Cardano’s price saw an increase of over 19% on December 9, reaching $0.64, its highest level in the last 18 months. The popular altcoin showed an increase of 75% just in December. So, what are the data that investors should pay attention to for ADA, which is trading at $0.59 at the time of writing this article? Let’s examine together.

Why is ADA Rising?

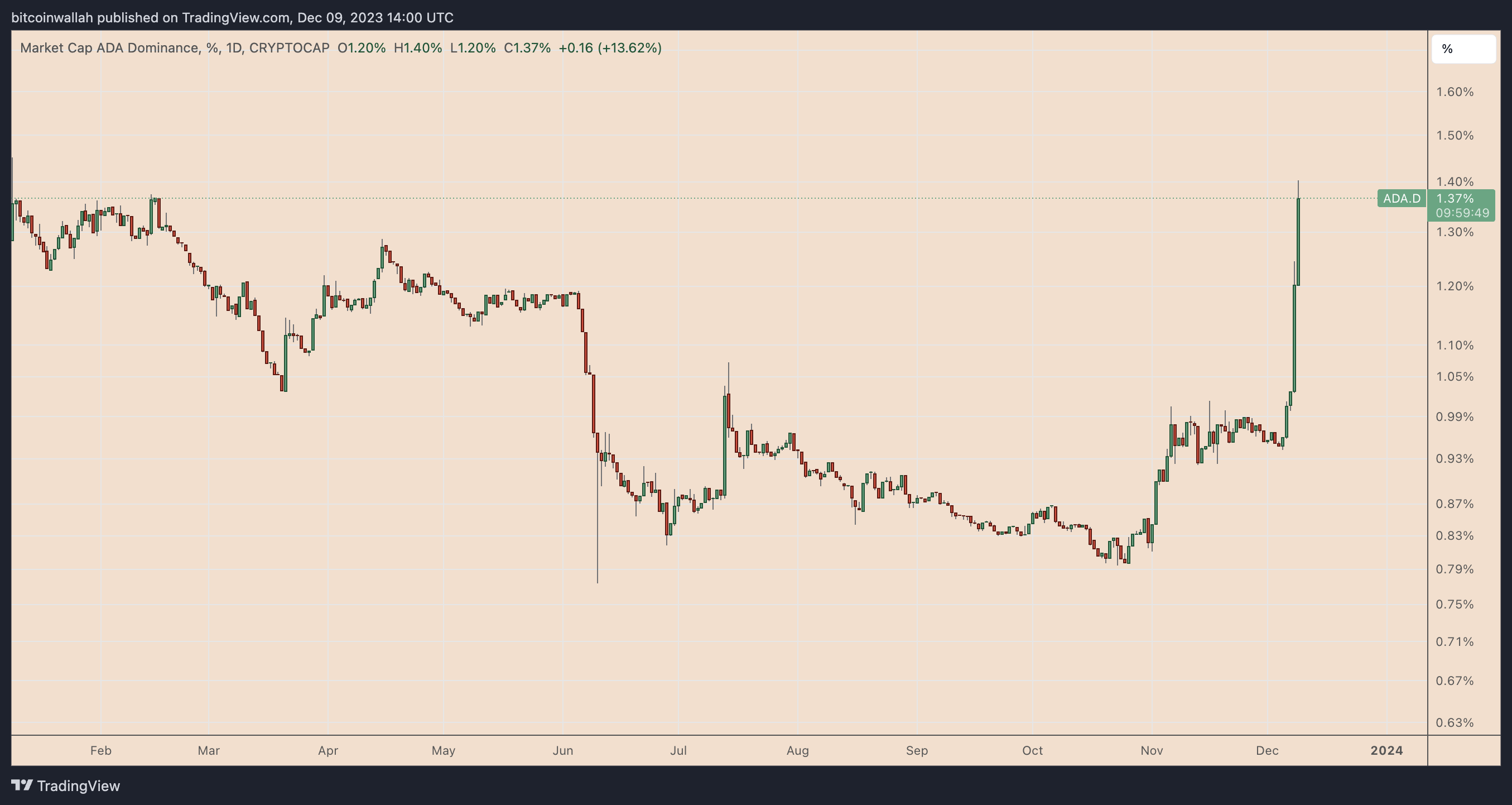

