Coinbase, one of the world’s largest crypto exchanges that has gone public in the U.S., faces a serious situation. Even though it appears that Coinbase is putting up a tough fight after facing lawsuits, it has been revealed that the CEO and other top executives have been selling stocks behind the scenes. Despite positive news lately, it seems that Coinbase CEO Brian Armstrong and other senior executives have sold millions of dollars in shares.

Coinbase Executives Selling COIN

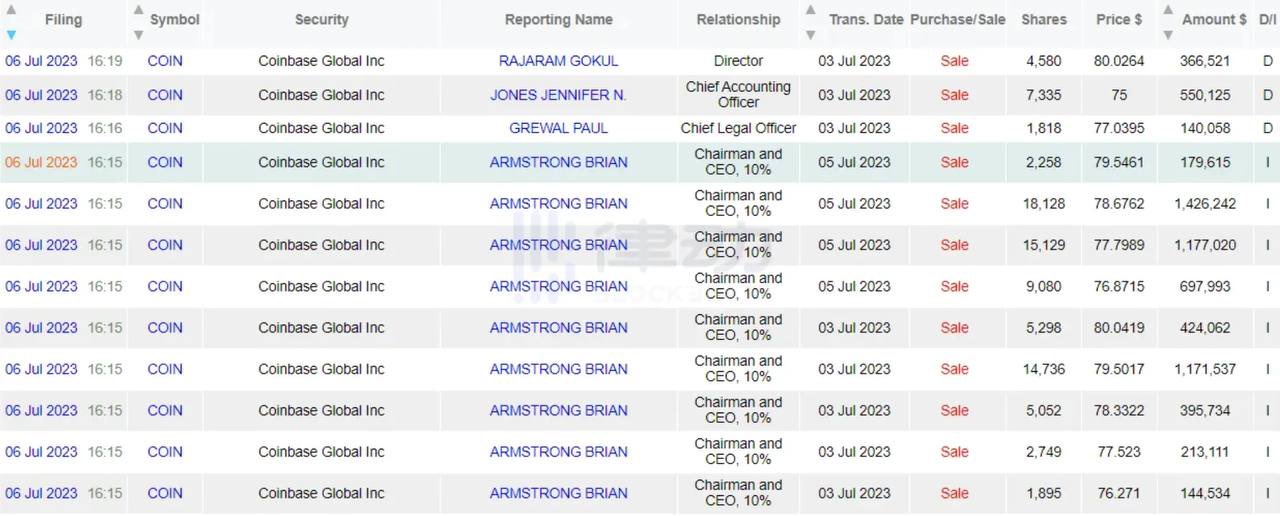

According to U.S. securities laws, any sales from publicly listed companies must be disclosed and shared transparently. When examining records in this context, it is observed that C-level executives like Brian Armstrong, Paul Grewal, Jennifer Jones, and Gokul Rajaram have made substantial stock sales. The sales made by CEO Armstrong and Chief Legal Officer Grewal are particularly noticeable.

Grewal, known for his fierce and assertive tweets against the SEC, has now started selling his stock, sparking debates.

It caught attention, particularly as tension rises between the SEC and Coinbase. The SEC recently refuted all of Coinbase’s claims in a statement. The SEC highlighted that Coinbase’s public user agreements indicate that the exchange itself carries the securities risk of cryptocurrencies. Coinbase has pointed out the inadequacy of the SEC and stated that they were not sufficiently guided.

Coinbase Allegations Intensify

Another surprising detail within the scope of Coinbase is BlackRock. BlackRock announced that it will work jointly with Coinbase for a spot BTC ETF and the stock sales came after this. Speculations on this suggest that Coinbase may have received news of a possible ETF rejection in advance. Although the SEC has recently emphasized that BTC ETFs are insufficient, it has not yet given an official response. The decision by Coinbase executives to sell stocks during a rise caused by good news is fueling fearsome allegations and increasing investors’ panic. Coinbase has not yet made a statement regarding these sales.