Former Ark Invest manager Chris Burniske has recently focused on the less-discussed Celestia (TIA) Coin. His evaluation goes beyond short-term predictions, addressing the long-term performance of TIA Coin. As a more specialized figure than other analysts, Chris’s perspective may offer investors a chance to see different details.

Future of TIA Coin

After an 80% drop, TIA Coin has become an asset of concern for many investors. Initially, it sparked hope for the future, but constant declines in Bitcoin  $104,785’s price have worn it down, similar to many other cryptocurrencies. Chris Burniske noted that short selling has reached significant levels for TIA Coin, with annual short costs nearing 380%.

$104,785’s price have worn it down, similar to many other cryptocurrencies. Chris Burniske noted that short selling has reached significant levels for TIA Coin, with annual short costs nearing 380%.

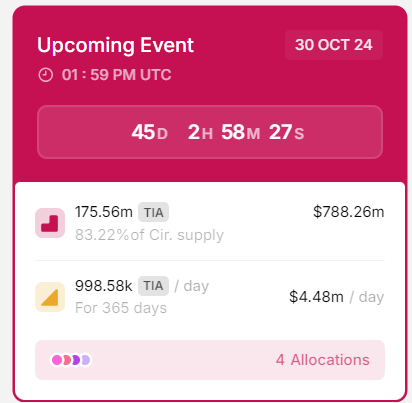

So where does this additional downward pressure originate? It undoubtedly stems from the upcoming $788 million unlocking event in October, as 83.22% of the circulating supply will become active, creating a substantial impact.

However, Chris Burniske remains optimistic about TIA Coin’s future for at least five reasons.

- Developers in the ecosystem are vigorously activating all elements, reminiscent of early Bitcoin, Ethereum

$2,516, and Solana

$2,516, and Solana  $155 energy.

$155 energy. - Liquidity from “bad VCs” is less likely to be offloaded in October, as they see the ecosystem’s allure and team’s commitment.

- When unlocking occurs, the market may realize there’s much less selling pressure than anticipated.

- Buyers who have stepped back due to concerns over unlocking will likely react positively to price movements and reduced uncertainty.

- The TIA market is beginning to recover from its current semi-paralyzed state.

“I also believe TIA Coin is fundamentally undervalued. I’m sure paid groups and dip trolls will jump on this topic, which is a good sign. They are anxious due to expensive short positions. They will bring up VC rounds and selling staking rewards, questioning how it differs from SOL’s unlocking in December 2020.

Some of their concerns are valid, but it’s essential to connect the broader picture and what’s already priced in.

While I hold the above view, I expect TIA’s price to remain quite volatile throughout September and into the fourth quarter, with the highest fluctuations likely occurring around the unlocking.

TIA Coin Price Prediction

TIA Coin, which has seen a race for short positions, has fallen from $21 to $3.76. In November 2023, the listing period saw a recovery from a low of $2.32. In cases like DYDX, listed with low supply, we have not seen the $20 price again. If TIA Coin continues to decline, it could reach a new low.

Beyond concerns about TIA Coin in October, if nearly $800 million in massive supply is released for sale, the price could drop below $1. Perhaps VCs might hold off selling for a while to prevent disappointing those patiently waiting for short positions. Time will tell, but reclaiming the $8 mark could signal a rapid rise.

Türkçe

Türkçe Español

Español