Blockchain data analysis firm Chainalysis has released a new report that draws attention to a significant development regarding the regulatory influence of the United States government on the stablecoin market. According to the report, the US government may be losing its regulatory control over the stablecoin market, leading to a significant flow of funds to unlicensed organizations in the country.

Chainalysis Report Draws Attention

Blockchain data analysis firm Chainalysis stated in its North America cryptocurrency report, which was released on October 23, that stablecoin activities are increasingly being conducted through unlicensed organizations in the United States.

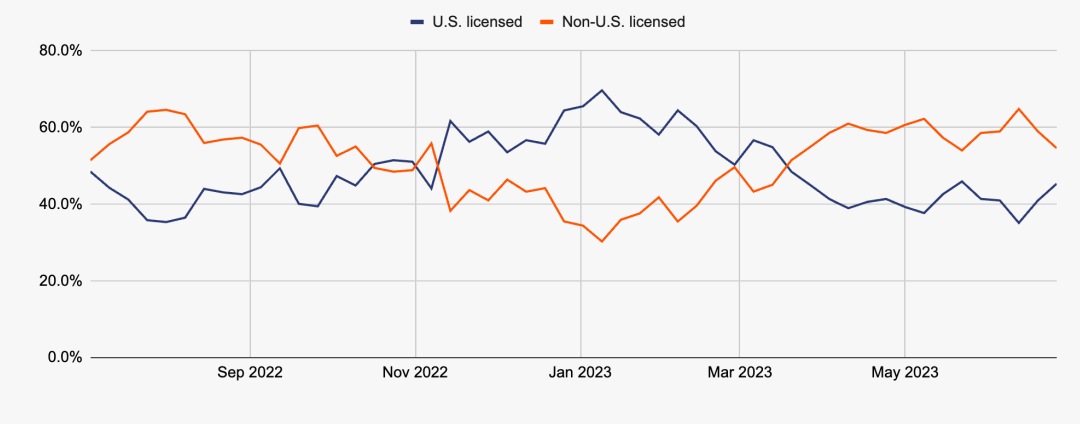

The company’s research reveals that since spring 2023, the majority of stablecoin entries into the top 50 cryptocurrency services have shifted from US-licensed crypto exchanges to unlicensed ones. The report also indicates that approximately 55% of stablecoin entries into the top 50 services have been transferred to licensed exchanges outside of the US since June 2023.

Regulations in the US Are Still Ongoing

The study suggests that the US government is gradually losing its ability to regulate the stablecoin market, causing American consumers to miss out on opportunities to engage with regulated stablecoin projects. Chainalysis commented on this issue in its report:

“While US institutions initially helped legitimize and invest in the stablecoin market, an increasing number of crypto users are conducting stablecoin-related activities with centralized trading platforms and issuers located overseas.”

According to company officials, Congress has not yet passed regulations related to stablecoin projects as it is still evaluating relevant bills such as the Clarity for Payment Stablecoins Act and the Responsible Financial Innovation Act.

Despite the decline in licensed stablecoin activities in the United States, the country became the largest cryptocurrency market with an estimated $1.2 trillion in transactions between July 2022 and June 2023. According to Chainalysis analysts, the region accounted for 24.4% of the global transaction volume during this period, surpassing the Central, Northern, and Western European regions, which received a trillion dollars.

Türkçe

Türkçe Español

Español