Chainlink (LINK) price recently surged above $8 triggered by the victory of Ripple‘s (XRP) against SEC on July 13. Unlike others, LINK token has maintained its double-digit gains above the $7 support level. Can bullish whales push for further price increase?

Chainlink team announced a groundbreaking partnership with Coinbase on August 8. This partnership envisions the integration of price feeds into Coinbase’s Layer 2 network, Base. On-chain data analysis explores how this integration could potentially impact LINK price movement in the coming weeks.

Coinbase and Chainlink Partnership

A group of price-savvy whales from Chainlink had made profits in the first week of August. However, interestingly, they started buying again immediately after the Coinbase partnership announcement on August 8.

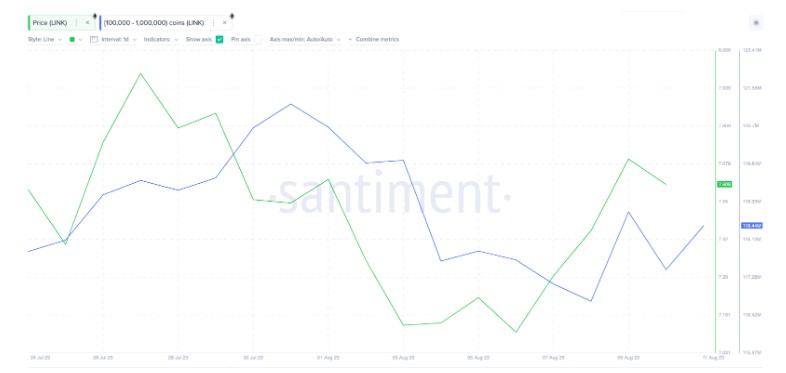

The following chart shows the trading activity of crypto whales with 100,000 to 1 million LINK balances in the past two weeks. In the first week of August, they had reduced their holdings from 121.9 million to 116.74 million tokens. However, they bought 1.7 million LINK tokens in the three trading days from August 8 to August 11, reversing the scenario.

Monitoring real-time changes in whale wallet balances provides objective information about current buying and selling sentiments. With the LINK price currently hovering around $7.56, the 1.7 million tokens recently purchased by whales are worth approximately $12.8 million.

Such a significant influx of whales in three days can be a bullish signal. However, considering the timing, the Coinbase partnership announcement on August 8 shows that it may have revived the confidence of whales. If individual investors also join the bullish momentum strategically, the LINK price can regain $9 with gains of up to 20%.

Chainlink Activity Shows a Significant Increase

Additionally, since the integration of proprietary price feeds into the Base network on August 8, Chainlink has witnessed a significant increase in network activity. According to Santiment, Chainlink had only 1,666 active addresses on August 6. However, it reached 3,033 active wallet addresses with an 82% increase on August 10.

The Daily Active Addresses (DAA) metric indicates the total number of network participants engaging in economic activities on a blockchain network. As seen above, when it rises astronomically, it indicates increasing demand and transaction activity across the network. This increase in network activity coincided with the announcement of the Coinbase partnership with Chainlink earlier this week.

From the highlighted indicators on the chain, it can be inferred that there is an increasing network demand from retail market participants. When combined with the buying pressure from whales, LINK can achieve price increases of up to 20% in the coming weeks.

Is $10 Possible for LINK?

The Global In/Out of Money (IOMAP) data shows the distribution of critical buying price levels analyzed to determine the fundamental support and resistance levels for current holders. This data indicates that the $9 region forms the strongest resistance that can hinder LINK from reaching the $10 price target.

As shown below, 43,400 addresses had purchased LINK tokens at an average price of $9.33 for just under 40 million tokens. If they start selling their positions, it can trigger a pullback. However, if the Coinbase partnership with Chainlink allows whales to buy as expected, LINK price can gain over 20% to reclaim $10.

Nevertheless, if the LINK price falls below $7 again, bears can invalidate this optimistic prediction. However, initially, 60,000 addresses that bought 82 million Chainlink tokens at an average price of $7.10 can provide the first support. However, if this support level collapses, LINK may retest the drop towards $6.50 for the first time in over a month.

Türkçe

Türkçe Español

Español