Circle USD (USDC) continues to increase its market share, challenging Tether USD’s (USDT) long-standing dominance. Regulatory developments threaten Tether’s position in key markets, directly challenging the largest stablecoin’s status.

USDC’s Growth and Market Presence

Launched in September 2018, USDC entered the stablecoin market, which was heavily dominated by USDT. Over the years, USDC quickly gained acceptance among investors concerned about Tether’s reserves and redeemability.

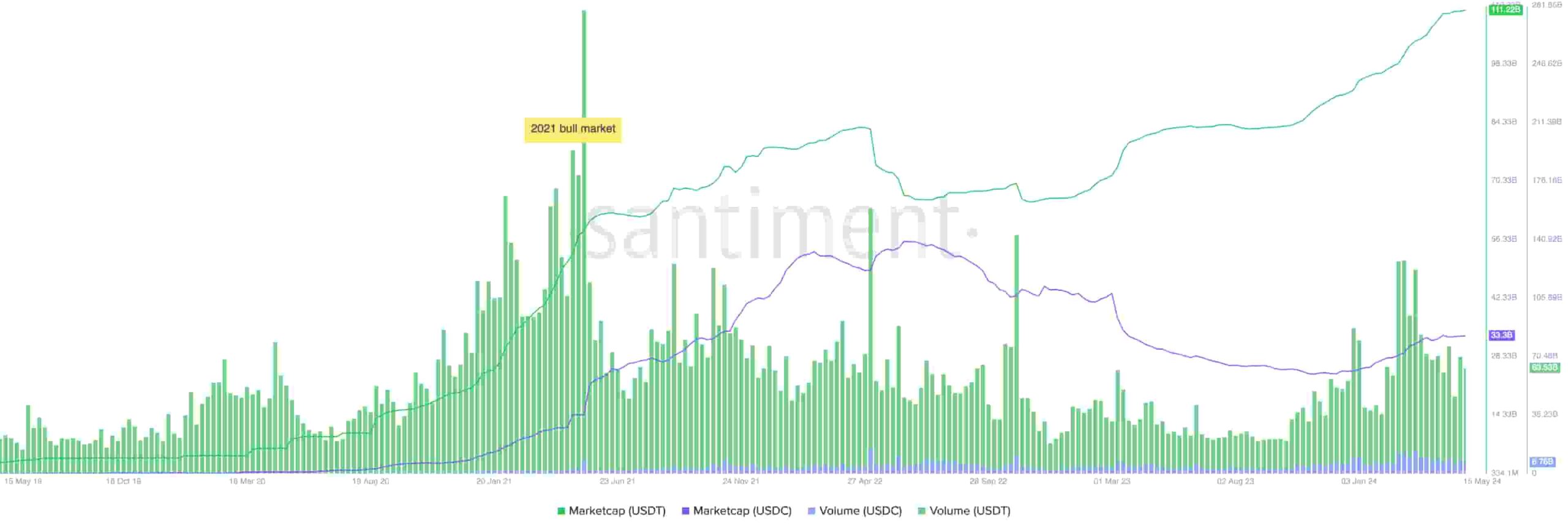

Currently, USDC’s market value stands at $33.34 billion, making it the sixth most valuable cryptocurrency and the fifth largest altcoin. In contrast, USDT has a market value of $111.22 billion, making it the third-largest cryptocurrency and the second-largest altcoin. Despite this, USDT maintains its lead in trading volume on centralized exchanges, while USDC has a stronger presence in decentralized finance (DeFi).

Regulatory Pressures and Market Dynamics

Circle’s strong political presence in the US gives it a significant advantage over Tether. Regulatory developments outside the US also pose challenges for USDT and create opportunities for USDC to increase its market share. For example, Kraken, one of the world’s largest cryptocurrency exchanges, is considering removing USDT from its platform for European users due to concerns related to the European Union’s MiCa regulations. Kraken’s move could set a precedent for other cryptocurrency exchanges and potentially lead to significant changes in the stablecoin market.

Kraken’s consideration of removing USDT follows a similar move by the OKX exchange, which recently announced the removal of most USDT trading pairs from its platform. These moves indicate a growing trend towards preferring USDC over USDT. The potential loss of key markets like Kraken and OKX would be a significant blow to Tether, while the capital shift from USDT to USDC could provide a substantial advantage to Circle’s USDC.

Additionally, asset management giant BlackRock highlighted risks related to stablecoins in its spot Bitcoin ETF applications to the SEC, citing concerns about Tether’s reserves and Circle’s ability to maintain the US dollar peg. Such concerns reflect broader worries about Tether’s stability and transparency.

Türkçe

Türkçe Español

Español