The Chainlink (LINK) price experienced an epic surge in the past weeks, reaching a yearly high of $16.60 ten days ago. Today, it has dropped by 15%. Analysts are assessing the main factors behind this price correction and the possibility of an early recovery.

LINK bulls have been showing consistent movements. After about a month of stable buying pressure, the exhaustion of the bulls is becoming evident. Can the price of LINK recover towards $20 or will it drop to $10?

Will the LINK Price Rise?

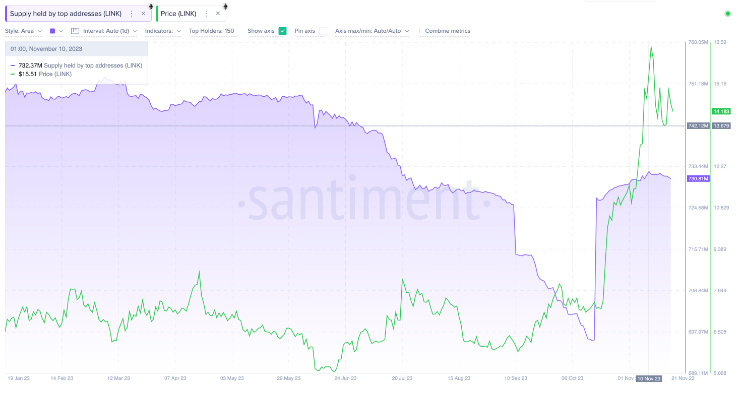

Recently, the Chainlink price witnessed a fantastic 130% surge between October 17 and November 11. Data reveals that the top 150 bulls of Chainlink played a crucial role in this rally.

According to data from Santiment, during this period, the bulls accumulated a significant 36.07 million LINK, increasing their cumulative balance to 730.37 million tokens, the highest in four months. However, since reaching its peak on November 11, the buying pressure has slowed down significantly.

As shown in the graph, Chainlink investors held a total of 732.37 million LINK tokens as of November 10. Concerningly, this figure experienced a rapid decline and dropped to 730.81 million LINK. In essence, the top 150 Chainlink investors have reduced their LINK assets by 1.56 million tokens since the local peak.

The above graph shows that the top 150 Chainlink holders sold 1.56 million LINK between November 11 and November 21, after almost a month of buying frenzy. Calculations based on the current market value of $14.2 reveal that they made $22 million from these sales.

Typically, when whales sell during a price rally, it can be considered an indicator of a downturn. Looking at this situation, it can be inferred that investors in the ecosystem are becoming more concerned.

The Future of LINK

Since the LINK price dropped from its yearly high of $16.60 last week, it has continued its downward movement with a sharp breakdown. However, data trends indicate that profit-making whales and individual investors are reducing their investments.

According to TheTie, 4,610 active Chainlink addresses increased their token holdings around November 10. However, in the past 11 days, this number has dropped to 2,150 wallets after the price decline.

Analyzing the graph above, if the weakness of the bulls continues, the Chainlink price could consolidate between $12 and $15. Data from Global In/Out of the Money (GIOM), which groups current LINK token addresses by their entry prices, also confirms this view.