As the price of the largest cryptocurrency, Bitcoin (BTC), consolidates around $34,200, altcoins like Solana (SOL), Cardano (ADA), and Chainlink (LINK) continue their upward rally. LINK’s price has increased by over 5% in the past 24 hours, approaching $12 and gaining about 45% in the last 10 days due to strong investor activity. Despite this positive picture, on-chain data raises alarms for LINK.

Can Chainlink Reach $15?

Popular crypto analyst Ali Martinez reported that Chainlink has broken the ascending triangle formation on its hourly chart. This bullish pattern indicates a potential 14% increase towards the $13 level for LINK.

Although LINK’s price has risen to around $11.50 today, supported by a 90% increase in trading volume in the past 24 hours, on-chain data suggests that new buyers should be cautious due to the declining on-chain activity.

On-Chain Data Indicates Caution for LINK

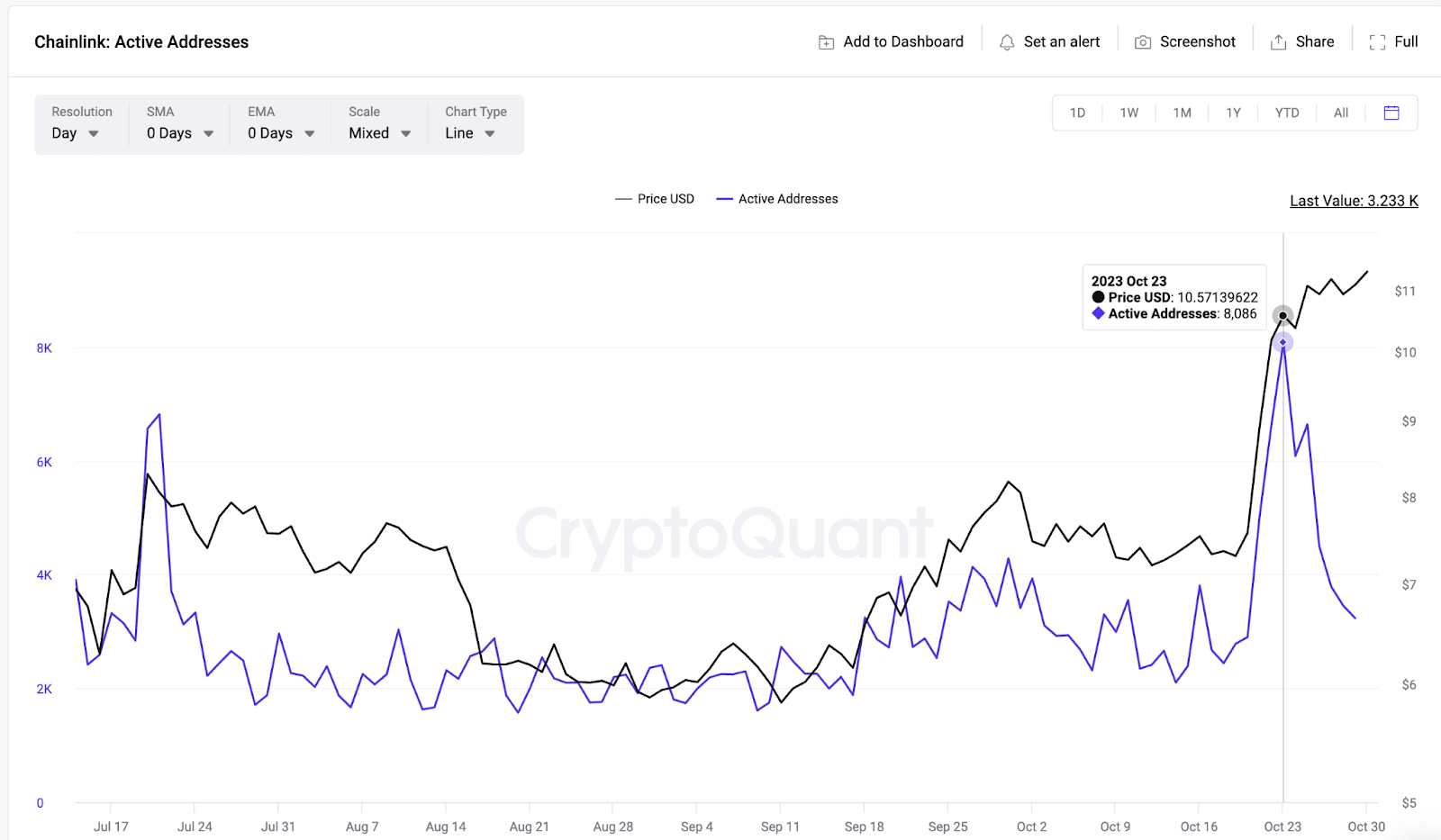

Data provided by on-chain analytics platform CryptoQuant reveals that Chainlink has shown impressive performance with its active wallet addresses reaching 8,086 on October 23, the highest level in the past three months. However, just 24 hours after this milestone, the number of active wallet addresses for Chainlink dropped significantly to 3,233 by October 29. This represents a 60% decrease in daily network participation in just one week.