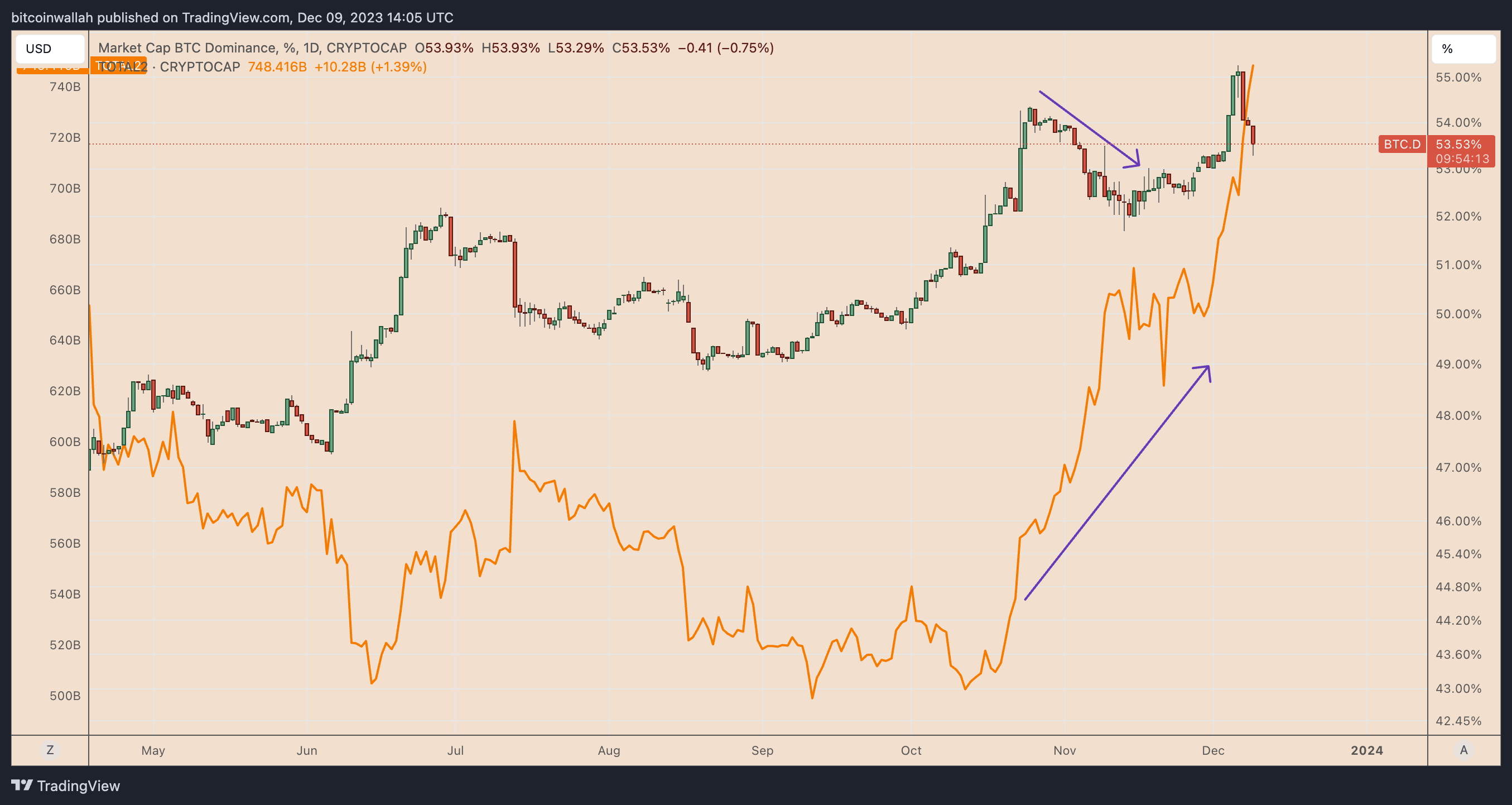

The recent gains on the Cardano front did not accompany any notable fundamentals. Instead, it was among the altcoins that caught Bitcoin‘s rise this month. Particularly, the 3.5% decline in Bitcoin’s dominance in the crypto market since the peak seen on December 6, caused many investors to sell on the Bitcoin side looking for profit opportunities in altcoins.

