Cardano (ADA), like many other altcoins, is at a critical juncture where it could either make substantial gains or face a steeper pullback. The decisive factors for the price movement will be the technical outlook, community support, and network development.

Cardano Price Analysis

A cryptocurrency exchange Gemini-backed media platform shared an insightful article at the beginning of this month, which addressed the past, ongoing, and future development processes within the Cardano ecosystem, including its multi-phase development roadmap. The focus of these development processes is the transformation of Cardano into a highly scalable, secure, and decentralized network.

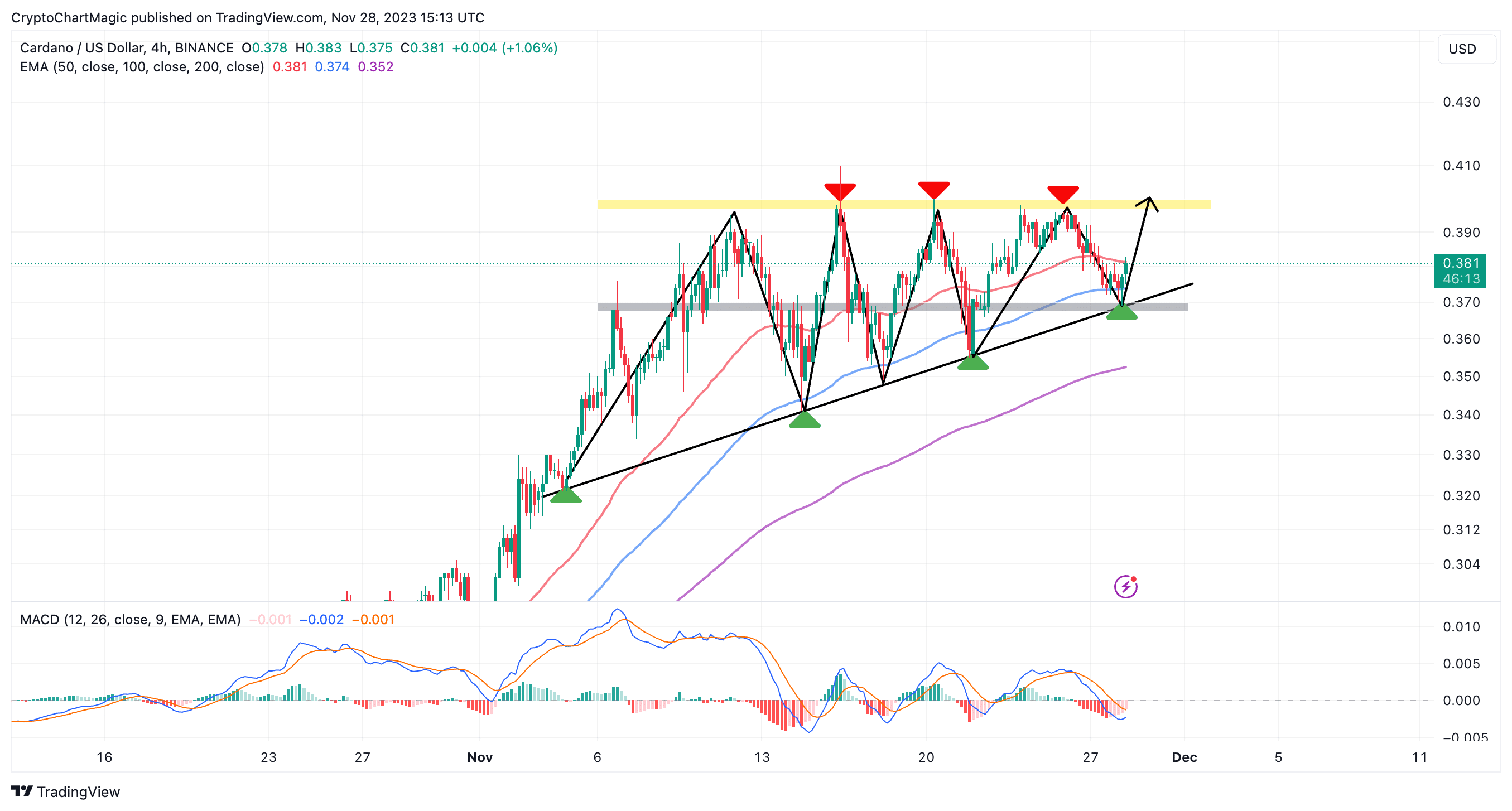

From a technical standpoint, ADA’s price has been on an upward trajectory since October 19, except for the resistance at $0.4, which is considered an important threshold for the bulls. This has led to the formation of a rise and fall fractal pattern, where the price seems to move up and down in similar patterns, creating a U-shape. Looking at the popular altcoin’s price chart, it appears that the bulls have already taken control, rallying the price from the short-term support at $0.37 to the current price of $0.38.

The Moving Average Convergence Divergence (MACD) indicator on ADA’s chart could reinforce the bullish trend by providing a buy signal in the upcoming trading sessions. Buyers, especially those looking to avoid sudden pullbacks, should wait for the blue MACD line to cross above the red signal line before placing a buy order. Although the 50-day Exponential Moving Average (EMA) (red) is capping the uptrend at $0.381, a price surge above this level will boost the confidence of buyers targeting above $0.4.

In ADA’s short-term bullish outlook, the $0.4 level emerges as another decisive factor due to seller density. Surpassing this level could lead to increased positive sentiment and a breakout towards above $0.5, and then towards $1.

Conversely, if the $0.4 resistance cannot be broken, thus reducing investor confidence, an increase in selling pressure can be expected. In such a scenario, ADA may retreat to lower support levels to accumulate liquidity and increase volatility for the next breakout.

Price Above a Key Demand Zone

On-chain data compiled by IntoTheBlock shows that Cardano is moving above a significant demand zone, ranging between $0.37 and $0.38. Approximately 166,000 wallet addresses have purchased 4.88 billion ADA in this region. According to seasoned crypto analyst Ali Martinez, Cardano is gathering strength for a significant breakout by staying above this zone with minimal resistance and strong support.

If this region is surpassed, a new bullish wave could form, potentially leading ADA’s price to reach the highest levels of the year. However, buyers should closely monitor the price reactions at the $0.37 level because if the price falls below this support, there could be a drop towards $0.34 before any potential recovery.

- ADA poised at a pivotal price point.

- Bullish trend relies on key indicators.

- A breakout could lead to new highs.

Türkçe

Türkçe Español

Español