The daily active wallet address metric reflects the level of user participation in a blockchain network. A decrease in active wallet addresses is often seen as a sign of decline, indicating a reduced demand for the project’s services. As shown in the graph above, Chainlink experienced a significant 60% decrease in network activity last week.

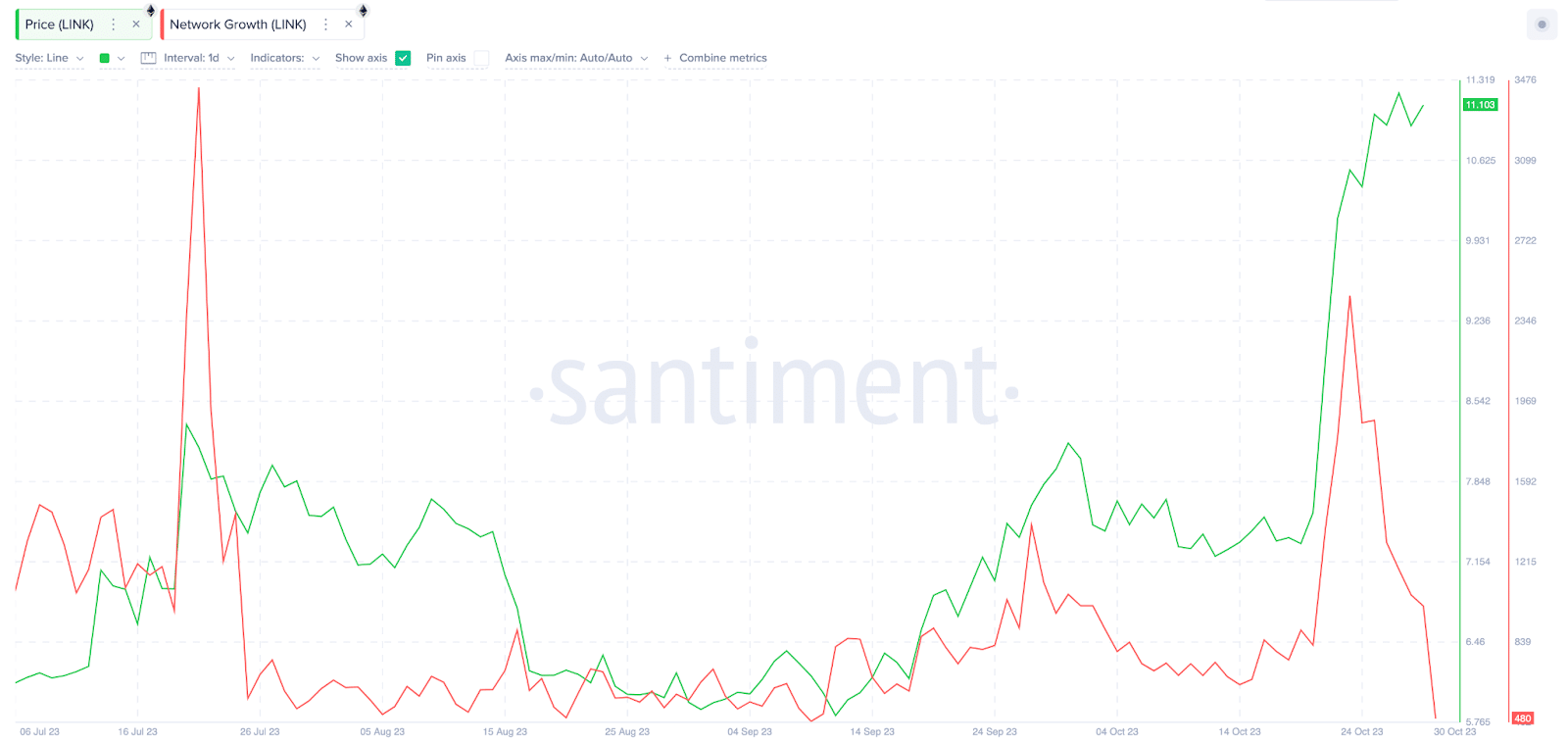

Similarly, Santiment reported a significant decrease in the creation of new wallet addresses on the Chainlink network. The graph below shows that Chainlink reached its highest point in network growth, reaching 2,465 on October 23, within 110 days.

Furthermore, there has been a sharp decline in network growth figures, similar to the observed trend in the active wallet address metric. As of October 29, network growth has decreased by 60%, falling to 1,008 new wallet addresses. Network growth measures the rate at which new wallet addresses are created daily, reflecting the rate at which new users join a blockchain ecosystem. Typically, a decrease in network growth has a negative impact on the price of the native asset.

Türkçe

Türkçe Español

Español