Chainlink (LINK) price appears to be starting October on a positive note after recording a 30% increase earlier this month. However, the underlying on-chain market data presents mixed signals.

The Results of the LINK Partnership!

Following a successful tokenization test with SWIFT in early September, Chainlink announced the mainnet launch of its Interoperability Protocol on Wednesday. Will bullish speculative investors be able to take advantage of these milestone product developments to outsmart the October sell-off whales?

Chainlink price has gained 30% this month, rising from $5.80 on August 31st to $7.90 on September 28th. However, despite the double-digit percentage gains, LINK traders in the derivatives markets are striving for more profits in October.

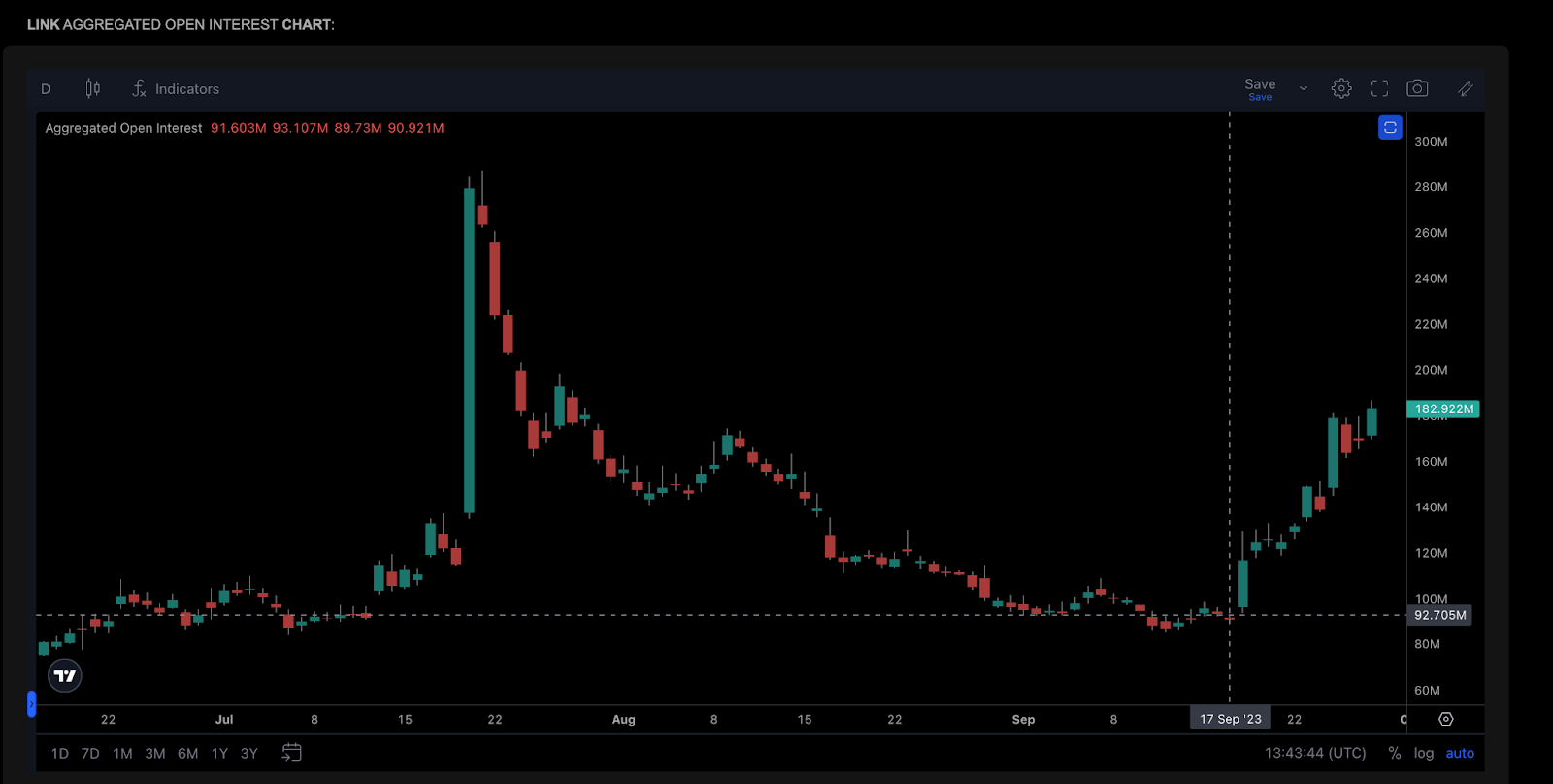

According to data from analytics firm CoinAlyze, Chainlink Open Positions were at $91 million as of the September 17th close. However, they have since risen to $182 million as of September 28th. This indicates that speculative investors have obtained an additional $91 million in capital inflows in the last 10 trading days. Open interest summarizes the total value of active derivative contracts for a token on various futures trading platforms. The upward trend in open interest can be considered as a bullish signal indicating an influx of new investors bringing fresh capital into the market.

When open positions consistently increase, it suggests a widespread belief among market participants that the current price direction will prevail. If this expectation proves correct, the LINK price could extend its upward performance until October and beyond. Chainlink price reached $7 for the first time in 40 days on Monday. When the LINK price reached this key resistance level, a group of crypto whales halted the month-long buying trend and began booking profits.

Current Data on LINK!

Whale investors holding between 100,000 and 10 million LINK had a cumulative wallet balance of 292.3 million tokens on September 24th. However, the graph below shows that this figure decreased to 291.3 million as of September 28th. This could mean that since Chainlink’s price reached $7 on Monday, they have consumed 1 million tokens from their balances. Currently, the market price of the 1 million LINK tokens sold by whales amounts to approximately $7.8 million.

Such selling activities by whale investors often lead to a decline in market prices. However, the above graph indicates a reverse trend where the LINK price is approaching $8 despite the small selling pressure from whales. As a result, it appears that bullish speculative investors currently have the upper hand. If the price continues to rise, whales may reconsider the downward trend.