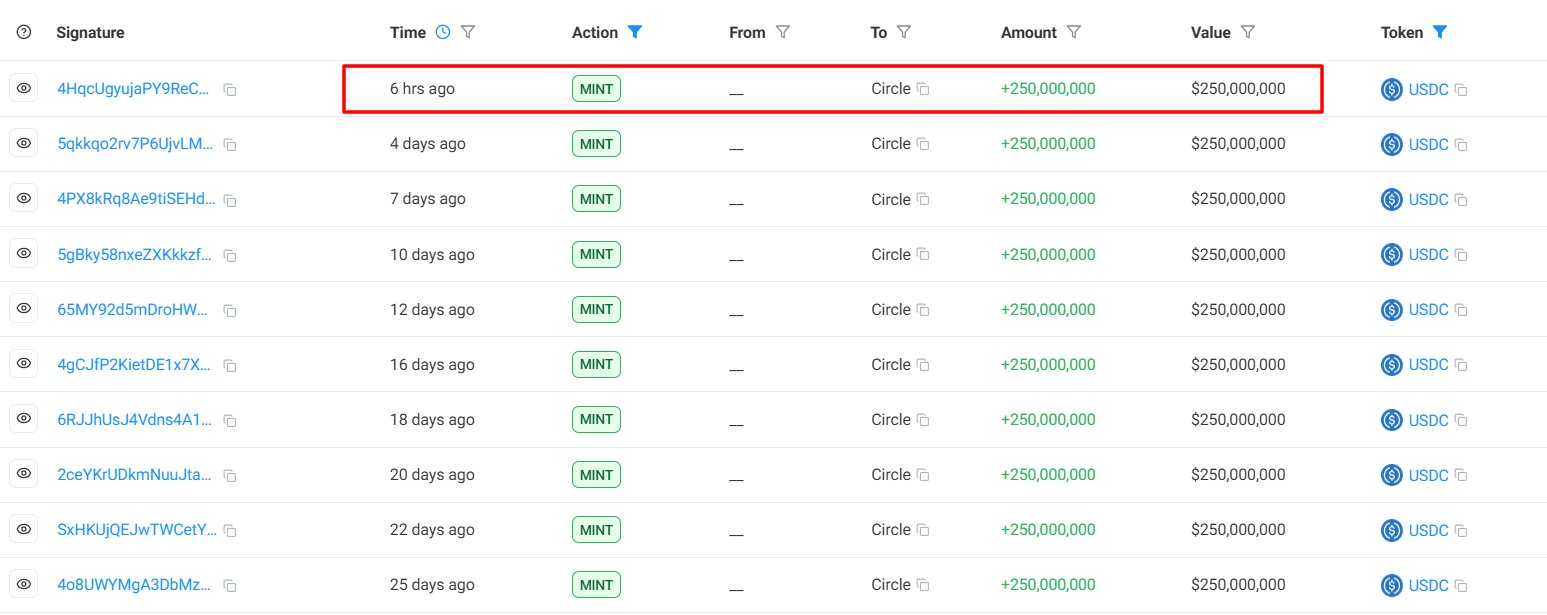

Circle, a U.S.-based payment and financial technology company, recently minted an additional 250 million USDC on the Solana  $139 network. This minting, reported by the blockchain data platform Onchain Lens, occurred in the early hours of the day and corresponds to a total value of 250 million dollars. This latest minting continues Circle’s trend of producing USDC on Solana throughout the year, bringing the total amount minted on the Solana network in the past 30 days to 2.5 billion USDC and a total of 10.75 billion USDC since the beginning of the year.

$139 network. This minting, reported by the blockchain data platform Onchain Lens, occurred in the early hours of the day and corresponds to a total value of 250 million dollars. This latest minting continues Circle’s trend of producing USDC on Solana throughout the year, bringing the total amount minted on the Solana network in the past 30 days to 2.5 billion USDC and a total of 10.75 billion USDC since the beginning of the year.

Rapid Increase of USDC Supply on Solana

The Solana blockchain has gained significant popularity among cryptocurrency investors due to its high transaction speed and low fees. The advantages of the Solana network are key factors driving Circle’s focus on USDC production. The increased supply of USDC on Solana directly impacts transaction volumes and enhances user engagement, particularly as decentralized finance (DeFi) protocols increasingly prefer USDC for their operations.

Solana has emerged as one of the rapidly growing cryptocurrency projects in recent years, and the frequent production of stablecoins like USDC on this network bolsters its reliability and attractiveness. This, in turn, intensifies the interest from investors and developers alike. The rising amount of USDC on Solana enhances the network’s stake in the cryptocurrency market, supporting its long-term growth.

Circle’s USDC Strategy and Its Effects

Circle aims to strengthen its position in the stablecoin market by increasing USDC production. As a stablecoin pegged to the U.S. dollar at a 1:1 ratio, USDC is favored by cryptocurrency investors. The expansion of USDC usage boosts Circle’s market presence and brand value, allowing the company to achieve a more robust position in the cryptocurrency landscape and expand its financial operations globally.

The increase in USDC supply on Solana also sparks competition in the stablecoin market. USDC aims to capture a larger market share through its increased production on Solana, especially in competition with other popular stablecoins like Tether (USDT). The growing popularity of stablecoins, which provide investors with secure and stable transaction opportunities, is vital for attracting liquidity into the cryptocurrency market.