These capital rotations are commonly seen in the crypto market and investors usually transfer their profits from Bitcoin to smaller and riskier crypto assets after a strong price rally. This situation resembles how altcoins performed in early November when Bitcoin’s market share also fell.

Record Broken at TVL Level

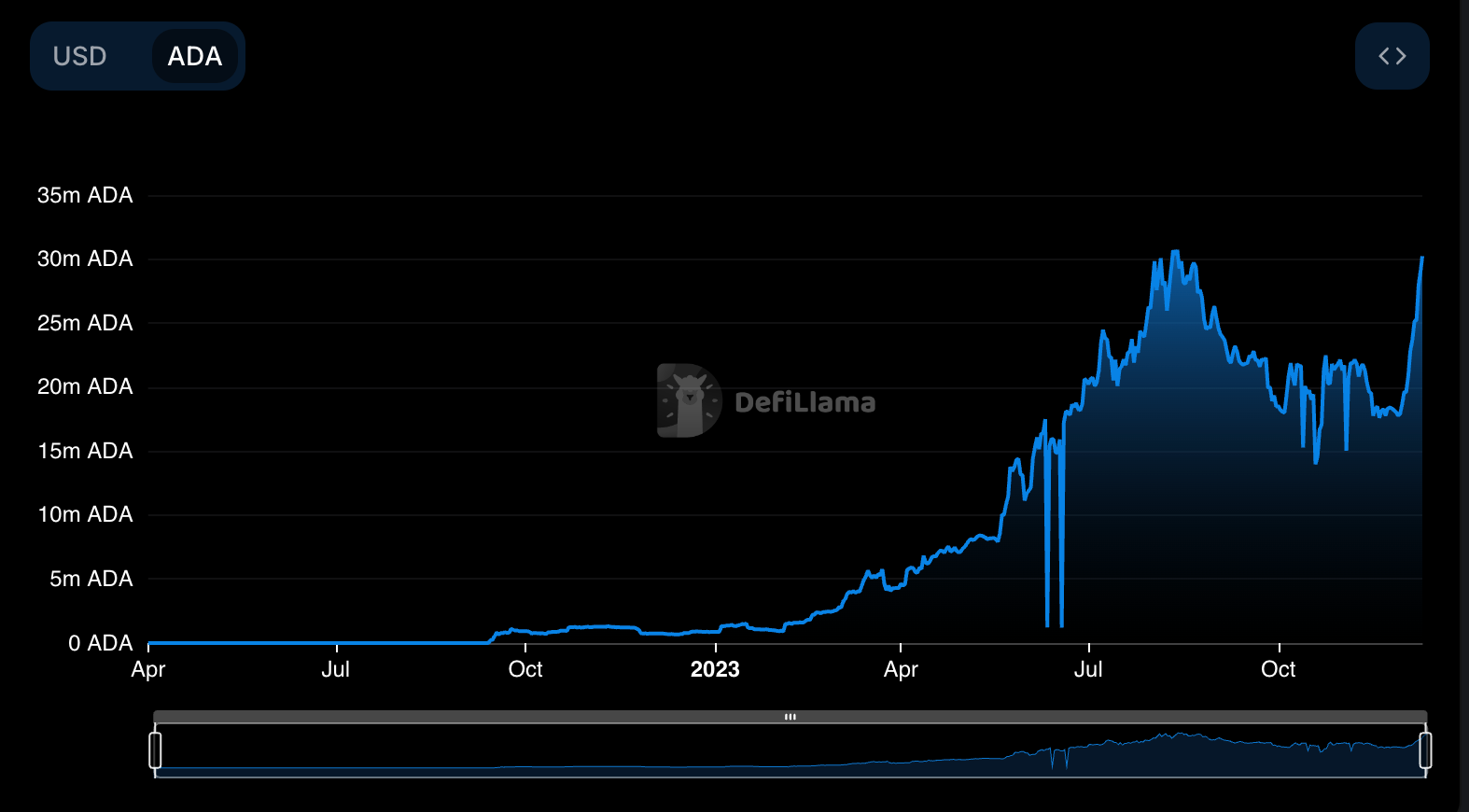

The increase in Cardano’s price is consistent with the notable increase in the total amount of ADA invested across the blockchain ecosystem. On December 9, the total value locked (TVL) in Cardano’s decentralized applications (dapps) reached a record level with 765.22 million ADA.

Lenfi, a lending and borrowing protocol on the Cardano network, experienced a 90% jump in ADA reserves. The rise in TVL allows the ADA token to effectively be removed from active circulation and this can increase the price in the case of high demand, as in the current rally.

