Altcoins are not having a good week, with most cryptocurrencies experiencing losses close to 10%. The 8% drop in BTC price is triggering even larger losses in altcoins. Despite entering the halving month, cryptocurrencies have not had a good start and are now focused on the upcoming break in the BTC price. So, what are the current predictions for TON Coin?

TON Coin Commentary

Telegram has millions of users and is facilitating the integration of crypto with such a large platform. Several steps announced last year have had significant impacts on the price. From the in-app wallet to the sale of channel names, many major moves have benefited TON Coin.

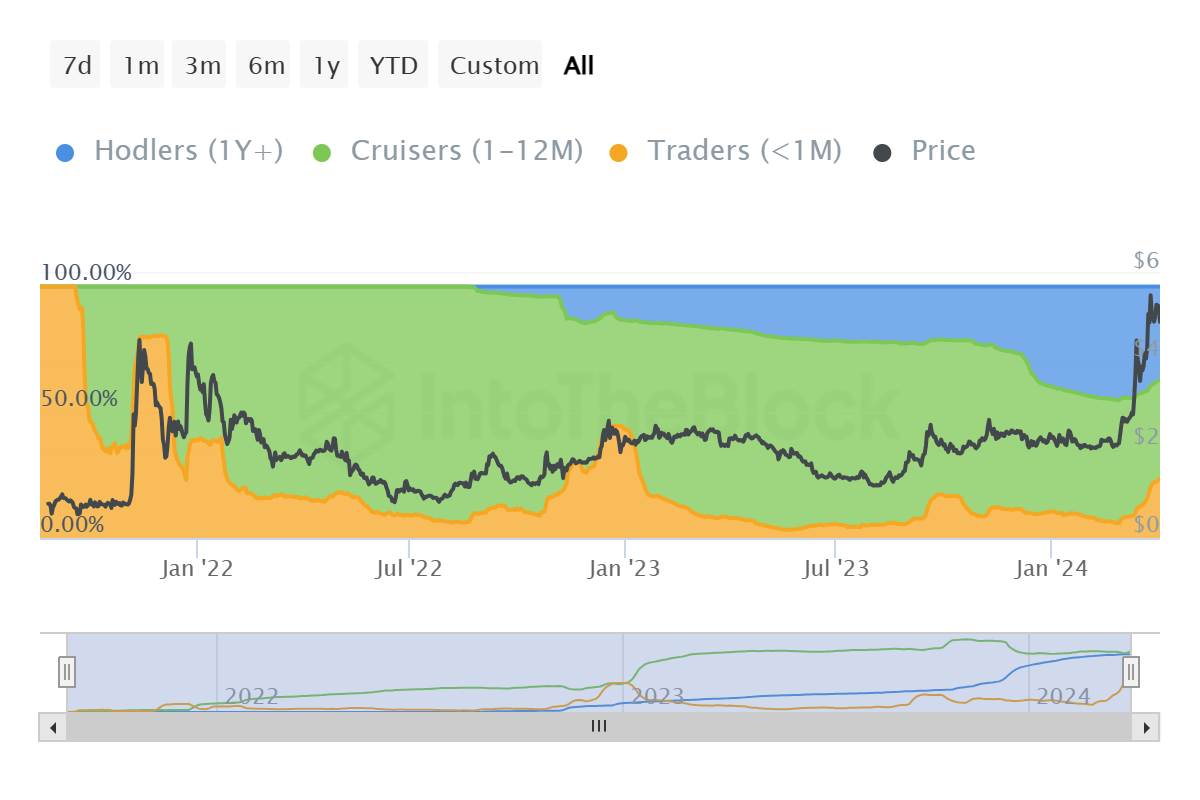

TON Coin’s price recently exceeded $5, entering an important turning point. According to the GIOM metric, when the price surpasses $5.33, a significant portion of investors will become profitable, setting the stage for a larger rally. However, for now, the volume has dropped by 30% compared to yesterday, tempering the excessive optimism somewhat.

