Crypto asset investment products continued to see outflows for the fourth consecutive week, totaling $251 million. This week marked the first instance of measurable outflows from newly issued ETFs in the US, with last week seeing an outflow of $156 million. It is noted that since the launch of these ETFs, the average purchase price has been $62,200 per Bitcoin. The BTC price dropped below 10% of this level last week, which may have triggered automatic sell orders.

What is the Situation by Country?

Regionally, the US plays a leading role in outflows, with $504 million recorded. On the other hand, Canada, Switzerland, and Germany also saw outflows of $9.6 million, $9.8 million, and $7.3 million, respectively.

Last week’s highlight was the successful launch of spot Bitcoin and Ethereum ETFs in Hong Kong, which saw an inflow of $307 million in the first week of trading.

Institutional Investors Buy These Altcoins

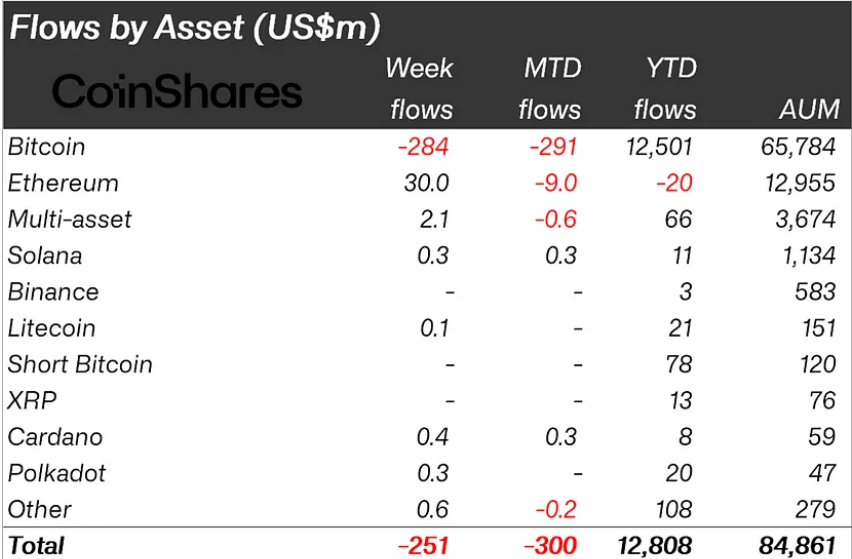

As usual, Bitcoin was the primary focus, seeing an outflow of $284 million. Unusually, BTC was the only crypto asset to experience outflows. Ethereum broke its seven-week outflow streak with an inflow of $30 million last week.

Aside from Ethereum, small inflows were noted in five other altcoins. Solana received $300,000, Litecoin $100,000, Cardano $400,000, Polkadot $300,000, and other altcoins including Avalanche saw an inflow of $600,000.

Türkçe

Türkçe Español

Español