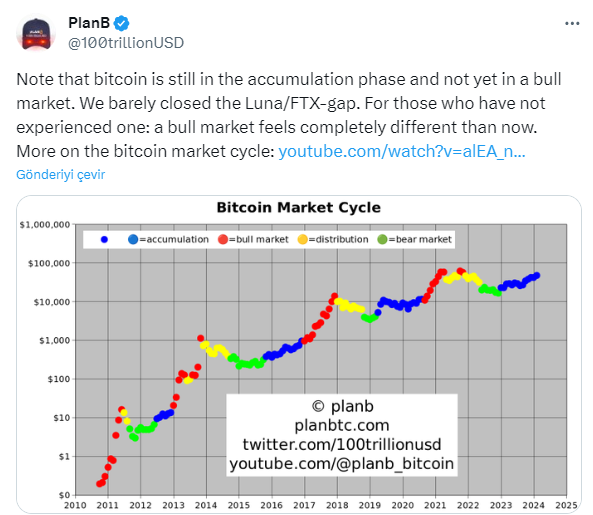

Cryptocurrency investors, especially in Bitcoin, need to understand market phases to make informed decisions. Currently, many speculate whether Bitcoin is on the verge of a bull market or still in an accumulation phase. Grasping the nuances of these stages is essential for effectively navigating the market. Today, PlanB made assessments for these stages. Let’s look at the details.

Defining Market Stages in Bitcoin and Cryptocurrencies

First, let’s define these stages. The accumulation phase typically occurs after a prolonged bear market. During this time, prices consolidate, and smart money accumulates assets at lower prices within a certain range.

This period is characterized by relatively low trading volumes and suppressed market sentiment. On the other hand, a bull market is marked by rising prices, increased investor optimism, and heightened trading activity.

Analyzing Bitcoin’s Current State

As noted by the famous crypto analyst PlanB, Bitcoin is still in an accumulation phase. Despite occasional price fluctuations, the market has not shown the consistent upward momentum characteristic of a bull market.

One significant indicator is the recent narrowing of the Luna/FTX gap. This metric, used to gauge market sentiment, indicates that we have not yet experienced the excitement associated with a bull run.

The Distinct Sentiment of a Bull Market

In a bull market, there is a palpable optimism and FOMO (fear of missing out) among investors. Prices rise as both individual and institutional investors rush to benefit from the uptrend, often surpassing previous all-time highs. The energy in the market is electrifying, with media attention and public interest reaching peaks.

During the accumulation phase, patience and strategic accumulation are crucial. Investors should focus on accumulating assets at favorable prices, maintaining a long-term perspective instead of succumbing to short-term fluctuations. This period offers an opportunity to accumulate assets before prices potentially skyrocket in the next bull run.

Understanding market phases is vital for successful investment in Bitcoin and other cryptocurrencies. While the allure of a bull market is undeniable, it’s important not to overlook the significance of the accumulation phase. Investors can confidently navigate the volatile crypto market by recognizing the distinct characteristics of each phase and adopting a patient, strategic approach. As PlanB suggests, Bitcoin may not be in a bull market yet, but the accumulation phase offers unique opportunities for knowledgeable investors.