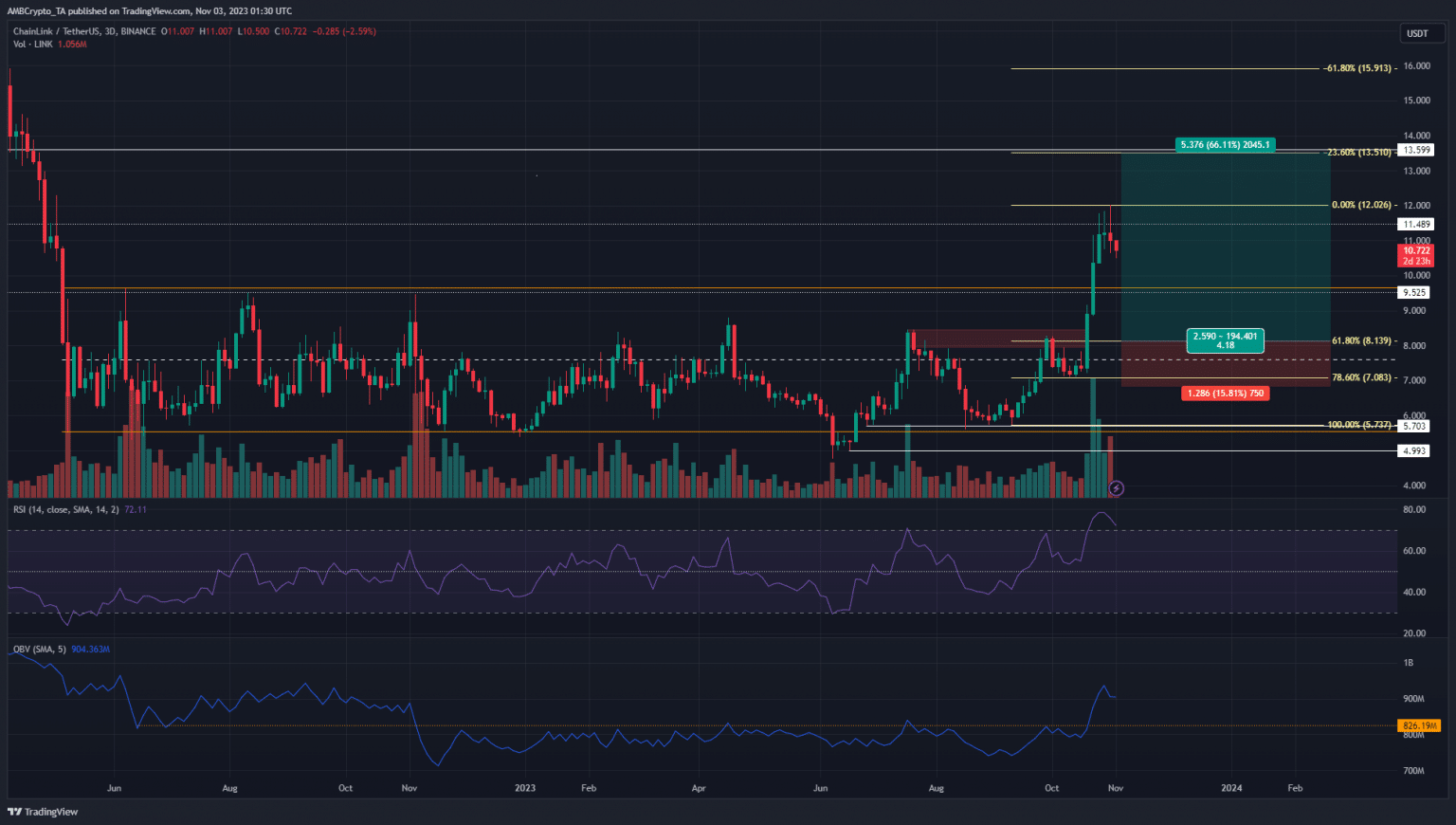

Chainlink (LINK) has broken out of a range that lasted for about eighteen months. This range extended from $5.55 at the lower levels to $9.65 at the higher levels. Technical analysis showed that the $8.15 region was a significant resistance zone before the recent rally.

Critical Report on LINK

A recent analysis highlighted the strong upward trend behind LINK and emphasized that the $10 level is an important support level for buyers. Will we soon see a retest of this region and will bulls enter the market at these prices?

According to experts, the $8.15 region in the altcoin was a twelve-hour drop order block that turned into a breakout due to the recent price movement. A series of Fibonacci retracement levels were drawn based on the rise from $5.73 in September to $12.02.

This indicated that the 61.8% level was around $8.14, close to the breakout block. Therefore, a retest of this region may present a buying opportunity.

In addition to the pullback to the $9.65 highest range, the psychological support level of $10 may also indicate the upward trend of LINK.

Breaking out of the 18-month range could be a sign of strong bullish sentiment. The Relative Strength Index (RSI) and On-Balance Volume (OBV) may indicate that bulls are in control. Therefore, investors may consider entering swing trades in the prevailing direction.

Furthermore, another important metric, circulating supply, has shown relatively flat movement in recent weeks. A sharp increase in this measurement may indicate an impending large sell-off wave. Similarly, the supply on exchanges has remained at low levels. High values in this measurement can also be a precursor to selling activity.

Current Situation of LINK Bulls

While the mentioned metrics paint a pleasant picture for bulls, the high positive value in the MVRV ratio is not very positive. It may highlight the possibility of investors withdrawing from LINK and an increase in selling pressure.

The social dominance of the token has decreased after the rally that exceeded $10, and this may be an indication of a weakening bullish trend reflected in the overall market on social media.