Oracle service provider Chainlink (LINK) recently surpassed $8, becoming one of the best-performing altcoins in the past few weeks. However, the party seems to be ending for Chainlink as its price is currently experiencing a strong pullback, dropping 4% in the last 24 hours. LINK is trading at $7.67 with a market cap of $4.26 billion at the time of writing. The trading volume has also increased by 20% in the same period, reaching $371 million. Furthermore, although Chainlink stood out by showing a strong correlation with Bitcoin (BTC) during the recent price rally, things have started to turn around.

On-Chain Data Signals Downtrend

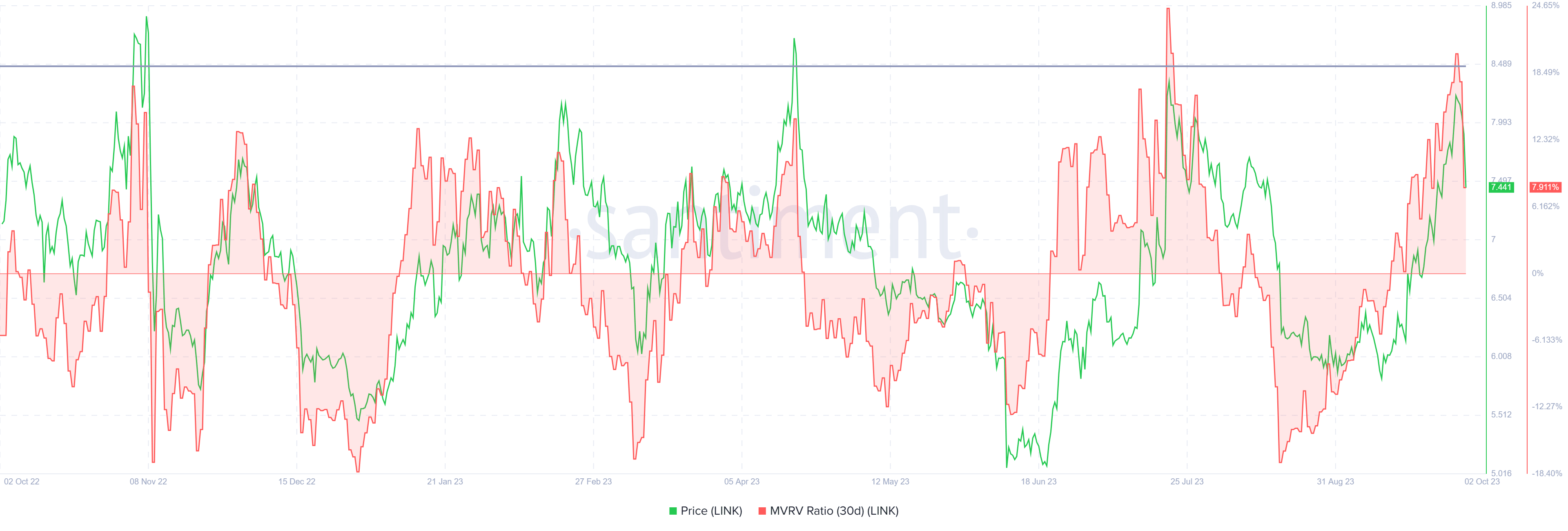

The on-chain data flow following LINK’s jump had led some market analysts to speculate that the upward trend may be coming to an end. This expectation was based on Santiment’s Market Value to Realized Value (MVRV) ratio. MVRV, which represents the ratio of market value to realized value, serves as an indicator for market tops and bottoms. High MVRV is seen as a potential top signal, while bottoms are considered accumulation stages.

Crypto analyst Ali Martinez highlighted the data from Santiment, stating that whenever LINK’s 30-day MVRV exceeded 19%, significant corrections occurred. Currently, LINK’s 30-day MVRV is at 20%, indicating a short-term pullback before further upward movement.

From a technical perspective, if the price of the altcoin fails to hold above $5.56, a deeper decline is expected, potentially forming a new bottom. Experienced crypto analyst Michael van de Poppe suggests that LINK’s price could drop to $7.

Introduction of Chainlink Data Streams

Web3 services platform Chainlink launched the “Data Streams” feature on October 2nd, aiming to reduce network congestion. Chainlink Data Streams integrates low-latency market data and automated functionality to facilitate the creation of ultra-fast and user-friendly derivative products. The term “low-latency market data” refers to financial market information delivered without significant delays.

This product adopts a “pull-based” data oracle approach, where high-frequency market data is continuously provided off-chain. The feature allows oracle reports to be generated for each block, enabling users to retrieve them off-chain and then verify them with on-chain transactions. This is different from the push-based approach, where oracles proactively feed data to smart contracts at varying intervals.

By adopting a pull-based system, Chainlink Data Streams alleviates latency issues and reduces the time required for data packets to move from one point to another. Message propagation between nodes often causes delays in processing and synchronization in distributed networks. Speaking about the new feature, Chainlink co-founder Sergey Nazarov said:

Data Streams not only enables DeFi protocols to support execution speeds and a user experience that rivals centralized exchanges but also does so without compromising the fair, transparent, and decentralized infrastructure that is at the core of Web3 values.