Cryptocurrencies have caught the attention of a famous billionaire who recently spoke about risks for market investors. Known for his past comments on BTC, ETH, and SOL Coin, he also provides significant insights into macroeconomic conditions. Here are his latest comments and reassuring statements for cryptocurrency investors.

Will the Fed Cut Interest Rates?

Bitcoin price was at $66,623 at the time of writing, hitting a daily low of $65,857. The famous billionaire closely following crypto, Chamath Palihapitiya, mentioned that Fed Chairman Powell and his team will be forced to cut interest rates due to economic conditions.

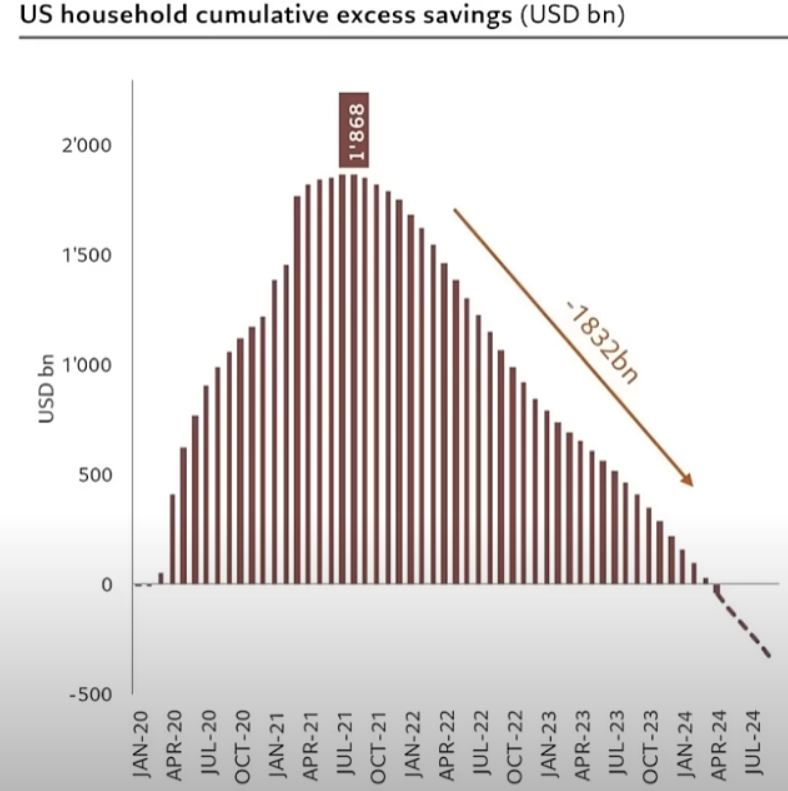

In the latest episode of the All-In Podcast, Palihapitiya said he saw data indicating Americans have spent all their savings. According to the Social Capital CEO, people who relied on their savings are now in trouble.

“To simplify the United States economy, 70% of GDP consists of individual spending. People can spend two things: their savings or their credit.

Interestingly, we have finally exhausted all the money in people’s bank accounts. So what does this force people to do? It actually forces people to re-enter the workforce to start earning money. However, the problem is that companies are downsizing and going into defensive positions. As a result, as you started to see in the last unemployment report, unemployment is rising because there are no jobs available for these people when they re-enter the workforce.”

Fed Forced to Cut Interest Rates

Palihapitiya predicts that the rise in unemployment will lead to an economic slowdown, forcing the Fed to cut interest rates.

“I think what we are starting to see is that we have run out of cash to spend for a large part of the economy. As a result, I think we will see an economic slowdown, and this will not only create a tremendous experimental rationale for Jerome Powell, but also worsen due to the political pressure he will face to cut rates.

Will this cause him to cut more aggressively than he otherwise would? On the margins, I actually think the answer is yes, but from my perspective, I think our money, our individual people’s money, has run out. Therefore, I think unemployment will rise again. I think GDP will shrink, and I believe we will see multiple rate cuts.”