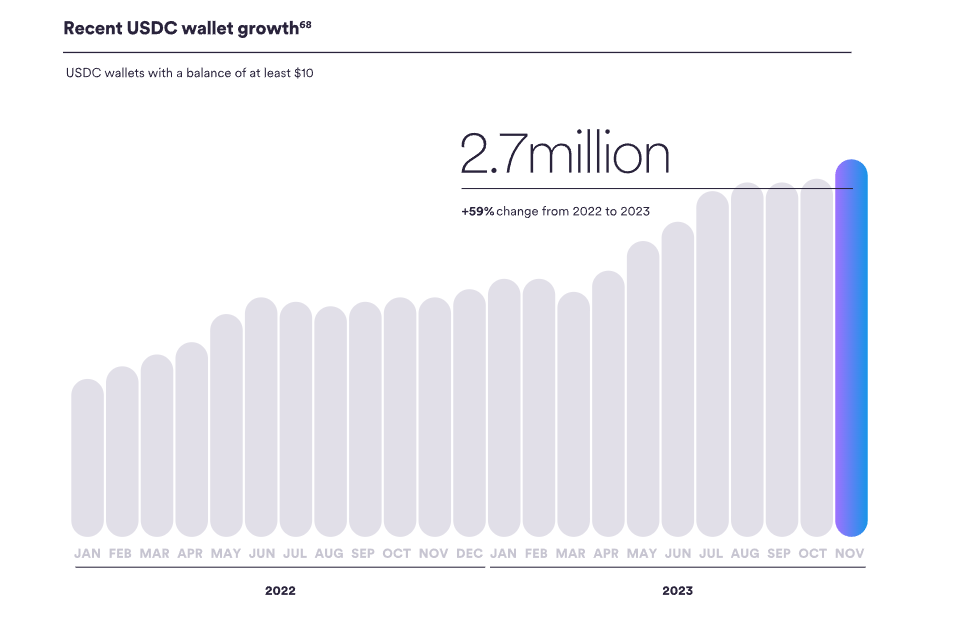

According to a report published on January 15 by USDC issuer Circle, the number of wallets holding at least $10 worth of USDC increased by 59% in 2023. This growth occurred despite a $20 billion decrease in the circulating supply of USDC, indicating that users continue to trust the stablecoin even as the company’s market value declined.

Circle Team Releases Insightful Report

The report titled “The State of the USDC Economy” provides a comprehensive overview of the current use of USDC. The report by Circle noted that the circulating supply of the crypto asset dropped from $45 billion to $25 billion in the first 11 months of 2023, a decline of approximately 44%.

This reduction by Circle was linked to users withdrawing their assets from the ecosystem and moving towards traditional markets due to regulatory pressures, bankruptcies, and fraud incidents in the crypto sector. The team pointed to the opportunity costs of holding USDC as a significant force behind this decline due to rising interest rates attracting investors to more traditional markets.

However, the report suggested that amidst this contraction, other factors indicated an increasing acceptance of USDC. Over the year, more than $197 billion of USDC was issued or burned, reinforcing the stablecoin’s role as a leading bridge between the crypto asset economy and traditional finance. Additionally, the number of wallets containing over $10 in USDC exceeded 2.7 million, marking a 59% increase compared to 2022.

USDC’s 2023 Report Card

2023 was a tumultuous year for USDC. In March, it briefly lost value during a short but concerning banking crisis in the United States. However, the issue was resolved after the Federal Reserve took action to reimburse depositors of several failed banks.

Circle filed for an initial public offering in the first two weeks of 2024 to further develop the USDC ecosystem and partnered with Yellow Card to expand the use of USDC in Africa. With these developments, the Circle team aims to expand its operations and increase its market value.

Türkçe

Türkçe Español

Español