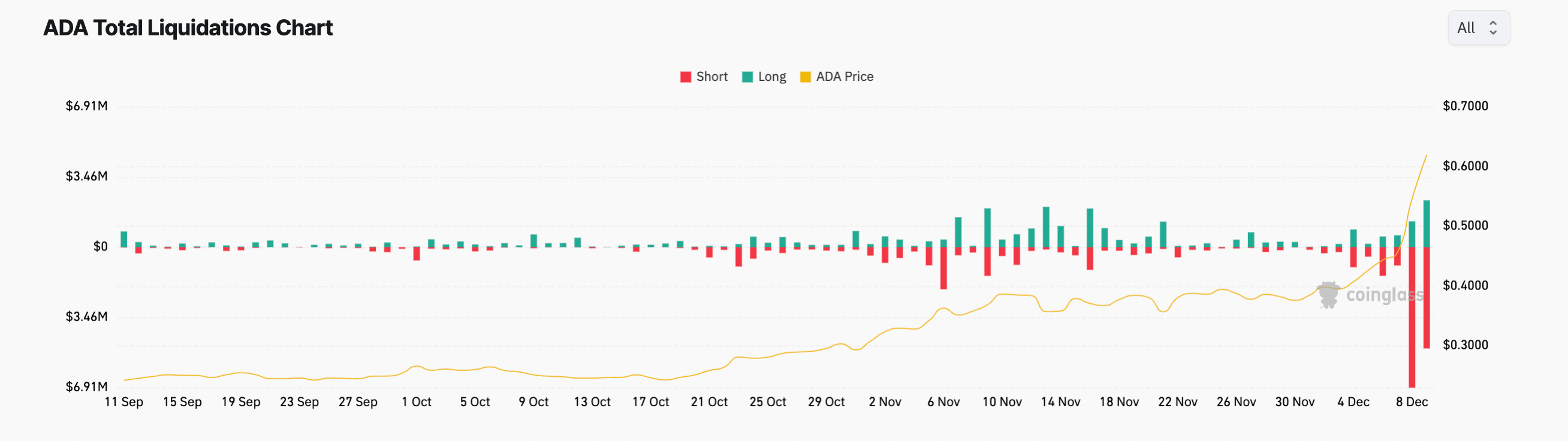

Short Liquidations Continue

Cardano’s rise on December 9 coincided with the liquidation of approximately $5 million worth of short positions, compared to $2.30 million worth of long liquidations. The previous day, $6.91 million worth of short positions were liquidated against $1.27 million worth of long positions in the ADA/USDT pair.

When a short position is liquidated, the platform automatically repurchases the asset at the current market price to close the position. The reason for this is that the investor has initially sold the borrowed asset and now needs to buy it back to return it. If many short positions are liquidated at the same time during significant price increases, this leads to significant purchases in the market and causes the ADA price to rise.