Bitcoin miner Core Scientific is working to diversify its revenue streams ahead of the upcoming halving. The company has signed a deal potentially worth over $100 million to provide data center services to the artificial intelligence initiative CoreWeave. Core Scientific announced it will lease a tier 3 data center in Texas, which previously hosted Hewlett Packard, to accommodate CoreWeave’s infrastructure.

Mining Company Takes Significant Step

According to the terms of the contract, the miner will offer up to 16 MW of capacity at its new data center in Austin and will expand its business to include high-performance computing (HPC). CoreWeave is an artificial intelligence cloud computing company backed by major Wall Street financial firms such as Jane Street, JP Morgan Asset Management, and Fidelity. The venture provides infrastructure for compute-intensive use cases like machine learning. As of December 2023, the company was valued at $7 billion. Core Scientific CEO Adam Sullivan commented:

“Our new data center in Austin will support CoreWeave’s short-term needs and will also expand and diversify Core Scientific’s hosting customer portfolio in two high-value computing categories: Bitcoin mining and a specialized GPU cloud computing system.” Crypto Traders Are Rushing to This App – Here’s Why You Should Too

Core Scientific and the Halving Process

Core Scientific’s expansion of its service offerings comes just weeks before the Bitcoin halving event, which will cut Bitcoin block reward income in half. The 2024 Bitcoin halving event, following previous events in 2020, 2016, and 2012, will see miners’ block rewards drop from the current 6.25 Bitcoins per block to 3.125 Bitcoins. The purpose of the halving event is to control Bitcoin’s inflation and reduce the supply of new tokens over time.

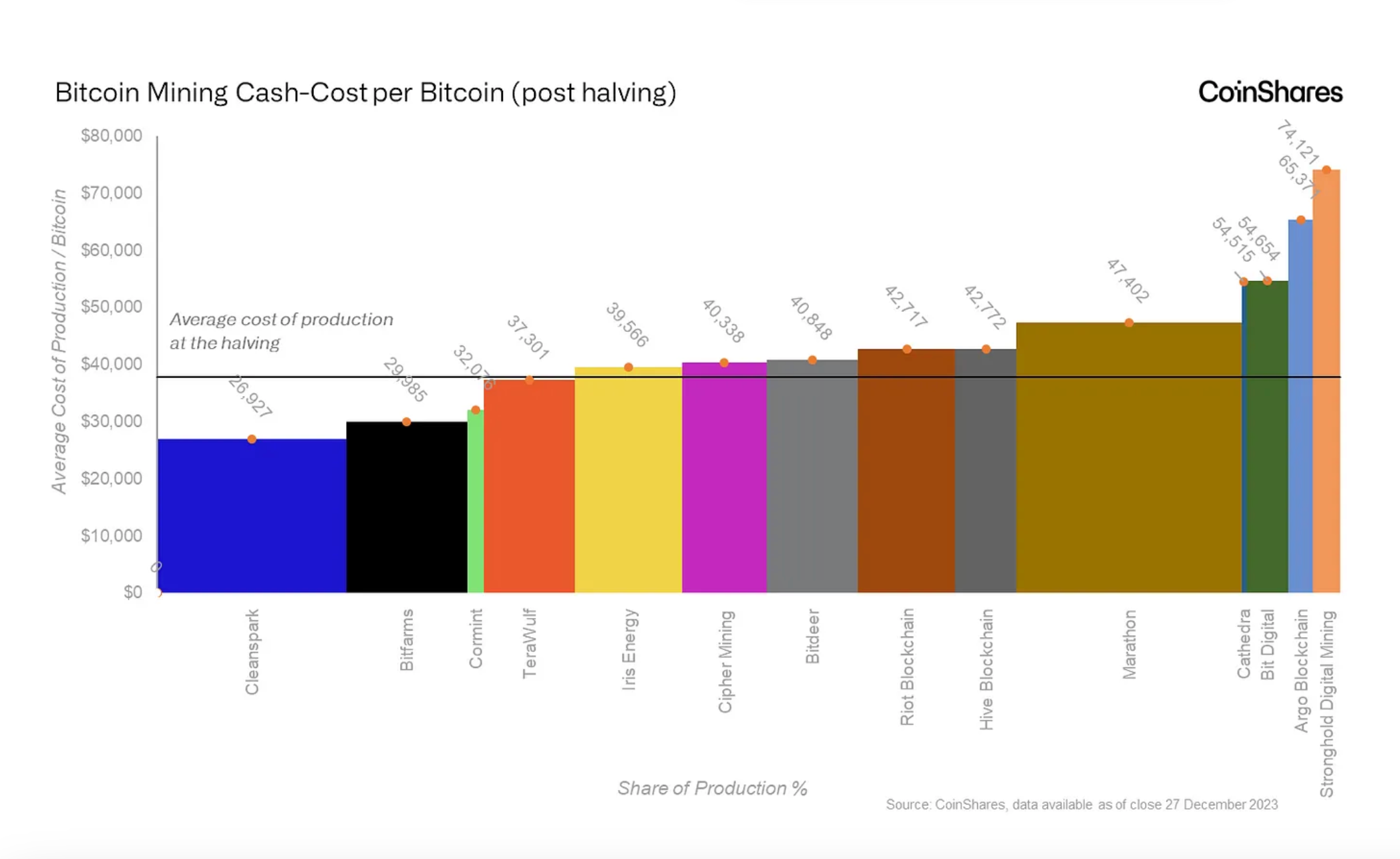

While miners will see a significant decrease in revenue, the costs associated with operations are likely to increase. According to an analysis by CoinShares, the electricity costs per Bitcoin before and after the halving represent approximately 68% and 71% of miners’ total cost structure, respectively. The average production cost for crypto miners after the halving is projected to be $37,856.

Core Scientific, after mining 19,274 Bitcoins valued at $812 million in 2023, became the largest publicly traded crypto mining company in North America. Following a 13-month restructuring process to resolve $400 million in debt caused by falling Bitcoin prices, rising energy costs, and debts related to the bankrupt Celsius Network, the miner recently emerged from bankruptcy under Chapter 11 in the United States.

Türkçe

Türkçe Español

Español