07 reflects stronger selling pressure compared to buying pressure, confirming the bearish trend.

On-Chain Data Also Negative

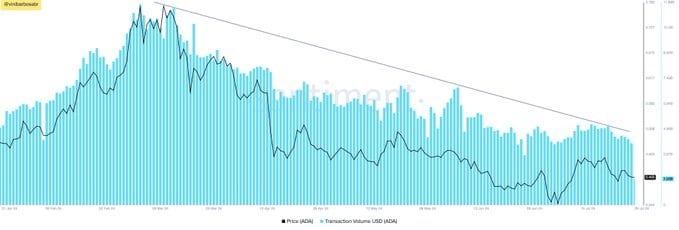

On-chain data also supports the bearish outlook for ADA. Data from Santiment reveals a significant decline in Cardano’s on-chain volume since March, recently dropping from $11.5 billion to around $1.5 billion. This decrease in volume indicates reduced activity and interest in the ADA network.

Similarly, data from Coinalyze shows a slight increase of 1.81% in ADA’s open interest, indicating minimal new capital inflow into ADA, while the daily funding rate shows a small increase.

In a recent development, the U.S. Securities and Exchange Commission (SEC) revised its classification of ADA, no longer considering it a security in its ongoing case against Binance. This change is expected to have positive effects on ADA and the broader cryptocurrency market, potentially influencing future ETF approvals and regulatory clarity.

Türkçe

Türkçe Español

Español