Cryptocurrency negativity continues, with BTC maintaining closures below $40,000. Significant data arrived today. Developments on the macro front had not been greatly affecting crypto due to the ETF excitement for a while. However, the sell-offs following approvals have increased the significance of US data.

US Data Arrives

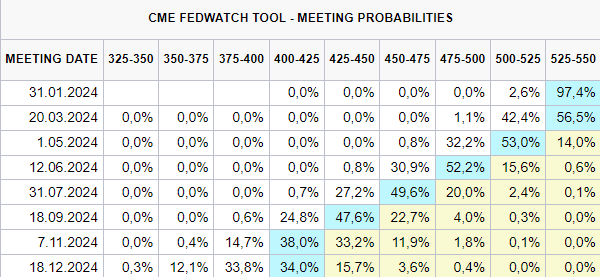

The day’s most critical data was the US GDP, that is, the growth data. Experts predicted a slowdown to 2% growth in the last quarter of 2023 from the previous 4.9%, which is an important indicator of the economy’s health. ING analysts think tomorrow’s PCE data will clarify the interest rate path, but today’s GDP was also a significant signal for a soft landing.

The slowdown in economic growth is what the Fed wants and is necessary for the weakening in the employment front. On the other hand, tomorrow’s PCE data will reveal the current state of inflation, making it the most critical data before the Fed meeting.

- US GDP Announced: (Expectation: 2% Previous: 4.9%)

- US Core Durable Goods Orders Announced: (Expectation: 1.5% Previous: 5.4%)

The unemployment claims data exceeded expectations, durable goods orders came in low, which is favorable for cryptocurrencies. However, the GDP data exceeding expectations might slightly encourage the Fed. We can expect increased volatility around these hours due to the upcoming PCE data, which will show the latest state of inflation. For now, today’s data has not negatively affected the BTC price.