TON Coin remains cautious about the ATH level, feeling the pressure from short-term investors. These investors, who typically hold their assets for less than a month, currently possess 37% of the circulating supply and could pave the way for new highs if they act boldly.

TON Coin Price Prediction

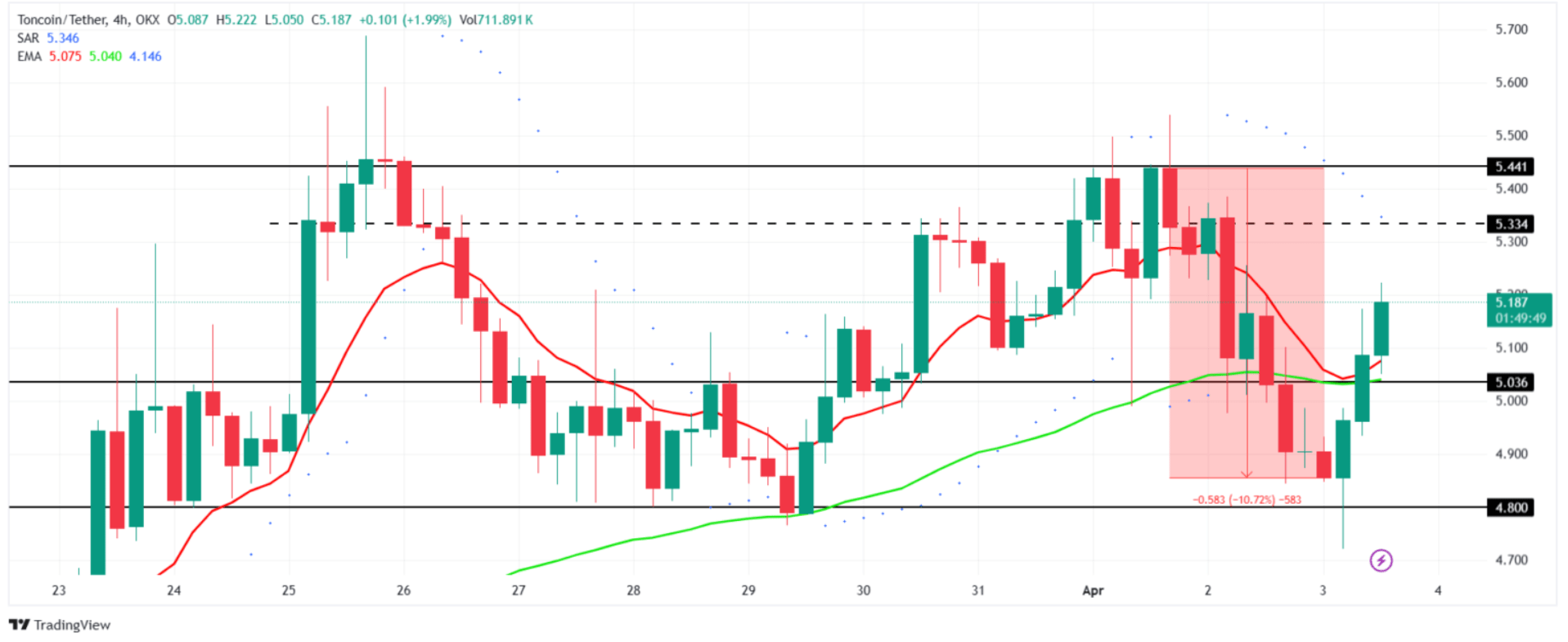

The falling volume and the possibility of short-term investors not remaining eager for a larger rally make a downturn seem more likely, even in the short term. The negativity in the BTC price also plays a role here. Considering all these factors, we could see Toncoin’s price continue its consolidation phase, retreating to $4.80.

If selling pressure increases and deeper lows are targeted, then the support level to watch would be $4.48. Conversely, for a move in the opposite direction, an increase in investors’ risk appetite or a climb back to $71,500 levels for BTC price would be necessary. In this scenario, TON Coin’s price would target the resistance area of $5.44. This move could turn into an important opportunity to push the all-time high even higher.