For months, investors in the crypto markets have not found what they were looking for, and BTC remains stuck below $70,000. Although BTC saw an early peak in this year’s cycle, it couldn’t break away from the 2021 peak. So, how do Coinbase analysts evaluate the current stagnant environment?

Why Isn’t Crypto Rising?

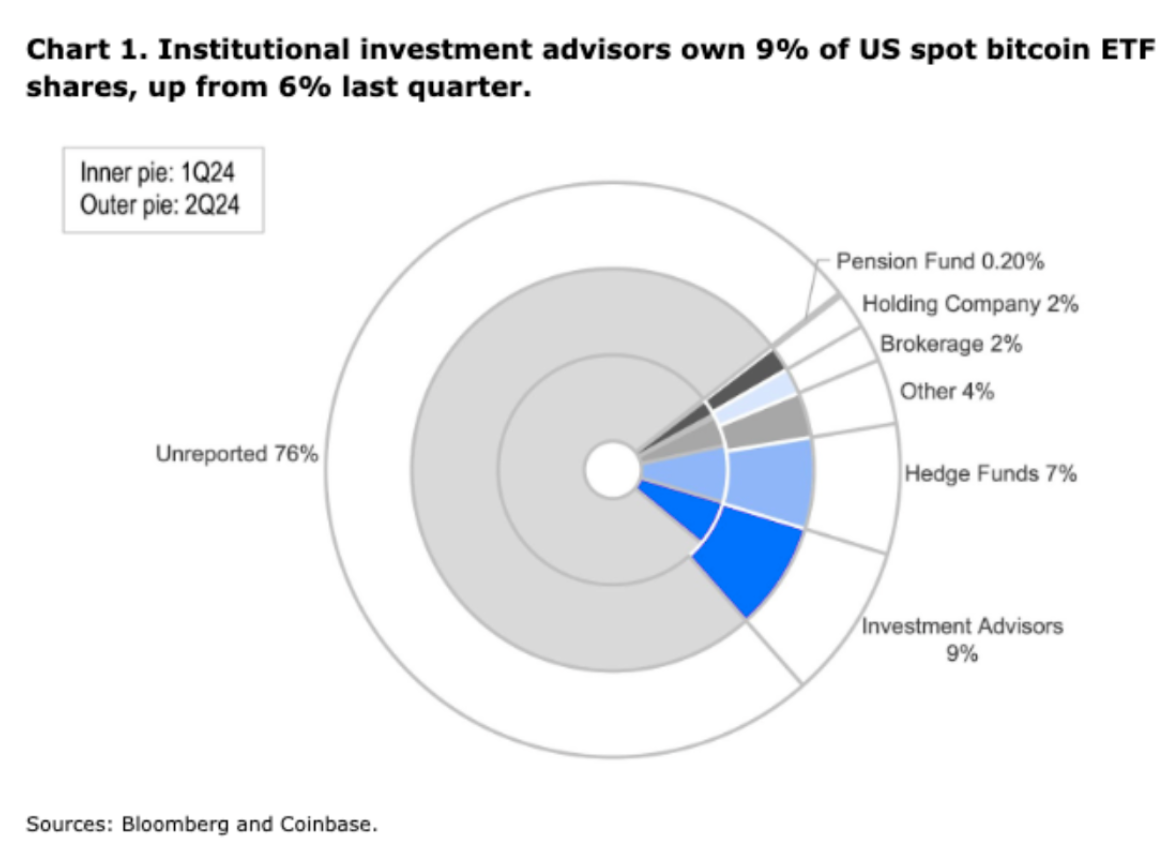

BTC is fluctuating around $59,100 even today. The leading crypto currency, which hasn’t even secured the $60,000 level, is causing a worse scenario for altcoins. According to researchers at Coinbase, while investment advisors’ shares in the ETF channel have increased, hedge funds’ assets have weakened.

According to the latest report, as more intermediary institutions complete their assessments on BTC and ETH ETFs, we will see stronger inflows. Currently, JPMorgan and many large companies have not allowed their investment advisors to offer these products.

The proportion of institutional ETF investors defined as investment advisors increased by 3% in the second quarter of 2024, now representing 9% of all institutional investors. Moreover, this is only valid for those managing more than $100 million in assets.

Recently, we mentioned that Morgan Stanley allowed its 15,000 financial advisors to offer Bitcoin ETFs. This could create a significant demand wave as more companies follow suit.

When Will Cryptocurrencies Rise?

Coinbase research indicates that the June-August period, being summer months, could delay significant inflows. This is largely the case for individual investors as well. People are on vacation and generally don’t want to spend much time on cryptocurrencies, leading to noticeable low volumes starting from May.

The interest in hedge funds might weaken in the ETF channel to take advantage of the difference between futures contracts. Indeed, we saw CME BTC futures contracts reach $2.75 billion in the second quarter of 2024, a 15% increase.

According to Farside data, spot BTC ETFs have seen a net inflow of $17.35 billion since their launch on January 11. If the expected happens with the end of summer, elections, and interest rate cuts, we might see sleepless but exciting days for cryptocurrencies in the last quarter.